By State (32)

Transfer on death deeds are currently permitted in 32 states. If a TODD is not recognized in the owner’s state, they may be able to use a living trust or a lady bird deed, if accepted in their state.

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Georgia

- Hawaii

- Illinois

- Indiana

- Kansas

- Maine

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Also Known As (AKA)

- Beneficiary deed

- Deed Upon Death

- Revocable Transfer on Death Deed

- TOD deed

- Transfer Upon Death Deed

- Transfer-on-Death Instrument

TODD Pros & Cons

Pros

- Allows the beneficiary to skip the probate process.

- Doesn’t change the grantor’s property ownership while alive.

- Can be revoked at any time prior to the grantor’s death.

Cons

- Transfers any liens and mortgages to the beneficiary.

- Jointly owned property overrides a TOD deed.

Transfer on Death Laws

This table lists the transfer on death laws as they apply to each individual state.

The table is current as of June 2025.

View State Requirements |

|||||

| STATE | ALLOWED? | STATUTE | |||

| Alabama | X | N/A | |||

| Alaska | ✓ | §§ 13.48.010 to 13.48.195 | |||

| Arizona | ✓ | § 33-405 | |||

| Arkansas | ✓ | § 18-12-608 | |||

| California | ✓ | §§ 5600 to 5698 | |||

| Colorado | ✓ | §§ 15-15-404 to 15-15-415 | |||

| Connecticut | X | N/A | |||

| Delaware | X | N/A | |||

| Florida | X | N/A | |||

| Georgia | ✓ | §§ 44-17-2, 44-17-3 | |||

| Hawaii | ✓ | §§ 527-1 to 527-17 | |||

| Idaho | X | N/A | |||

| Illinois | ✓ | §§ 755 ILCS 27/1 to 27/100 | |||

| Indiana | ✓ | § 32-17-14-11 | |||

| Iowa | X | N/A | |||

| Kansas | ✓ | Ch. 59, Art.35 | |||

| Kentucky | X | N/A | |||

| Louisiana | X | N/A | |||

| Maine | ✓ | §§ 6-401 to 6-421 | |||

| Maryland | X | N/A | |||

| Massachusetts | X | N/A | |||

| Michigan | X | N/A | |||

| Minnesota | ✓ | § 507.071, Chapter 38, Article 3, Section 74 | |||

| Mississippi | ✓ | §§ 91-27-1 to 91-27-37 | |||

| Missouri | ✓ | Title 31, Ch. 461 | |||

| Montana | ✓ | §§ 72-6-401 to 72-6-418 | |||

| Nebraska | ✓ | §§ 76-3401 to 76-3423 | |||

| Nevada | ✓ | §§ 111.655 to 111.699 | |||

| New Hampshire | ✓ | Chapter 563-D | |||

| New Jersey | X | N/A | |||

| New Mexico | ✓ | §§ 45-6-401 to 45-6-417 | |||

| New York | ✓ | N.Y. Real Prop. Law § 424 | |||

| North Carolina | X | N/A | |||

| North Dakota | ✓ | §§ 30.1-32.1-01 to 30.1-32.1-14 | |||

| Ohio | ✓ | §§ 5302.22, 5302.23 | |||

| Oklahoma | ✓ | 58 §§ 1252, 1253 | |||

| Oregon | ✓ | §§ 93.948 to 93.985 | |||

| Pennsylvania | X | N/A | |||

| Rhode Island | X | N/A | |||

| South Carolina | X | N/A | |||

| South Dakota | ✓ | §§ 29A-6-401 to 29A-6-435 | |||

| Tennessee | X | N/A | |||

| Texas | ✓ | §§ 114.001 to 114.106 | |||

| Utah | ✓ | §§ 75-6-401 to 75-6-419 | |||

| Vermont | X | N/A | |||

| Virginia | ✓ | §§ 64.2-621 to 64.2-638 | |||

| Washington | ✓ | §§ 64.80.010 to 64.80.904 | |||

| West Virginia | ✓ | §§ 36-12-1 to 36-12-17 | |||

| Wisconsin | ✓ | § 705.15 | |||

| Wyoming | ✓ | §§ 2-18-101 to 2-18-105 | |||

Revocability of TODDs

A transfer on death deed can be revoked anytime before the owner’s death. This can be done by either completing a new transfer on death deed and recording it in the same manner as the first, or by completing and recording a revocation of the transfer on death deed.

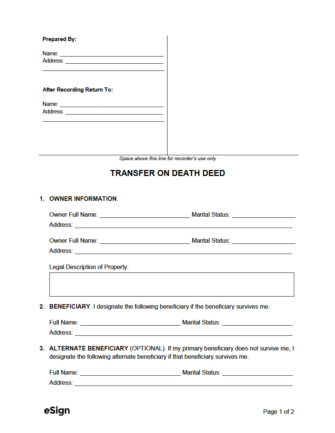

Sample

Formatting standards vary by state.

