By Type (10)

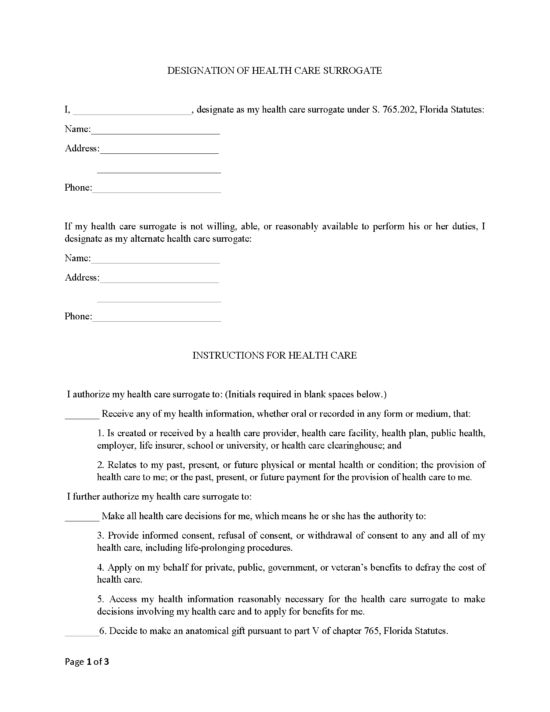

Advance Directive – Appoints an agent to make health care decisions for the principal and gives instructions for medical staff regarding end-of-life care. Advance Directive – Appoints an agent to make health care decisions for the principal and gives instructions for medical staff regarding end-of-life care.

