Lease Agreements: By Type (6)

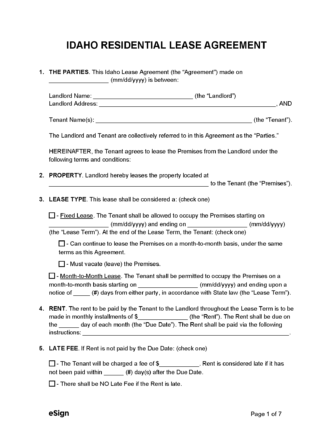

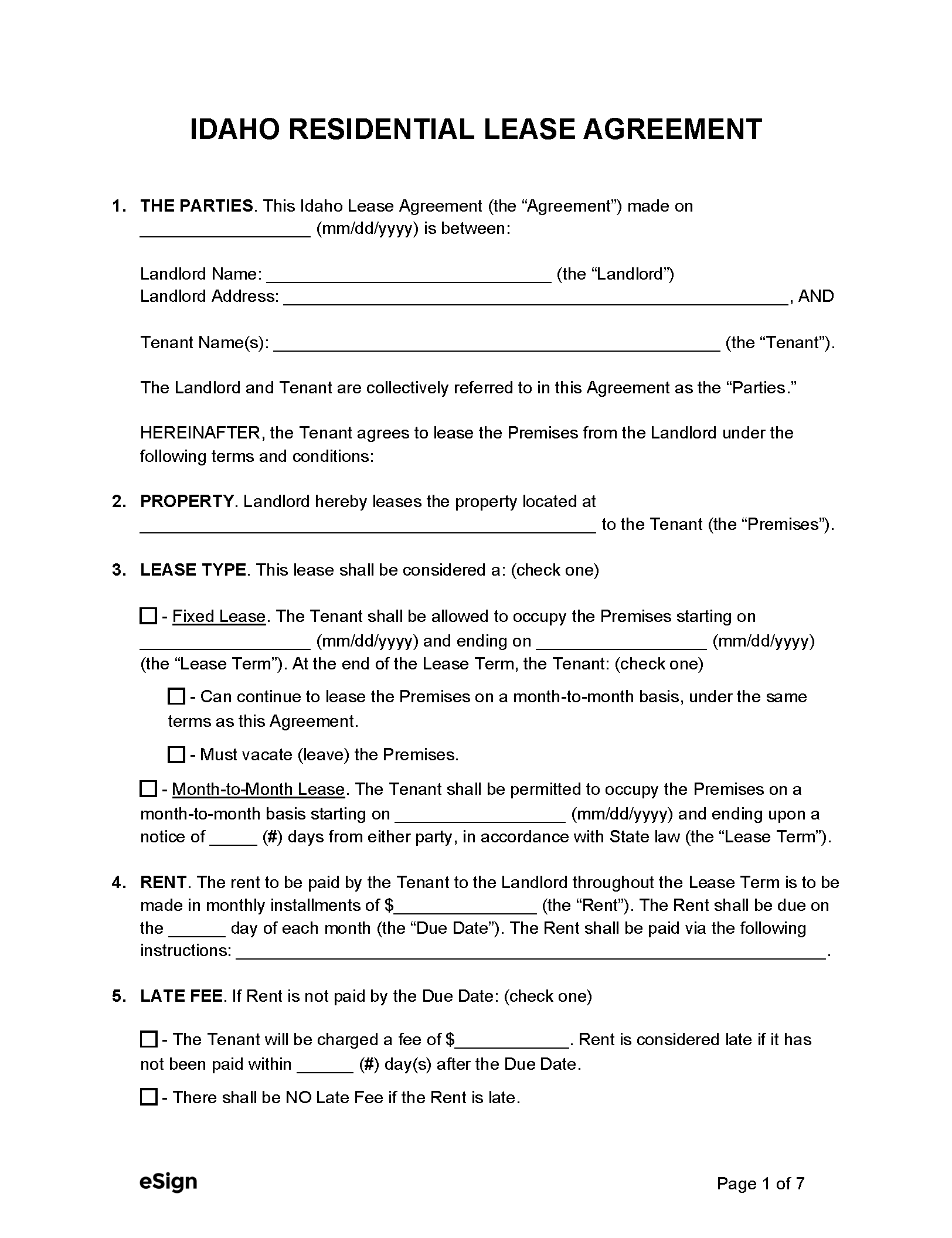

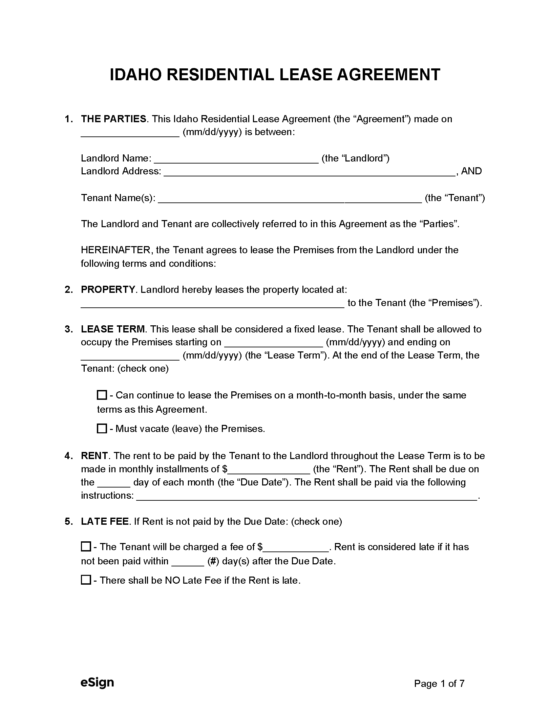

Standard (1-year) Lease Agreement – A contract designed to rent out residential property for a fixed term with monthly rent installments. Standard (1-year) Lease Agreement – A contract