Also Known As (AKA)

- Beneficiary deed

- TOD deed

By State (30)

Transfer-on-death deeds are currently permitted in 30 states. If a TODD is not permitted in the owner’s state, they may be able to use a living trust or a lady bird deed, if accepted in their state.

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Hawaii

- Illinois

- Indiana

- Kansas

- Maine

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

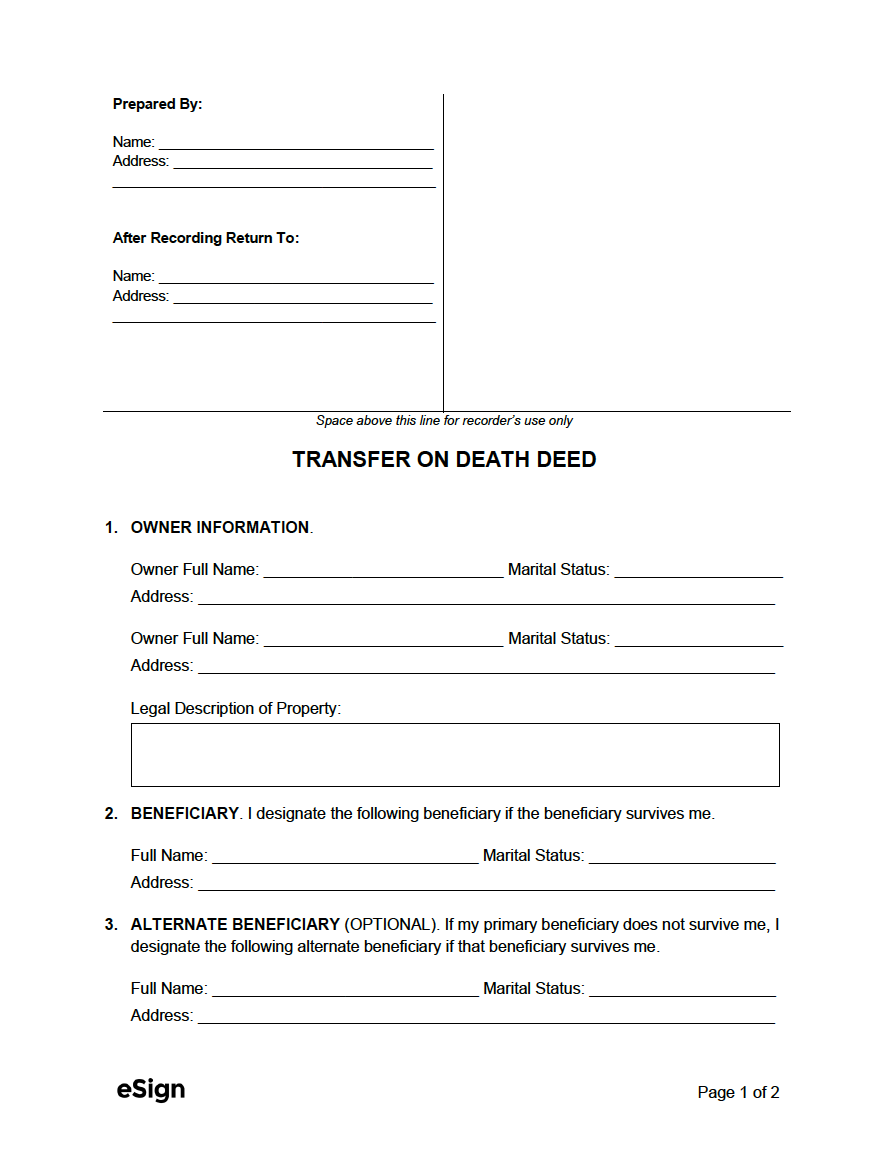

Sample

Name: [PREPARER NAME]

Address: [PREPARER ADDRESS]

After Recording Return To:

Name: [RETURN NAME]

Address: [RETURN ADDRESS]

TRANSFER ON DEATH DEED

1. OWNER INFORMATION.

Owner Full Name: [OWNER NAME] Marital Status: [OWNER MARITAL STATUS]

Address: [OWNER ADDRESS]

Owner Full Name: [OWNER NAME] Marital Status: [OWNER MARITAL STATUS]

Address: [OWNER ADDRESS]

Legal Description of Property: [ENTER PROPERTY’S LEGAL DESCRIPTION]

2. BENEFICIARY. I designate the following beneficiary if the beneficiary survives me.

Full Name: [BENEFICIARY NAME]

Marital Status: [MARITAL STATUS]

Address: [BENEFICIARY ADDRESS]

3. ALTERNATE BENEFICIARY (OPTIONAL). If my primary beneficiary does not survive me, I designate the following alternate beneficiary if that beneficiary survives me.

