By Type (6)

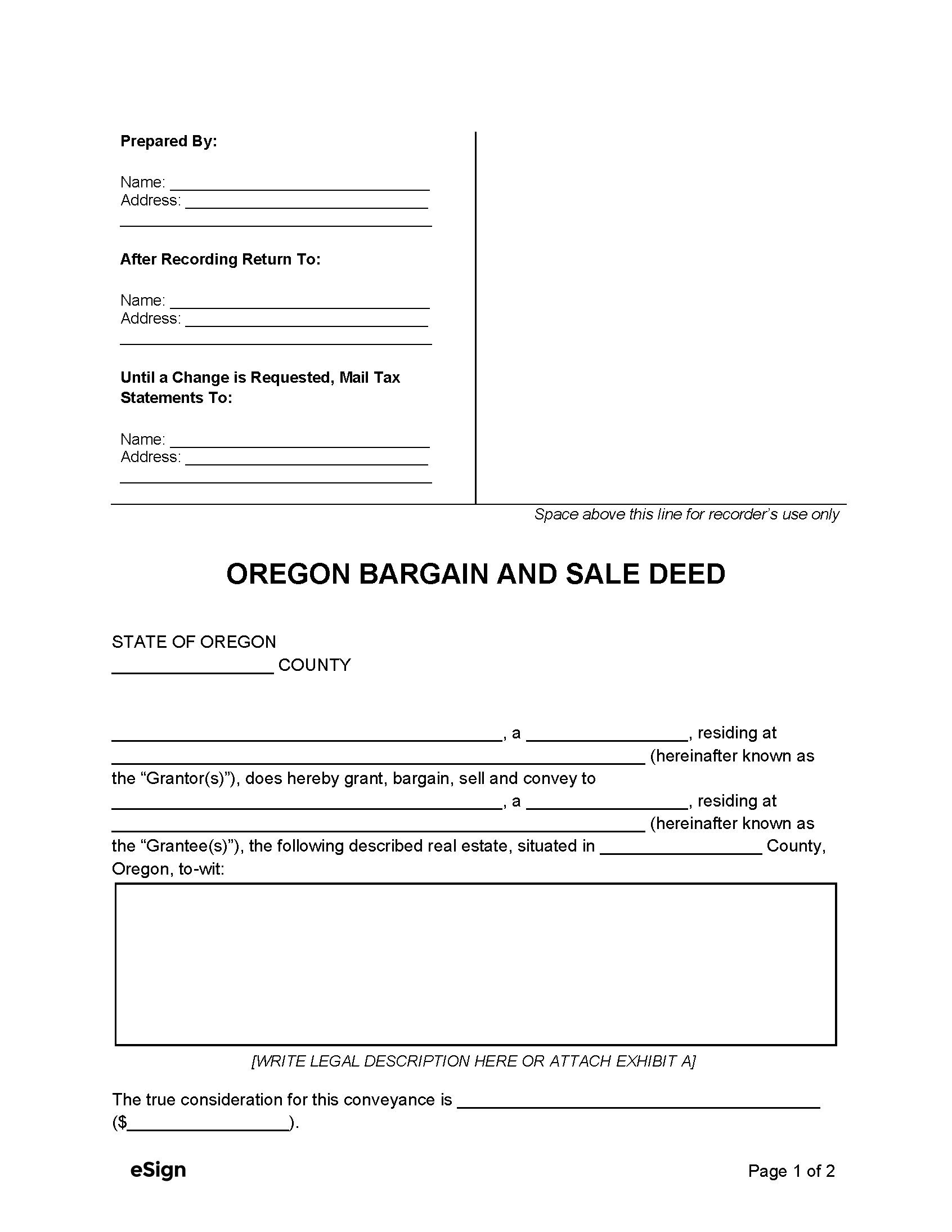

Bargain and Sale Deed – Affirms the grantor’s right to transfer ownership but does not guarantee a clear title. Bargain and Sale Deed – Affirms the grantor’s right to transfer ownership but does not guarantee a clear title.

