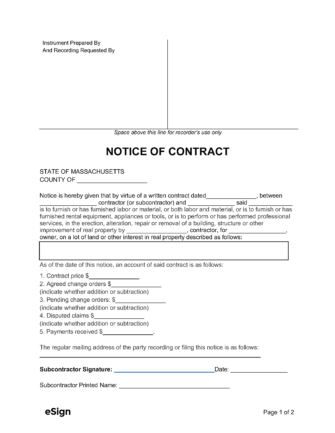

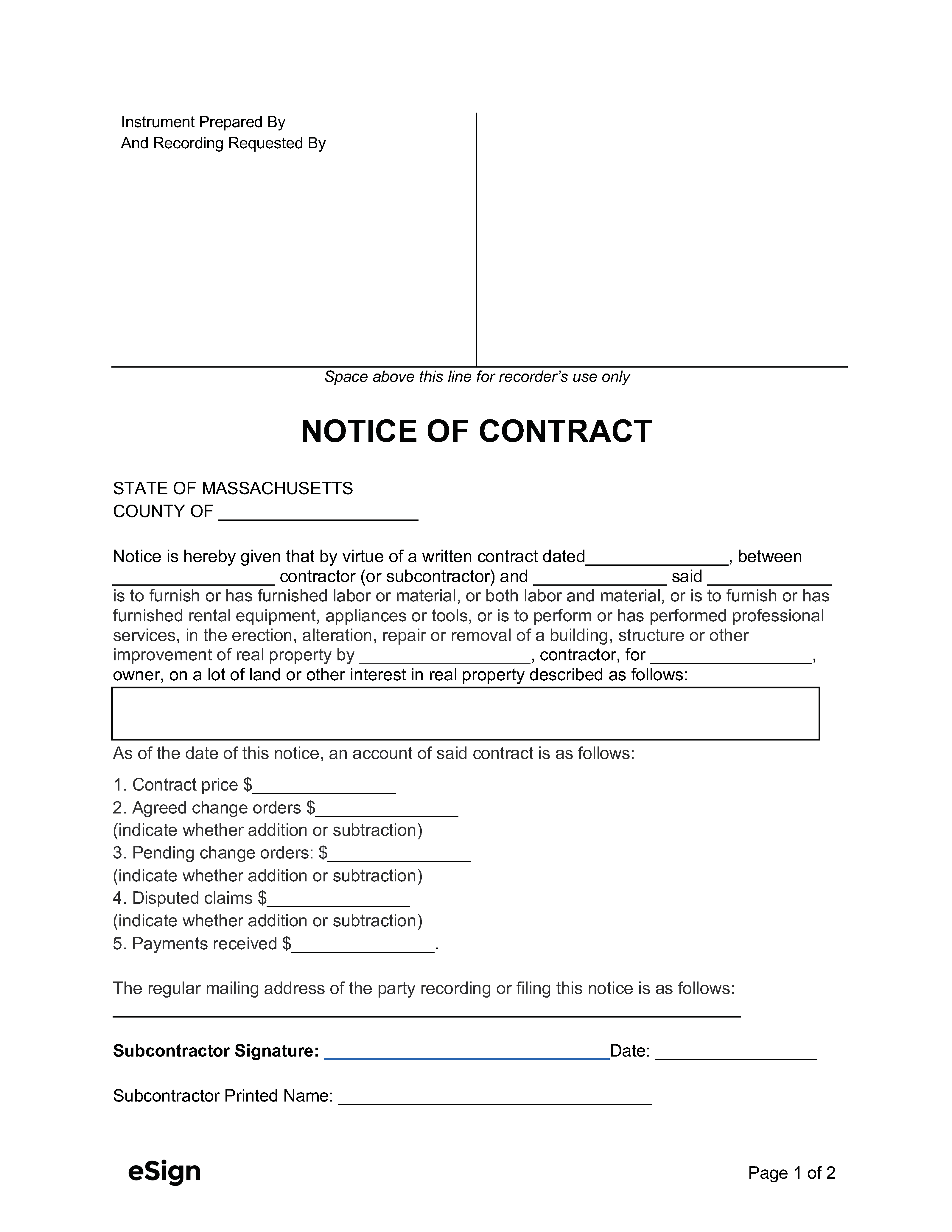

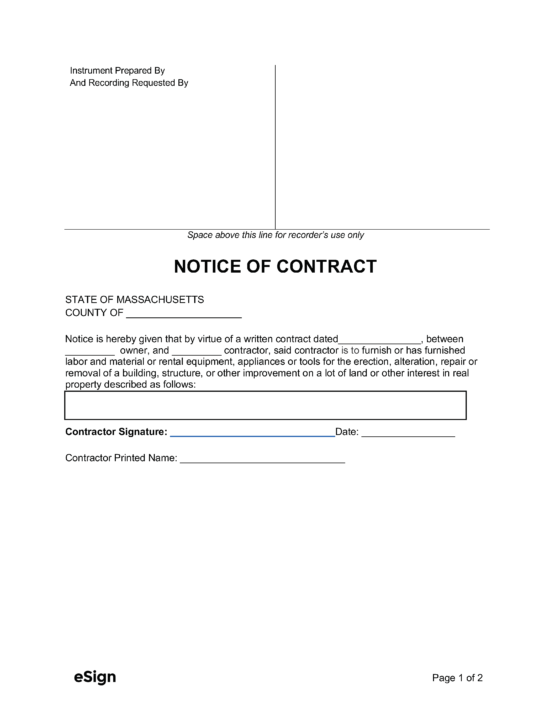

The notice must include a description of the real property where any labor to materials has been furnished, while the statement provides a description of the property and a “just and true” account of the compensation the claimant is seeking. It should be noted that contractors who have a written contract with a property owner need to file a different Notice of Contract than that of a subcontractor or sub-subcontractor.

Subcontractors and sub-subcontractors are required to mail their Notice of Contract by certified mail to the property owners. Workers without a direct contract with the contractor must also file a Notice of Identification to the original contractor within thirty (30) days after beginning work on a project to claim a lien.

Laws & Requirements

- Laws: Chapter 254: LIENS ON BUILDINGS AND LAND

- Signing Requirements: Not mentioned in state statutes.

- Time Limit for Recording Notice (M.G.L. ch. 254, § 4, M.G.L. ch. 254, § 2 ): The time limit for recording the notice is the earliest of the one of the following:

- Sixty (60) days after Notice of Substantial Completion is recorded;

- Ninety (90) days after Notice of Termination is recorded; or

- Ninety (90) days after labor or materials was last furnished to the project.

- Time Limit for Recording Statement of Account (M.G.L. ch. 254, § 8): The time limit for recording the statement is the earliest of the one of the following:

- Ninety (90) days after Notice of Substantial Completion is recorded;

- One hundred and twenty (120) days after Notice of Termination is recorded; or

- One hundred and twenty (120) days after labor or materials was last furnished to the project,

- Deadline for Enforcing Lien (M.G.L. ch. 254, § 11): Ninety (90) days

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF, MS Word, OpenDocument