Typically Includes

- Merchant name

- Customer name, billing address, and contact info

- Transaction amount and date

- Transaction frequency

- Payment type (credit card or ACH) and info

- Customer signature

By Type (4)

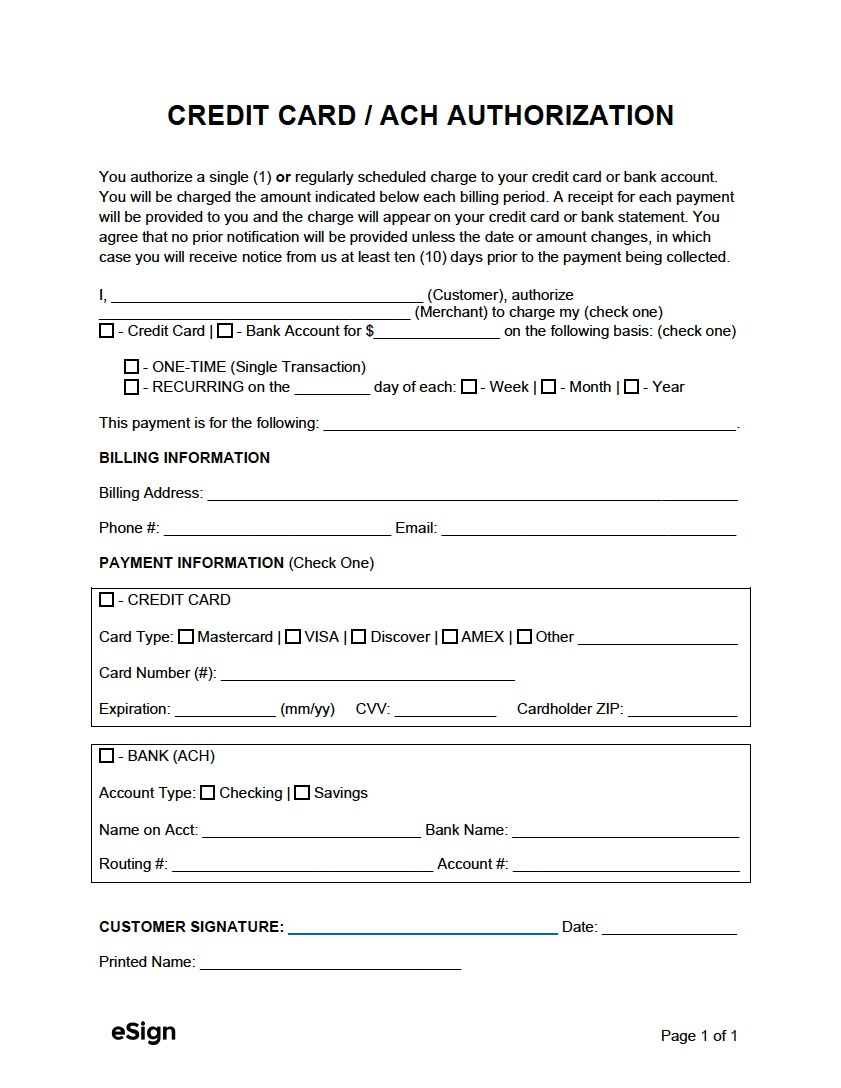

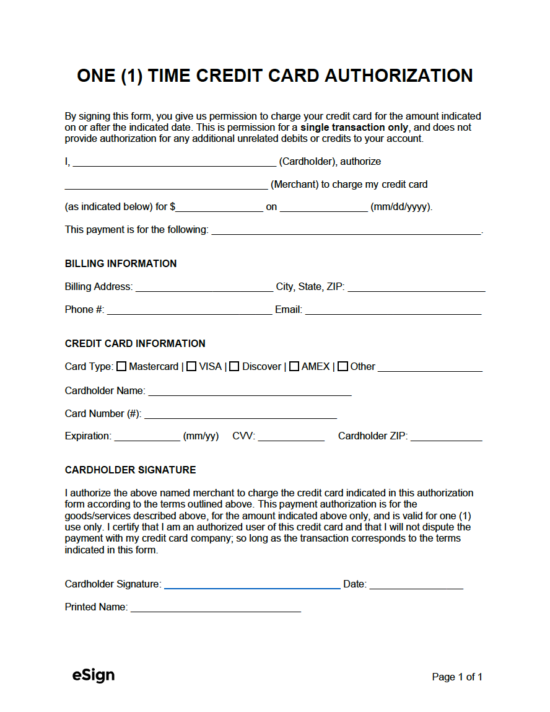

Credit Card Authorization Forms (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