Download: PDF |

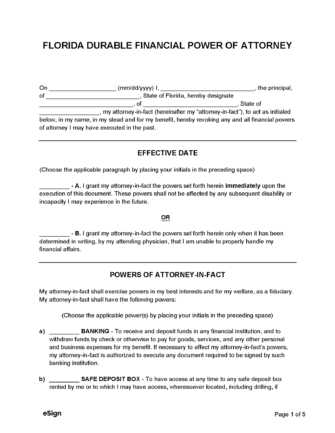

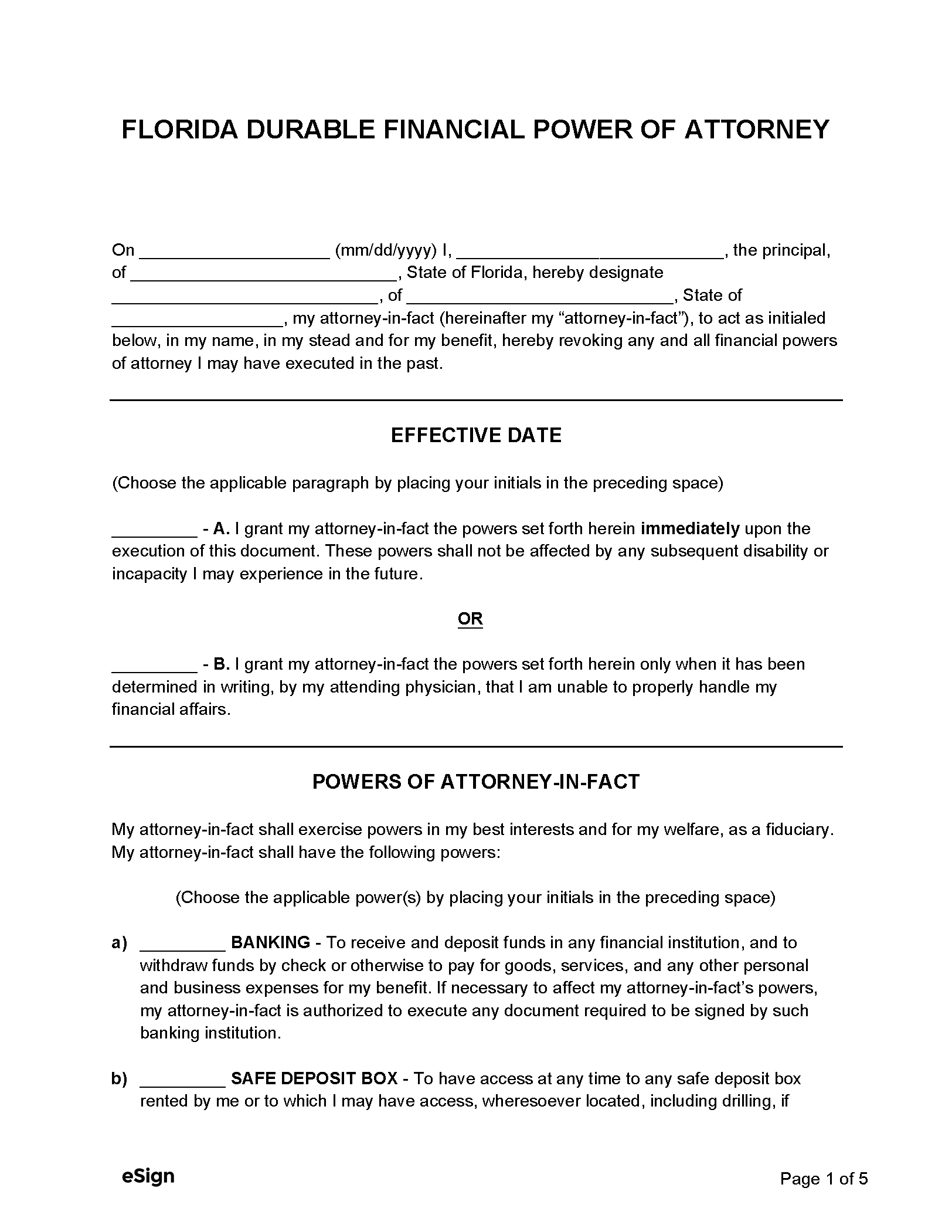

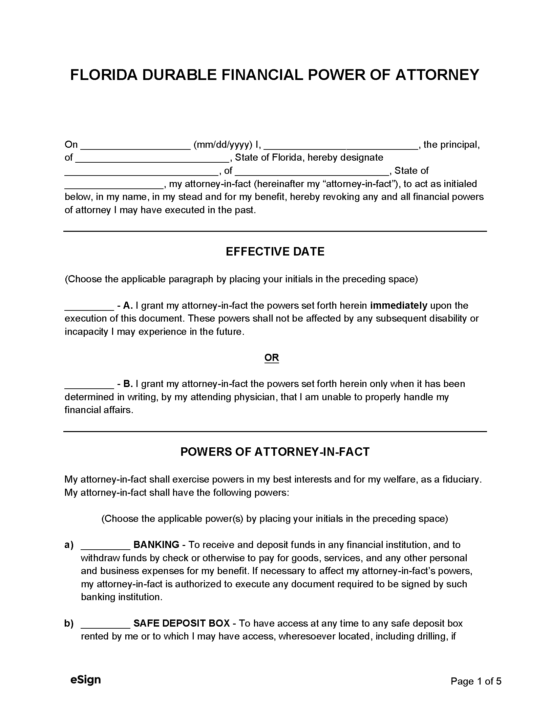

Durable Power of Attorney – Used to select a financial agent to oversee the principal’s finances even in the event of incapacitation. Durable Power of Attorney – Used to select a financial agent to oversee the principal’s finances even in the event of incapacitation.

Download: PDF, Word (.docx), OpenDocument |

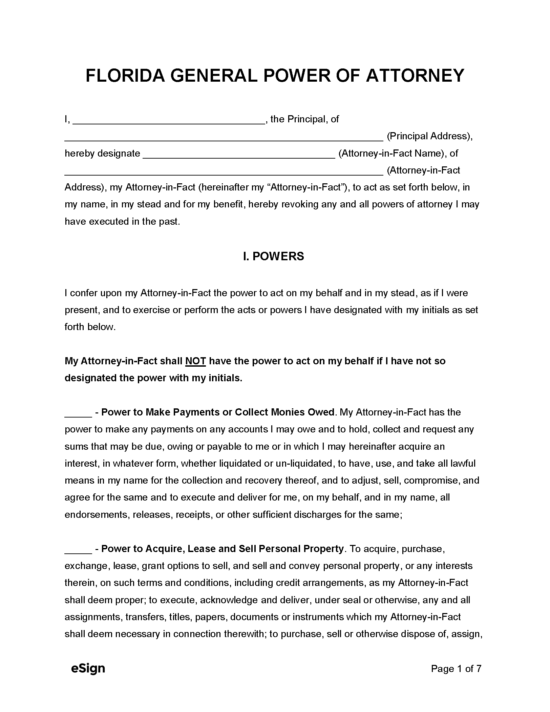

General (non-durable) Power of Attorney – Authorizes an agent to handle a principal’s finances until they lose cognitive function or revoke the form. General (non-durable) Power of Attorney – Authorizes an agent to handle a principal’s finances until they lose cognitive function or revoke the form.