Full Name: [ALTERNATE BENEFICIARY NAME]

Marital Status: [MARITAL STATUS]

Address: [ALTERNATE BENEFICIARY ADDRESS]

4. TRANSFER ON DEATH. At my death, I transfer my interest in the described property to the beneficiaries as designated above. Before my death, I have the right to revoke this deed.

5. SIGNATURES.

Owner Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [OWNER NAME]

Owner Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [OWNER NAME]

6. WITNESSES (IF REQUIRED).

Witness Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

Address: [WITNESS ADDRESS]

Witness Signature: _____________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

Address: [WITNESS ADDRESS]

7. NOTARY ACKNOWLEDGMENT.

STATE OF [STATE]

COUNTY OF [COUNTY]

I, the undersigned, a Notary Public in and for said County, in said State, hereby certify that [OWNER(S)] whose names are signed to the foregoing instrument, and who is known to me, acknowledged before me on this day that, being informed of the contents of the instrument, they, executed the same voluntarily on the day the same bears date.

Given under my hand this [MM/DD/YYYY]

____________________________________

Notary Public

My Commission Expires: [MM/DD/YYYY]

What is a Transfer on Death Deed?

A transfer on death deed passes one’s ownership in real property to another person (or persons) upon the owner’s death. The owner is known as the grantor, and the recipient is called the beneficiary or grantee.

The deed can be revoked anytime before the owner’s death. This can be done by either completing a new transfer on death deed and recording it in the same manner as the first, or by completing and recording a revocation of the transfer on death deed.

Benefits and Drawbacks

TODD Benefits

- Allows the beneficiary to skip the probate process.

- Doesn’t change the grantor’s ownership over the property.

- Can be revoked at any time prior to the grantor’s death.

TODD Drawbacks

- Transfers any liens and mortgages to the beneficiary.

- Jointly owned property overrides a TOD deed.

Transfer on Death Laws

The table below contains the statutes pertaining to transfer on death for the 30 states that permit this type of deed.

The table is current as of June 2025.

View State Requirements |

||||

| STATE | STATUTE | |||

| Alabama | N/A | |||

| Alaska | §§ 13.48.010 to 13.48.195 | |||

| Arizona | § 33-405 | |||

| Arkansas | § 18-12-608 | |||

| California | §§ 5600 to 5698 | |||

| Colorado | §§ 15-15-404 to 15-15-415 | |||

| Connecticut | N/A | |||

| Delaware | N/A | |||

| Florida | N/A | |||

| Georgia | N/A | |||

| Hawaii | §§ 527-1 to 527-17 | |||

| Idaho | N/A | |||

| Illinois | §§ 755 ILCS 27/1 to 27/100 | |||

| Indiana | § 32-17-14-11 | |||

| Iowa | N/A | |||

| Kansas | § 59-3501 | |||

| Kentucky | N/A | |||

| Louisiana | N/A | |||

| Maine | §§ 6-401 to 6-421 | |||

| Maryland | N/A | |||

| Massachusetts | N/A | |||

| Michigan | N/A | |||

| Minnesota | § 507.071, Chapter 38, Article 3, Section 74 | |||

| Mississippi | §§ 91-27-1 to 91-27-37 | |||

| Missouri | § 461.025 | |||

| Montana | §§ 72-6-401 to 72-6-418 | |||

| Nebraska | §§ 76-3401 to 76-3423 | |||

| Nevada | §§ 111.655 to 111.699 | |||

| New Hampshire | N/A | |||

| New Jersey | N/A | |||

| New Mexico | §§ 45-6-401 to 45-6-417 | |||

| New York | § 424 | |||

| North Carolina | N/A | |||

| North Dakota | §§ 30.1-32.1-01 to 30.1-32.1-14 | |||

| Ohio | § 5302.22 | |||

| Oklahoma | 58 § 1253 | |||

| Oregon | §§ 93.948 to 93.985 | |||

| Pennsylvania | N/A | |||

| Rhode Island | N/A | |||

| South Carolina | N/A | |||

| South Dakota | §§ 29A-6-401 to 29A-6-435 | |||

| Tennessee | N/A | |||

| Texas | §§ 114.001 to 114.106 | |||

| Utah | §§ 75-6-401 to 75-6-419 | |||

| Vermont | N/A | |||

| Virginia | §§ 64.2-621 to 64.2-638 | |||

| Washington | §§ 64.80.010 to 64.80.904 | |||

| West Virginia | §§ 36-12-1 to 36-12-17 | |||

| Wisconsin | § 705.15 | |||

| Wyoming | §§ 2-18-101 to 2-18-105 | |||