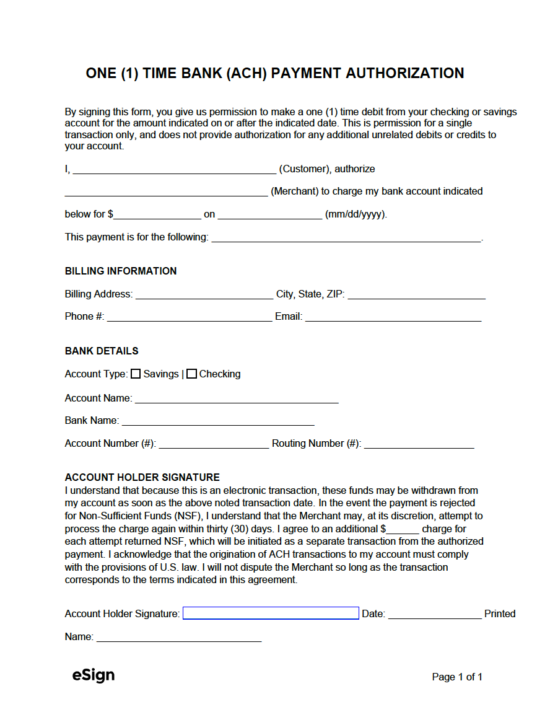

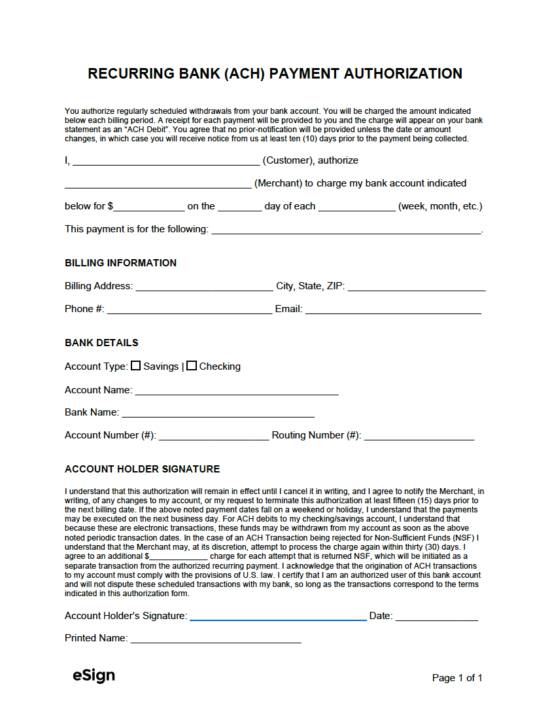

ACH Authorization Forms (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Sample

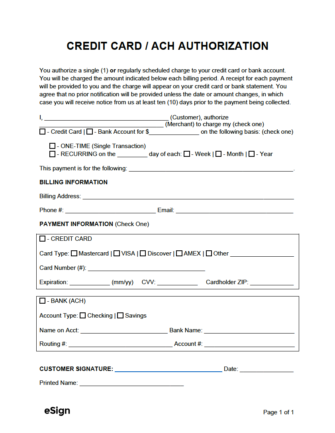

CREDIT CARD / ACH AUTHORIZATION FORM

You authorize a single (1) or regularly scheduled charge to your credit card or bank account. You will be charged the amount indicated below each billing period. A receipt for each payment will be provided to you and the charge will appear on your credit card or bank statement. You agree that no prior notification will be provided unless the date or amount changes, in which case you will receive notice from us at least ten (10) days prior to the payment being collected.

I, [CUSTOMER NAME], authorize [MERCHANT NAME] to charge my (check one) ☐ credit card | ☐ bank account for $[AMOUNT] on the following basis:

☐ ONE-TIME (Single Transaction)

☐ RECURRING on the [#] day of each ☐ week | ☐ month | ☐ year.

The payment is for the following: [DESCRIPTION]

BILLING INFORMATION

Billing Address: [BILLING ADDRESS]

Phone Number: [PHONE] Email: [EMAIL]

PAYMENT INFORMATION (Check One)

☐ CREDIT CARD

Card Type: ☐ Mastercard | ☐ VISA| ☐ Discover ☐ AMEX| ☐ Other: [OTHER CARD TYPE]

Card Number: [CREDIT CARD NUMBER]

Expiration: [MM/YY] CVV: [#] Cardholder ZIP: [ZIP CODE]

☐ BANK (ACH)

Account Type: ☐ Checking | ☐ Savings

Name on Account: [NAME ON ACCOUNT] Bank Name: [BANK NAME]

Routing Number: [#] Account Number: [#]

Customer Signature: _____________________________

Date: [DATE]

Printed Name: [CUSTOMER NAME]