|

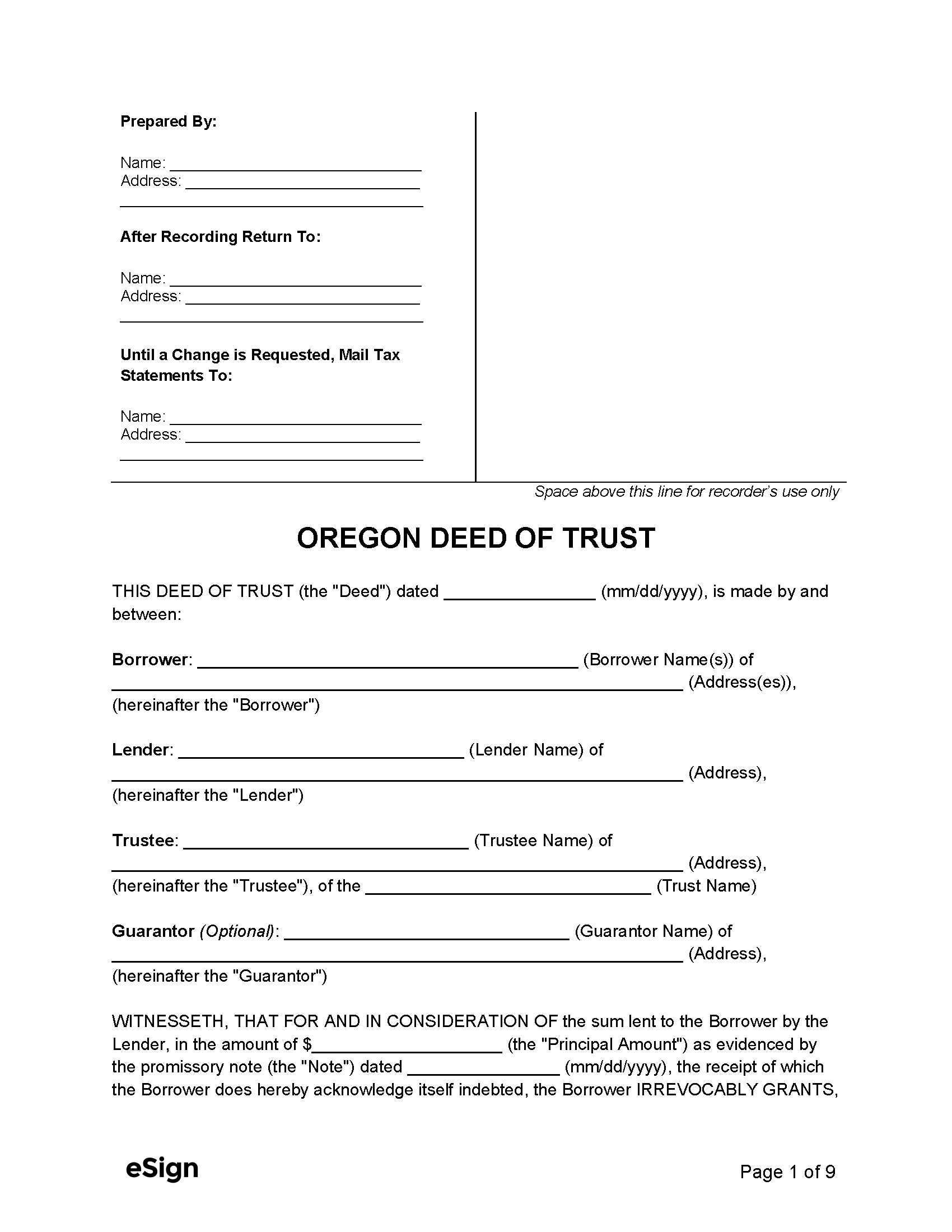

Deed of Trust – Transfers the grantor’s property title to a trustee as collateral for a real estate loan. Deed of Trust – Transfers the grantor’s property title to a trustee as collateral for a real estate loan.