designed to rent out residential property for a fixed term with monthly rent installments.

Download: PDF, Word (.docx), OpenDocument |

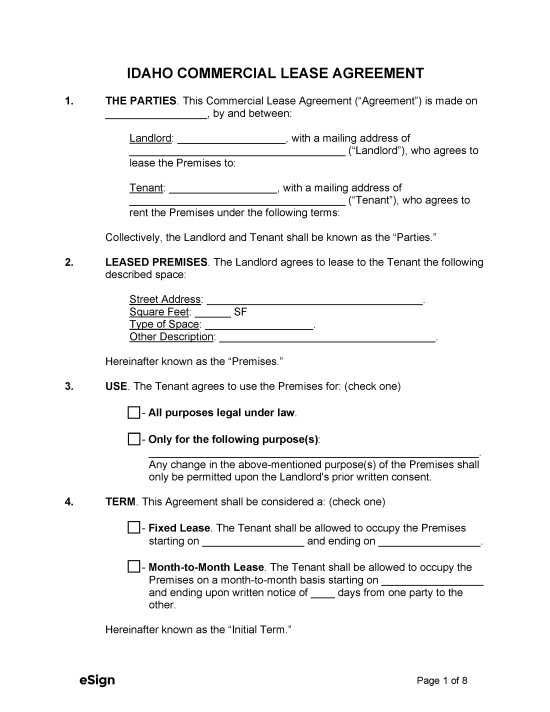

Commercial Lease Agreement – A rental contract used to rent out property for business purposes. – A rental contract used to rent out property for business purposes.

