By Type (4)

General Warranty Deed – Provides the grantee complete protection against all title issues. General Warranty Deed – Provides the grantee complete protection against all title issues.

|

Quit Claim Deed – Includes a warranty against title defects arising under the grantor’s ownership. Quit Claim Deed – Includes a warranty against title defects arising under the grantor’s ownership.

|

Release Deed – Transfer the grantor’s interest in property with no title warranties for the grantee. Release Deed – Transfer the grantor’s interest in property with no title warranties for the grantee.

|

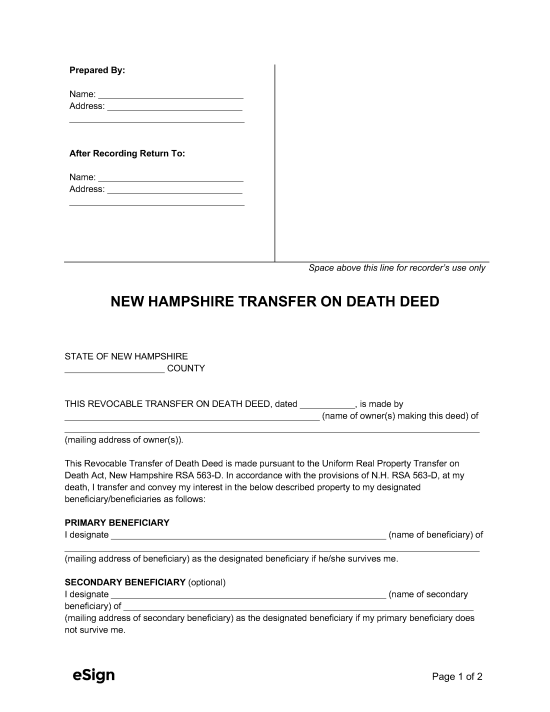

Transfer on Death Deed – Transfer the grantor’s interest in property with no title warranties for the grantee. – Transfer the grantor’s interest in property with no title warranties for the grantee.

|

Formatting

Each county’s Register of Deeds establishes unique document formatting standards. These requirements typically apply:

Paper – White, minimum 20lb weight, sized between 8.5″ x 11″ and 8.5″ x 14″

Margins – 3″ top-right margin on the first page, 1″ space for all other margins

Font – Black or dark blue ink, at least 10pt font[1]

Recording

Signing Requirements – New Hampshire deeds must contain the grantor’s notarized signature.[2]

Where to Record – Property deeds need to be presented to the Register of Deeds for recording.[3]

Cost – $10 for the first page, $4 for each additional page, $25 LCHIP surcharge (as of this writing)[4]