Name: [PREPARER NAME]

Address: [PREPARER ADDRESS]After Recording Return To:

Name: [RETURN NAME]

Address: [RETURN ADDRESS]

TRANSFER ON DEATH DEED

1. OWNER INFORMATION.

Owner Full Name: [OWNER NAME] Marital Status: [OWNER MARITAL STATUS] Address: [OWNER ADDRESS]

Owner Full Name: [OWNER NAME] Marital Status: [OWNER MARITAL STATUS] Address: [OWNER ADDRESS]

Legal Description of Property: [ENTER PROPERTY’S LEGAL DESCRIPTION]

2. BENEFICIARY. I designate the following beneficiary if the beneficiary survives me.

Full Name: [BENEFICIARY NAME] Marital Status: [MARITAL STATUS] Address: [BENEFICIARY ADDRESS]

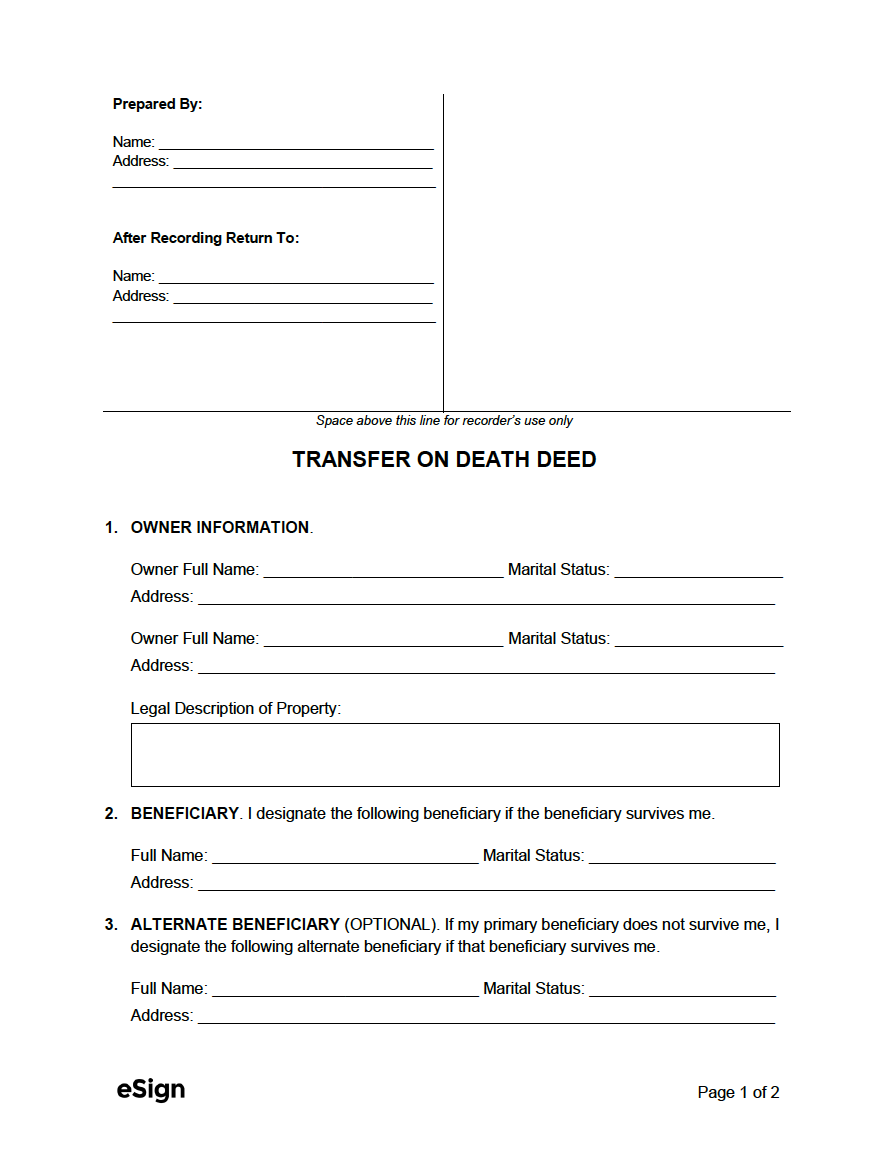

3. TRANSFER ON DEATH. At my death, I transfer my interest in the described property to the beneficiaries as designated above. Before my death, I have the right to revoke this deed.

4. SIGNATURES.

Owner Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [OWNER NAME]

5. WITNESSES (IF REQUIRED).

Witness Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

Witness Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

6. NOTARY ACKNOWLEDGMENT.

STATE OF [STATE]

COUNTY OF [COUNTY]

I, the undersigned, a Notary Public in and for said County, in said State, hereby certify that [OWNER(S)] whose names are signed to the foregoing instrument, and who is known to me, acknowledged before me on this day that, being informed of the contents of the instrument, they, executed the same voluntarily on the day the same bears date.

Given under my hand this [MM/DD/YYYY]

____________________________________

Notary Public

My Commission Expires: [MM/DD/YYYY]