By Type (4)

Enhanced Life Estate Deed – An estate planning document that conveys a title to beneficiaries when the grantor dies. Enhanced Life Estate Deed – An estate planning document that conveys a title to beneficiaries when the grantor dies.

|

General Warranty Deed – Includes a title warranty covering existing encumbrances from all ownership periods. General Warranty Deed – Includes a title warranty covering existing encumbrances from all ownership periods.

|

Quit Claim Deed – Conveys a real estate title without warranties from the grantor. Quit Claim Deed – Conveys a real estate title without warranties from the grantor.

|

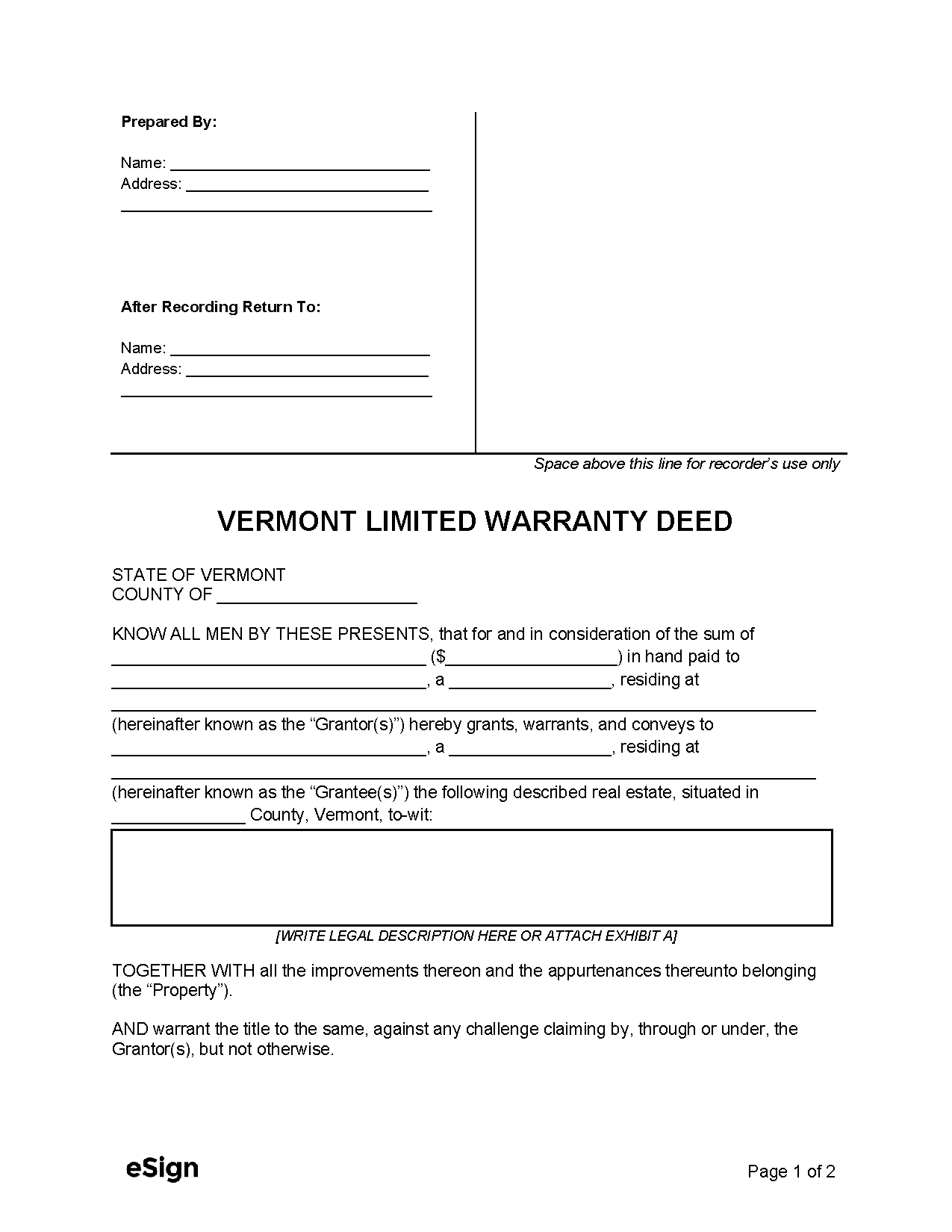

Special Warranty Deed – Warrants against title defects originating from when the grantor owned the property. Special Warranty Deed – Warrants against title defects originating from when the grantor owned the property.

|

Formatting

Vermont law doesn’t outline rules for deed formatting, but local recording offices may have their own requirements. Before filing, it’s best to contact the town/county clerk to see what’s needed.

Recording

Signing Requirements – All Vermont deeds need the grantor’s signature and a notarial acknowledgment.[1]

Where to Record – A signed and notarized deed must be recorded at the Town/County Clerk’s Office.[2]

Cost – $15 per page (at the time of this writing)[3]

Additional Forms

Property Transfer Tax Return (Form PTT-172) – Needed when filing a deed to calculate the property transfer tax (see form instructions).[4]