Download: PDF, Word (.docx), OpenDocument |

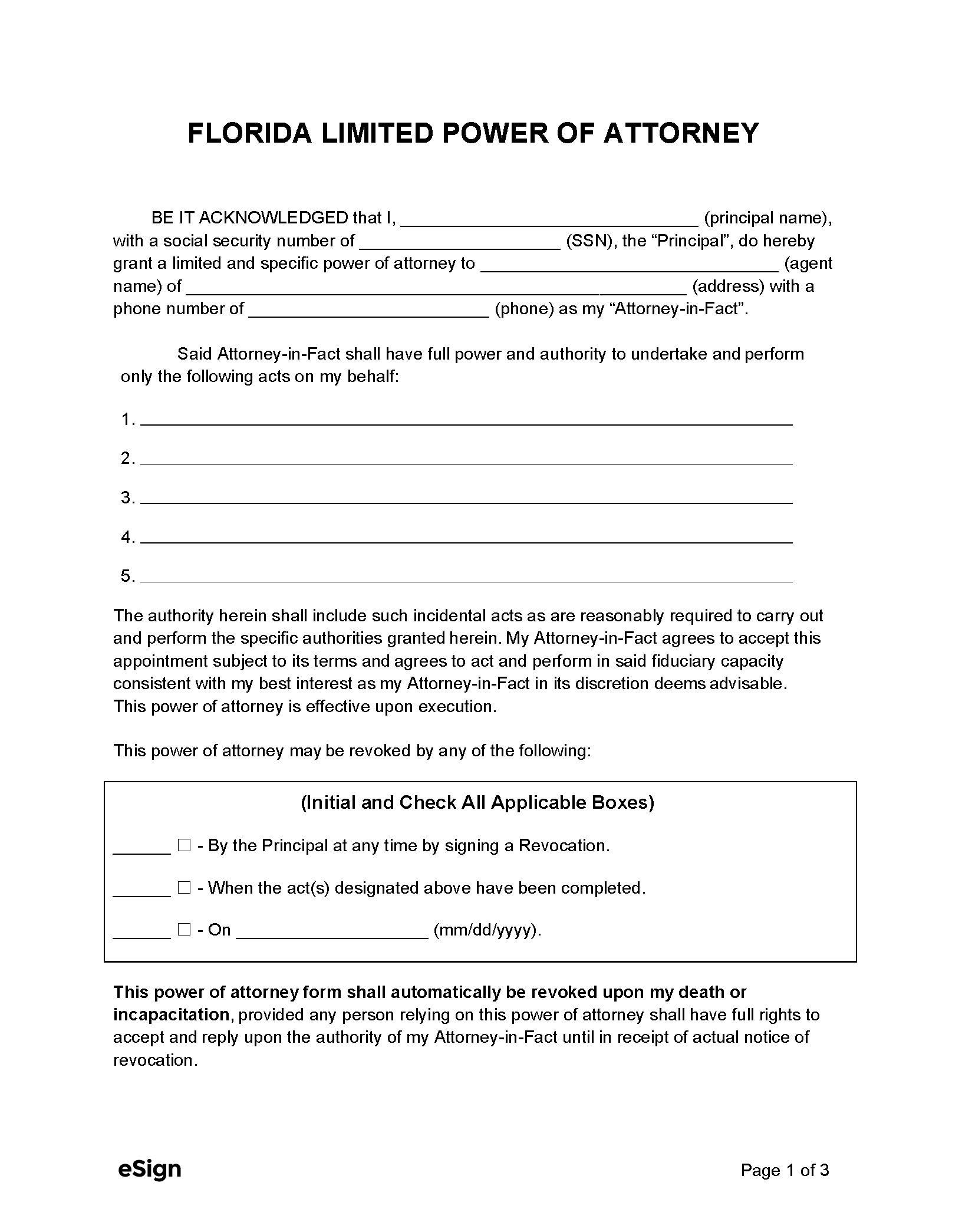

Limited Power of Attorney – Grants specific and limited responsibilities and duties to an authorized agent. Limited Power of Attorney – Grants specific and limited responsibilities and duties to an authorized agent.