|

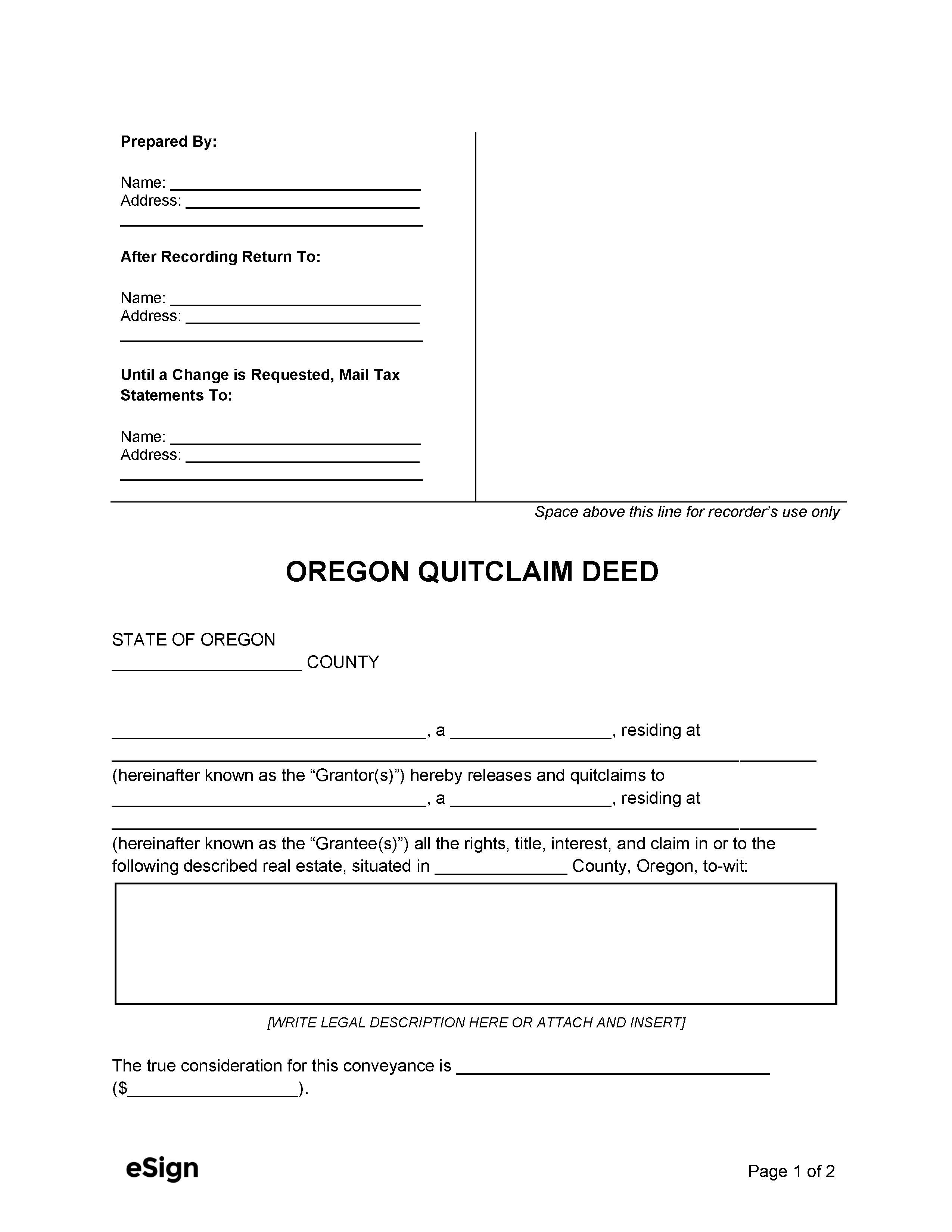

Quit Claim Deed – A deed that provides no warranties or guarantees that the grantor has the right to convey. Quit Claim Deed – A deed that provides no warranties or guarantees that the grantor has the right to convey.