Download: PDF, Word (.docx), OpenDocument |

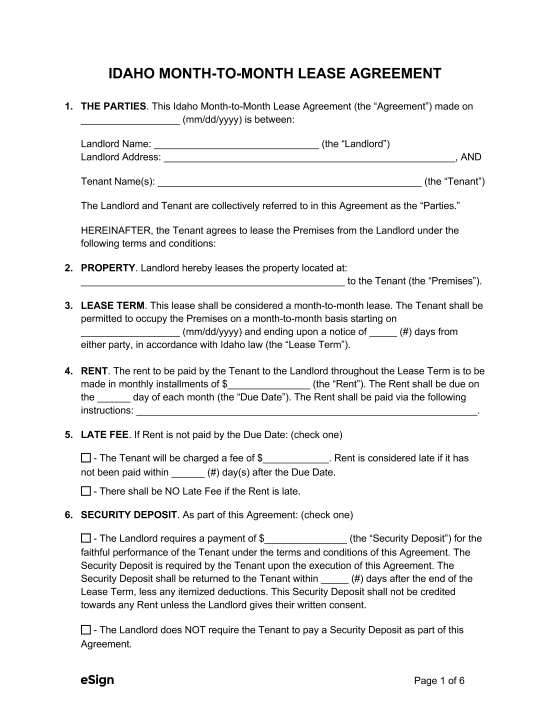

Month-to-Month Lease Agreement – A contract for landlords who wish to rent out their property on a monthly basis without a fixed term. Month-to-Month Lease Agreement – A contract for landlords who wish to rent out their property on a monthly basis without a fixed term.

Download: PDF, Word (.docx), OpenDocument |

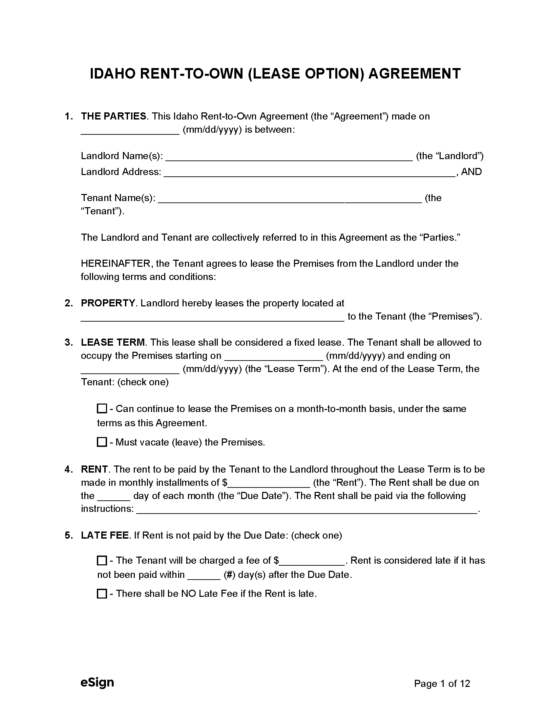

Rent-to-Own (Lease Option) Agreement – A lease that enables a tenant to purchase the property after renting it for a designated period. Rent-to-Own (Lease Option) Agreement – A lease that enables a tenant to purchase the property after renting it for a designated period.

Download: PDF, Word (.docx), OpenDocument |

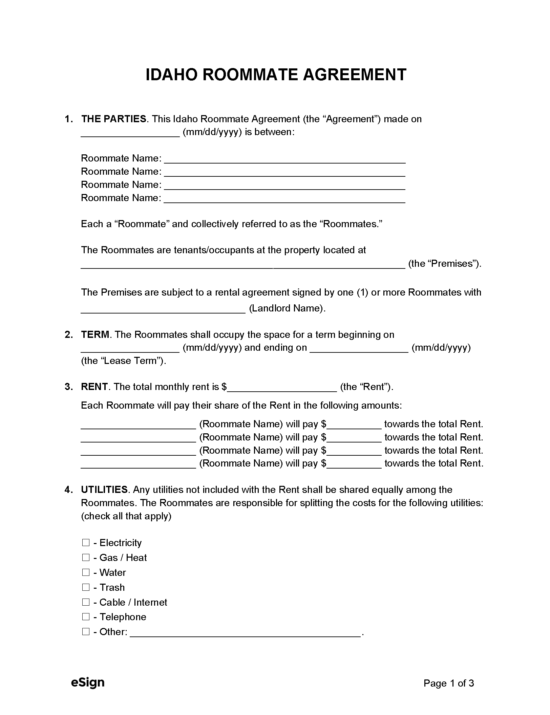

Roommate Agreement – A document used by roommates who wish to establish certain terms and conditions of living together (rent amount, deposits, utilities, etc.). Roommate Agreement – A document used by roommates who wish to establish certain terms and conditions of living together (rent amount, deposits, utilities, etc.).

