Lease Agreements: By Type (6)

Standard (1-Year) Lease Agreement – A fixed-term contract that permits a tenant to occupy a residential dwelling for one year. Standard (1-Year) Lease Agreement – A fixed-term contract that permits a tenant to occupy a residential dwelling for one year.

Download: PDF, Word (.docx), OpenDocument |

Commercial Lease Agreement – A rental contract for non-residential property, such as retail, industrial, and office space. Commercial Lease Agreement – A rental contract for non-residential property, such as retail, industrial, and office space.

Download: PDF, Word (.docx), OpenDocument

|

Month-to-Month Lease Agreement – A rental contract that lasts one month and renews every month until terminated by either party with proper notice. Month-to-Month Lease Agreement – A rental contract that lasts one month and renews every month until terminated by either party with proper notice.

Download: PDF, Word (.docx), OpenDocument

|

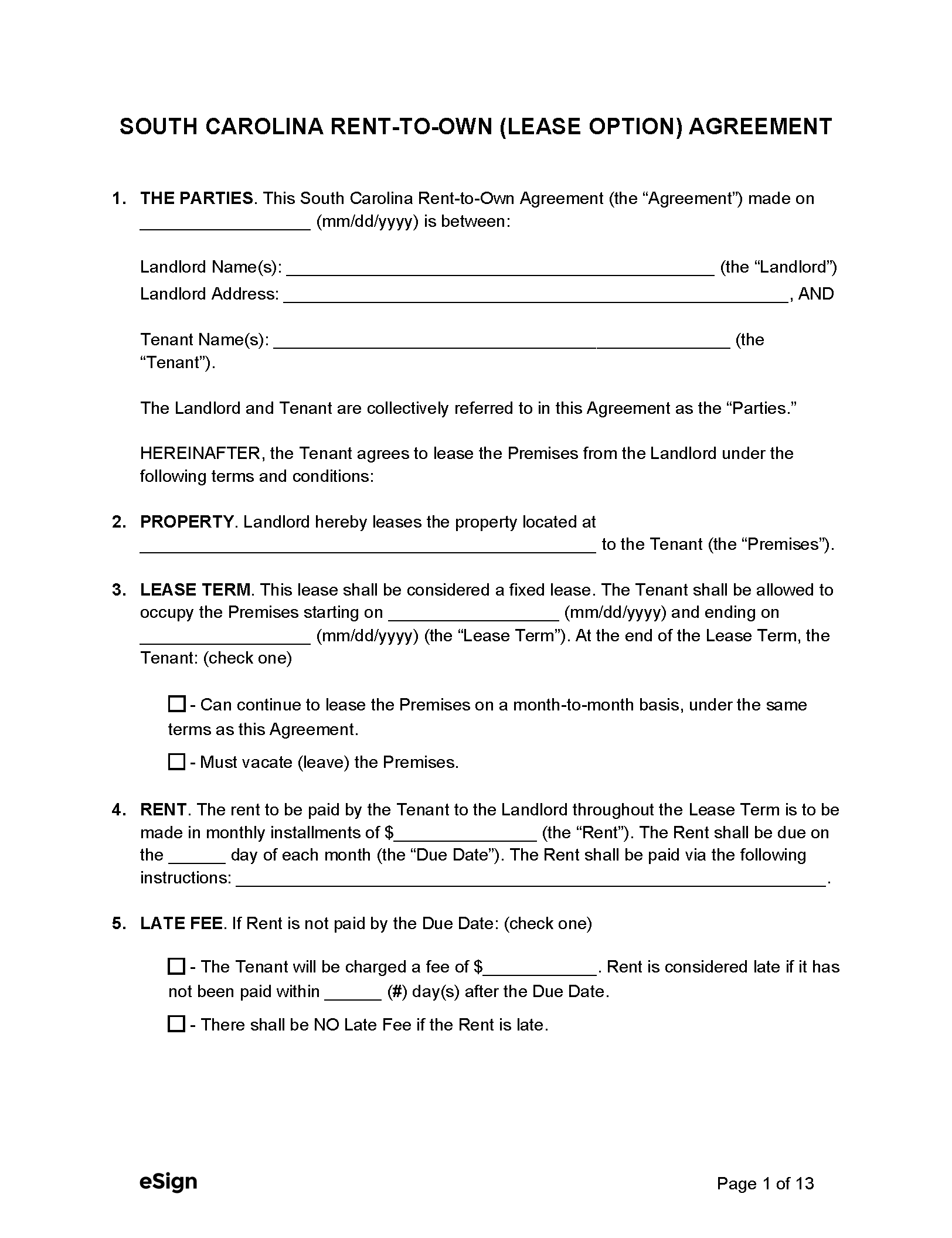

Rent-to-Own Agreement (Lease Option) – Serves the same function as a standard lease but provides tenants with the opportunity to purchase the property. Rent-to-Own Agreement (Lease Option) – Serves the same function as a standard lease but provides tenants with the opportunity to purchase the property.