|

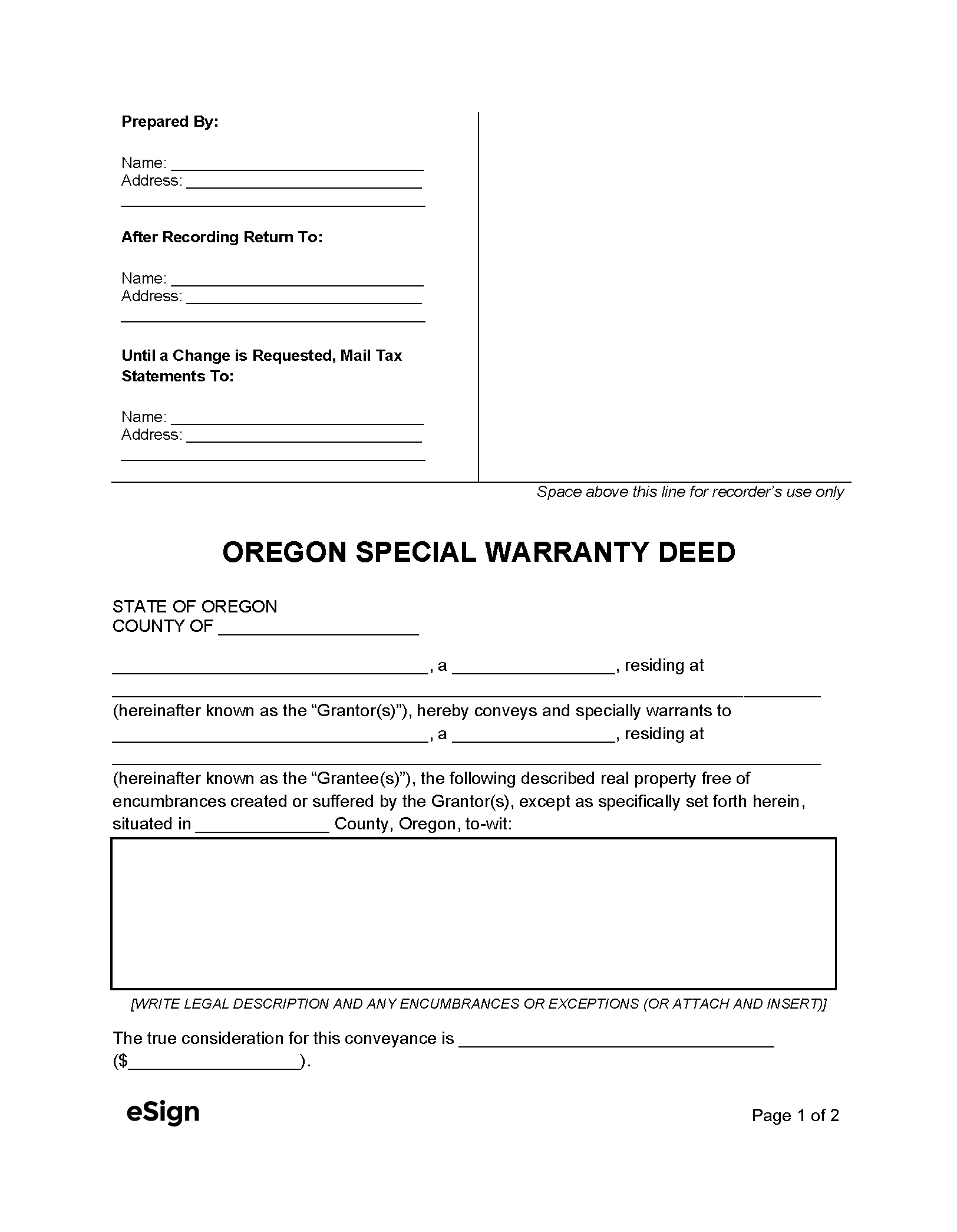

Special Warranty Deed – Guarantees the grantor will protect the grantee against title defects resulting from their period of ownership. Special Warranty Deed – Guarantees the grantor will protect the grantee against title defects resulting from their period of ownership.