Download: PDF, Word (.docx), OpenDocument |

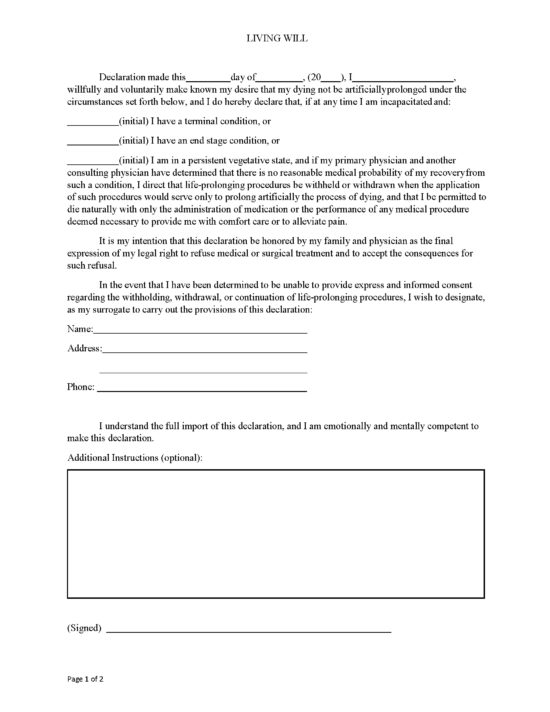

Living Will – Communicates the medical treatments and procedures a person wishes to receive in the event that they are unable to make decisions. Living Will – Communicates the medical treatments and procedures a person wishes to receive in the event that they are unable to make decisions.

Download: PDF |

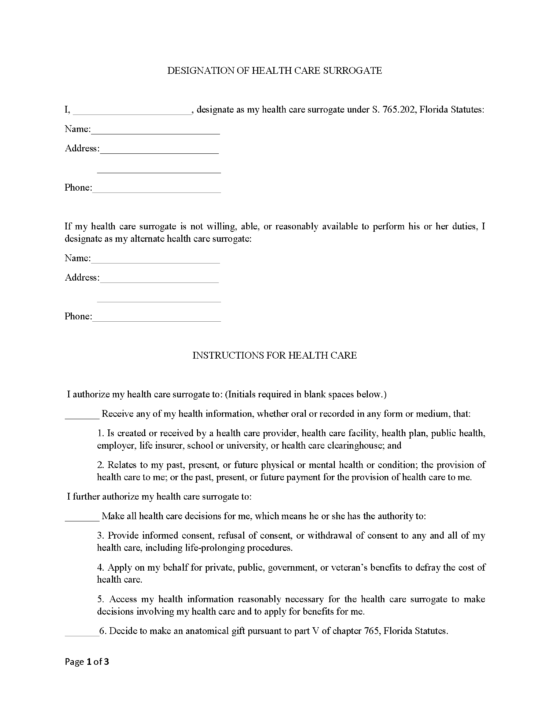

Medical Power of Attorney – Used to appoint an attorney-in-fact to make health care decisions for the principal if they are unable to do so for themselves. Medical Power of Attorney – Used to appoint an attorney-in-fact to make health care decisions for the principal if they are unable to do so for themselves.

Download: PDF |

Motor Vehicle (HSMV 82053) Power of Attorney – This form authorizes an agent to handle vehicle transactions (title transfer, title application, registration, etc.). Motor Vehicle (HSMV 82053) Power of Attorney – This form authorizes an agent to handle vehicle transactions (title transfer, title application, registration, etc.).

Download: PDF |

Minor (Child) Power of Attorney – Temporarily transfers guardianship of a child or children to a trusted agent. Minor (Child) Power of Attorney – Temporarily transfers guardianship of a child or children to a trusted agent.

Download: PDF, Word (.docx), OpenDocument |

Real Estate Power of Attorney – Enables a principal to appoint another person to represent them in real estate transactions. Real Estate Power of Attorney – Enables a principal to appoint another person to represent them in real estate transactions.

Download: PDF, Word (.docx), OpenDocument |

Tax (Form DR-835) Power of Attorney – This form assigns an agent (usually CPA or tax professional) to handle a person’s tax return and other related tasks. Tax (Form DR-835) Power of Attorney – This form assigns an agent (usually CPA or tax professional) to handle a person’s tax return and other related tasks.

Download: PDF |