Download: PDF, Word (.docx), OpenDocument

|

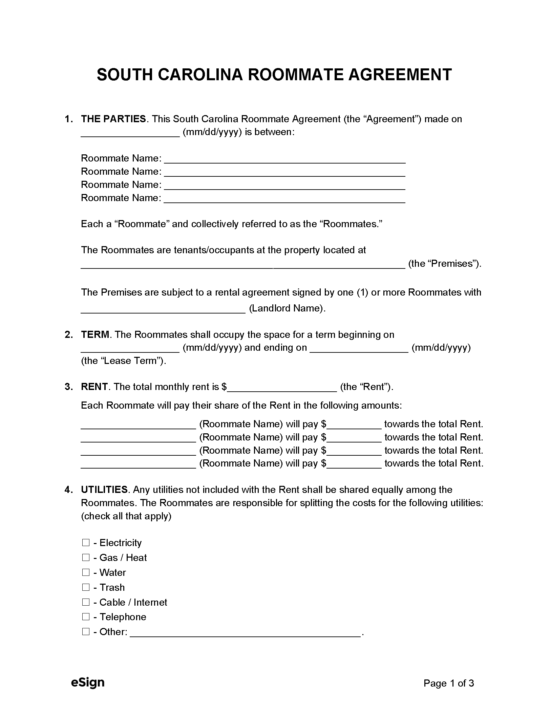

Roommate Agreement – An agreement between roommates that defines the occupants’ financial obligations and household responsibilities. Roommate Agreement – An agreement between roommates that defines the occupants’ financial obligations and household responsibilities.

Download: PDF, Word (.docx), OpenDocument

|

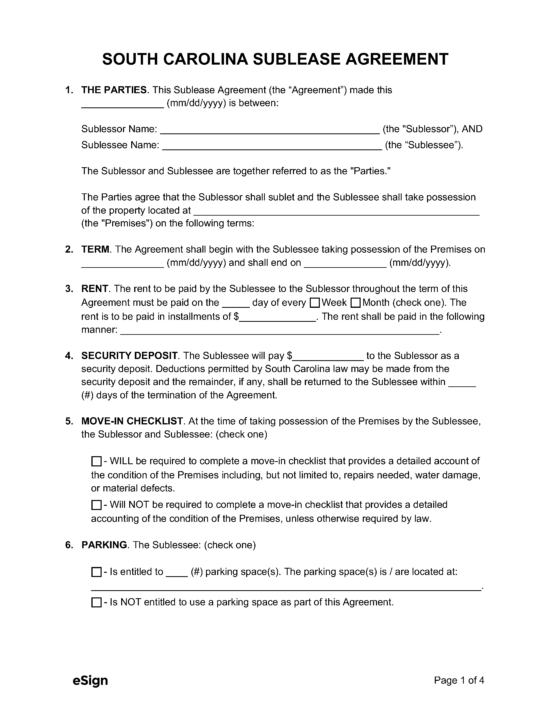

Sublease Agreement – Used by tenants to rent all or a portion of their residential dwelling to another lessee. Sublease Agreement – Used by tenants to rent all or a portion of their residential dwelling to another lessee.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (3)

- Lead-Based Paint Disclosure (PDF) – This disclosure alerts tenants to the existence of hazardous paint on the premises of the rental unit (only required if the property was built before 1978).[1]

- Owner Disclosure – Tenants must be given a written statement with the name and address of the property owner or anyone permitted to act on the owner’s behalf for the purpose of service of process and the receipt of notices and demands.[2]

- Security Deposit Calculation – If the landlord rents more than four adjoining residential units and imposes different methods to calculate each tenant’s security deposit, the calculation method must be disclosed to each tenant.[3]

Security Deposits

Maximum Amount ($) – No state law limits the amount of security deposit the landlord can request from the tenant.

Collecting Interest – No law obligates the landlord to collect interest on the security deposit for the tenant.

Returning to Tenant – Security deposits must be returned to the tenant within 30 days.[4]

Itemized list Required? – Yes, if the landlord deducts from the security deposit, they must provide the tenant with an itemized list within 30 days of the end of the lease.[5]

Separate Bank Account? – No statute obligates the landlord to maintain a security deposit in a seperate bank account.

Landlord’s Entry

General Access – 24 hours’ notice is required before entering the premises of a dwelling. The time of entry scheduled with the tenant must be a reasonable hour of the day.[6]

Immediate Access – A landlord may enter the premises at any time without consent in cases of emergency.[7]

Rent Payments

Grace Period – There is no grace period that must be given to tenants before the landlord can charge late fees.[8]

Maximum Late Fee ($) – No state law limits the late fee amount that the landlord may impose on a tenant.

Bad Check (NSF) Fee – A service charge of $30 is the most that can be charged for a bad check.[9]

Withholding Rent – If the landlord fails to provide essential services, the tenant may notify the landlord, remedy the violation, and deduct the costs from their rent.[10]

Breaking a Lease

Non-Payment of Rent – The day after the tenant fails to pay the rent, the landlord may send them a 5-day notice to quit.[11]

Non-Compliance – If the tenant violates the rental agreement, they may be sent a 14-day notice to quit stating that they have 14 days to remedy the problem or they must vacate the property.[12]

Lockouts – The landlord may not change the locks or attempt to remove the tenant by interrupting services without a court order.[13]

Leaving Before the End Date – If the tenant abandons the property, they must pay the lost rent for the time the property is empty.[14] The landlord must make a reasonable effort to re-rent the dwelling.[15]

Lease Termination

Month-to-Month Tenancy – To terminate a periodic monthly lease, the landlord or tenant must give a 30-day notice.[16]

Unclaimed Property – The landlord may dispose of any personal property left by a tenant if the value of that property is $500 or less.[17]