|

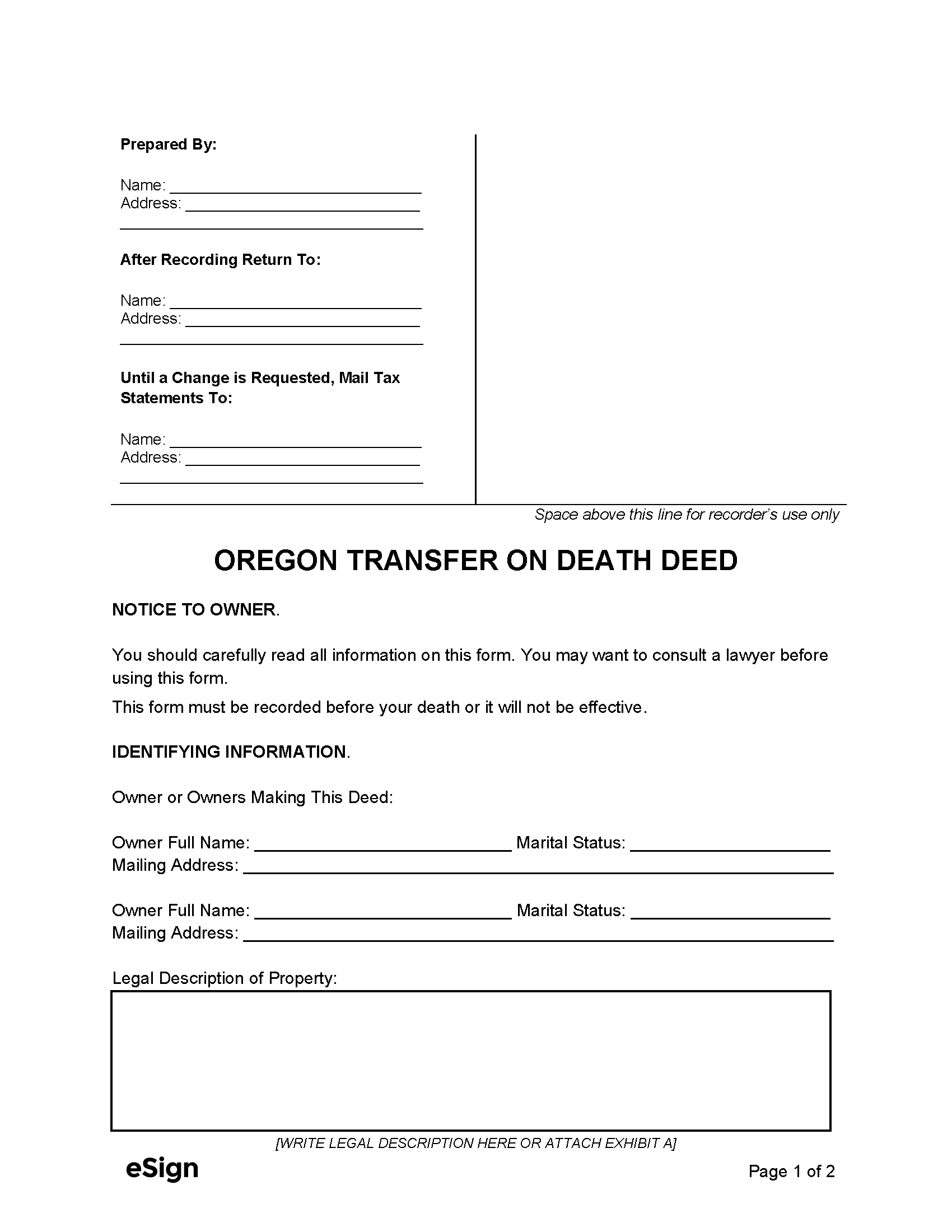

Transfer on Death Deed – Used to name a beneficiary who will receive property upon the owner’s death. Transfer on Death Deed – Used to name a beneficiary who will receive property upon the owner’s death.

