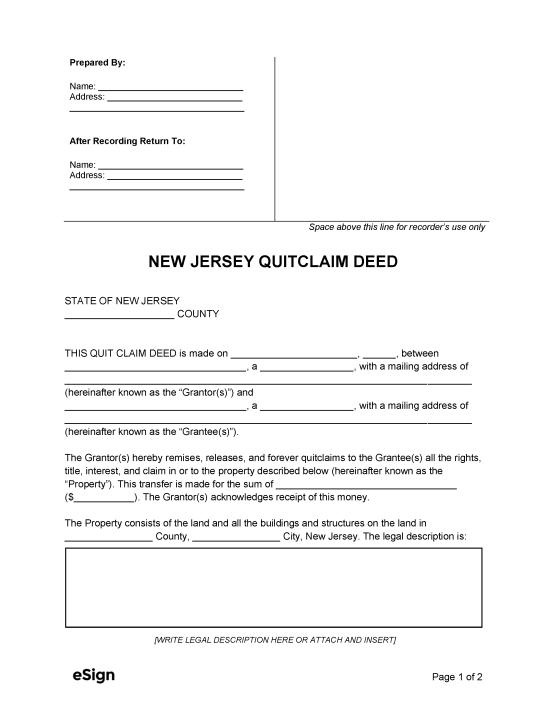

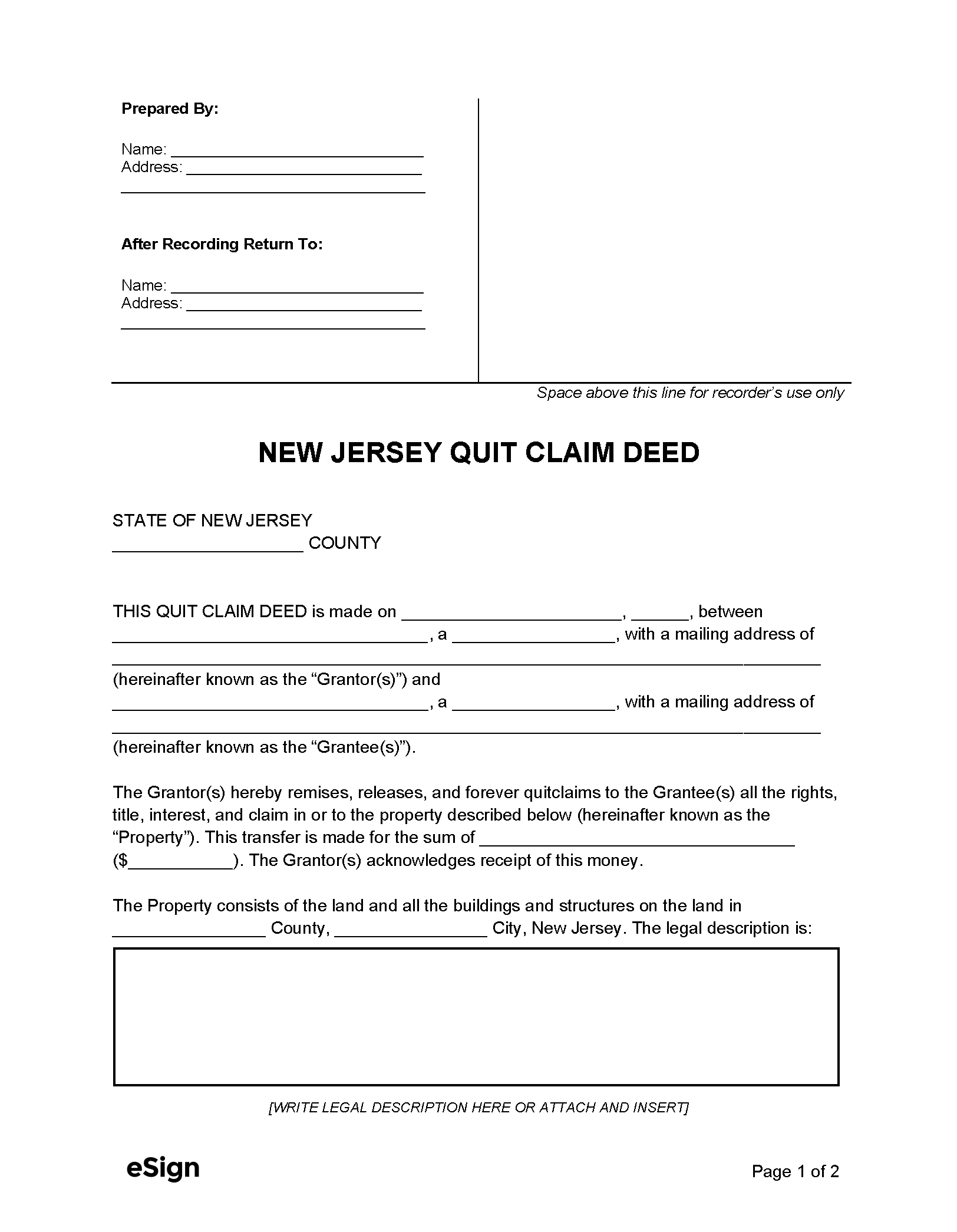

Recording Details

- Signing Requirements – The grantor must sign the deed in the presence of a notarial officer.[1]

- Where to Record – County Clerk or Register of Deeds[2]

- Recording Fees – $40 for the first page + $10 for each additional page (as of this writing).[3] Some counties may charge higher fees.

Additional Forms

The New Jersey Division of Treasury requires additional forms to be filed with the deed[5]:

- GIT/REP-3: Seller’s Residency Certification/Exemption – This form must be filled out by either residents or non-residents who meet one of the “seller’s assurances” listed in the form.

- GIT/REP-1: Nonresident Seller’s Tax Declaration – Grantors residing outside of New Jersey must complete this form.

- GIT/REP-2: Nonresident Seller’s Tax Prepayment Receipt – This must accompany the Nonresident Seller’s Tax Declaration.

- RTF-1: Affidavit of Consideration for Use by Seller – This form is to be filed with any deed that claims an exemption from the Realty Transfer Fee, if the consideration is not reported on the deed, or if the property is a commercial, industrial, or apartment property.

A cover sheet is also required when recording (can be obtained at the recorder’s office).[6]