Download: PDF, Word (.docx), OpenDocument |

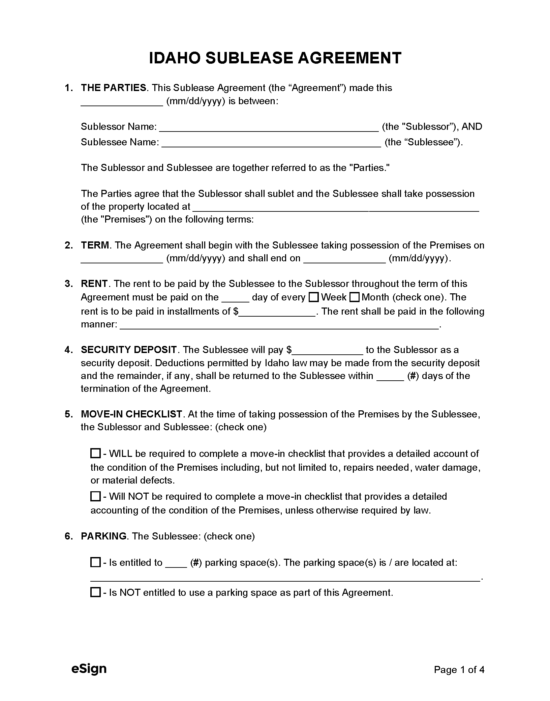

Sublease Agreement – An agreement for tenants to rent out their current rental space to a subtenant. Sublease Agreement – An agreement for tenants to rent out their current rental space to a subtenant.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (1)

- Lead-Based Paint Disclosure (PDF) – Landlords must inform tenants about the possible or known presence of toxic paint if a rental property was built before 1978.[1]

Security Deposits

Maximum Amount ($) – There is no maximum amount for security deposits.

Collecting Interest – There’s nothing in the state statutes that requires the landlord to collect interest made on the security deposit on behalf of the tenant.

Returning to Tenant – Security deposit refunds must be made within 21 days unless the lease agreement says otherwise (can’t exceed 30 days).[2]

Itemized List Required? – Yes, if the landlord makes any deductions from the security deposit less the full amount, they must give the tenant a written statement of the amounts and reasons for the deductions.

Separate Bank Account? – No deposits are required to be kept in a separate bank account.

Landlord’s Access

General Access – State law doesn’t specify the landlord’s right of access.

Immediate Access – Although it isn’t mentioned in state law, landlords are reasonably allowed immediate access in emergencies.

Rent Payments

Grace Period – There is no grace period required for rent payments.

Maximum Late Fees ($) – State law doesn’t set a maximum amount landlords can charge for late fees.

Bad Check (NSF) Fee – The landlord is entitled to charge a fee of up to $20 for bounced checks.[3]

Withholding Rent – The tenant is only permitted to withhold rent for the cost of installing smoke detectors if the landlord doesn’t install them after receiving written notice.[4]

Breaking a Lease

Non-Payment of Rent – Tenants who haven’t paid rent on time can be given a 3-Day Notice to Quit for Non-Payment.[5]

Non-Compliance – If a tenant breaks the terms of their lease, the landlord can give them three days’ notice to fix the violation or quit the property.[6]

Lockouts – Landlords cannot change the tenant’s locks during their tenancy.[7]

Leaving Before the End Date – No statute.

Lease Termination

Month-to-Month Tenancy – One month’s notice must be given to terminate a month-to-month tenancy.[8]

Unclaimed Property – When a tenant is evicted, they will have 72 hours to remove their personal property before the landlord can claim it. If the property is left by a tenant who has not been evicted, the landlord must file an eviction complaint and obtain a court order to remove and sell the property.[9]