|

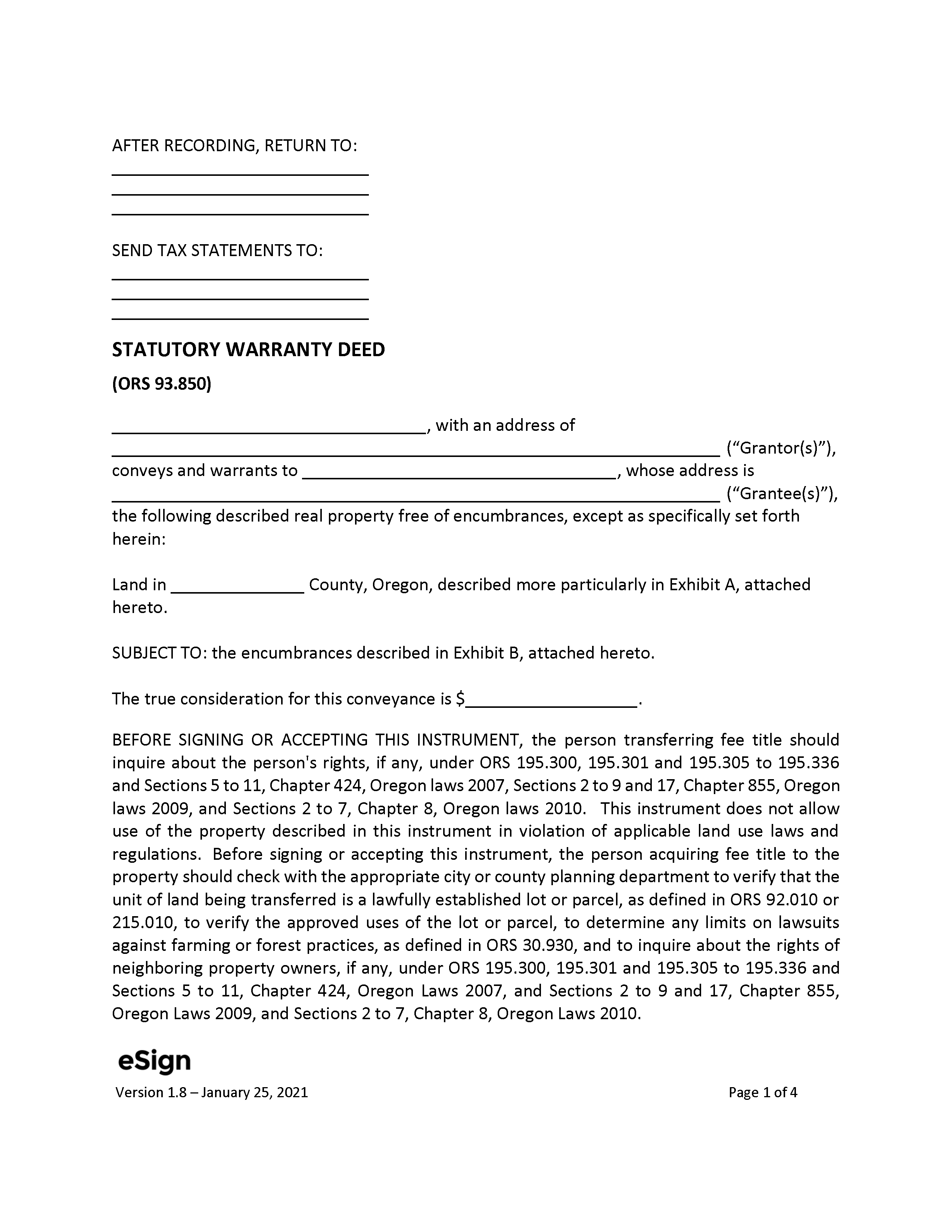

Warranty Deed – Fully protects the grantee against any potential title encumbrances. Warranty Deed – Fully protects the grantee against any potential title encumbrances.

|

Formatting

Paper – Cannot be larger than 8.5″ in width and 14″ in length

Font – Min. 10-point font[1]

Recording

Signing Requirements – In Oregon, the grantor’s signature must be acknowledged in the presence of a notary public.[2]

Where to Record – Completed property deeds are recorded with the County Clerk.[3]

Cost – $5 per page (at the time of this writing)[4]