Contents |

Adverse Action Letters: By Type (7)

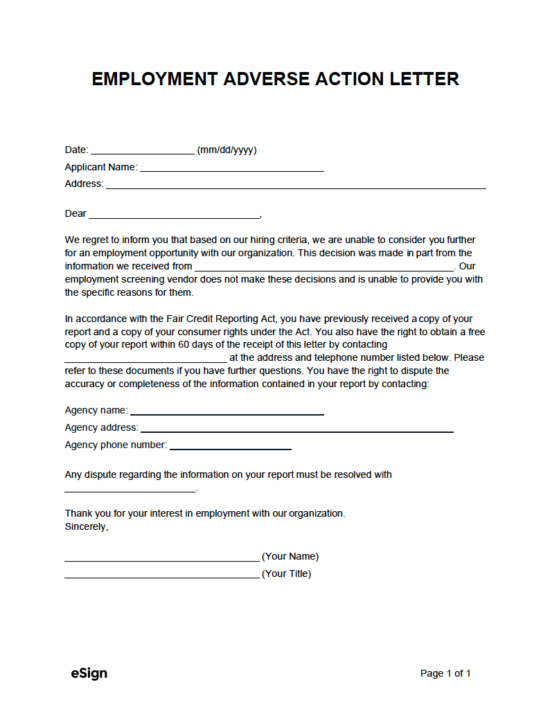

Download: PDF, Word (.docx), OpenDocument

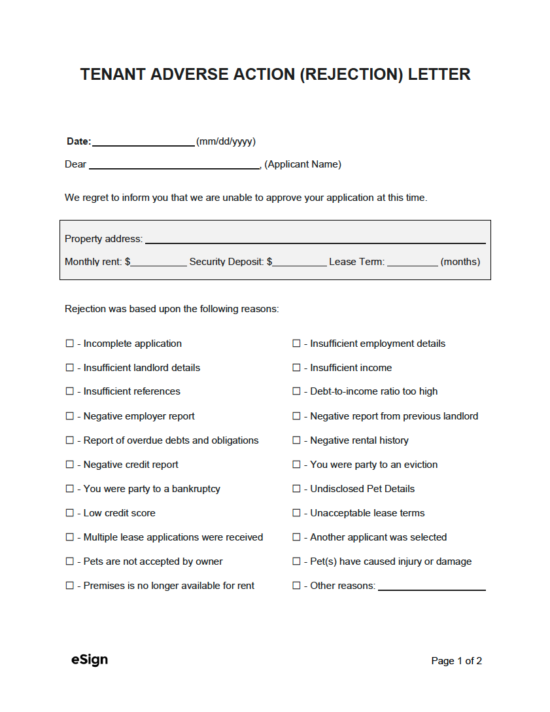

Download: PDF, Word (.docx), OpenDocument

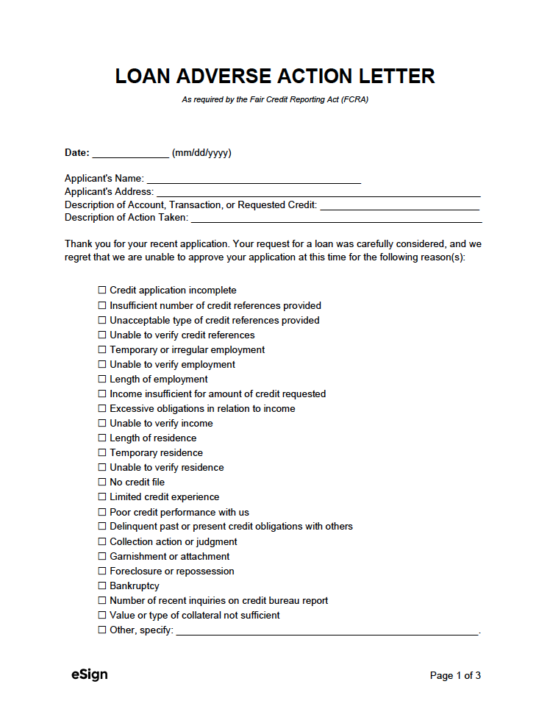

Download: PDF, Word (.docx), OpenDocument

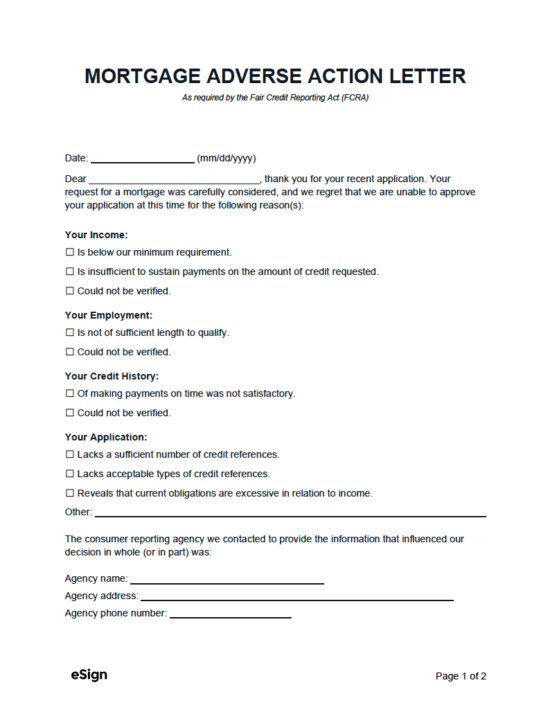

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

What is an Adverse Action Letter?

An adverse action letter is required to be sent under federal law (15 U.S. Code § 1681m) to an individual that has been denied credit, employment, insurance, or other similar types of benefits because of a poor credit score or background history (“consumer report”).

Requirements (FCRA)

After the rejection, the denying party is required to send a letter containing the following:

- Notice of the rejection (does not need to be specific);

- Consumer reporting agency contact details:

- Name

- Mailing Address

- Telephone Number

- A statement that the consumer reporting agency did not make this decision;

- A statement that the individual has the right to view the consumer report within sixty (60) days; and

- A statement that the individual has the right to dispute the accuracy of the consumer report in accordance with (15 U.S. Code § 1681i).

Sample Letter

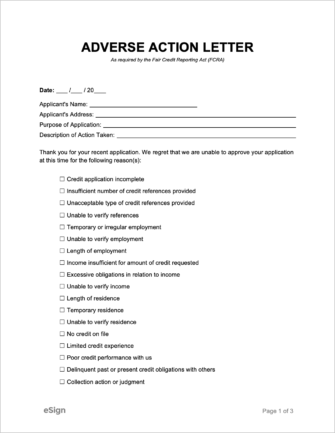

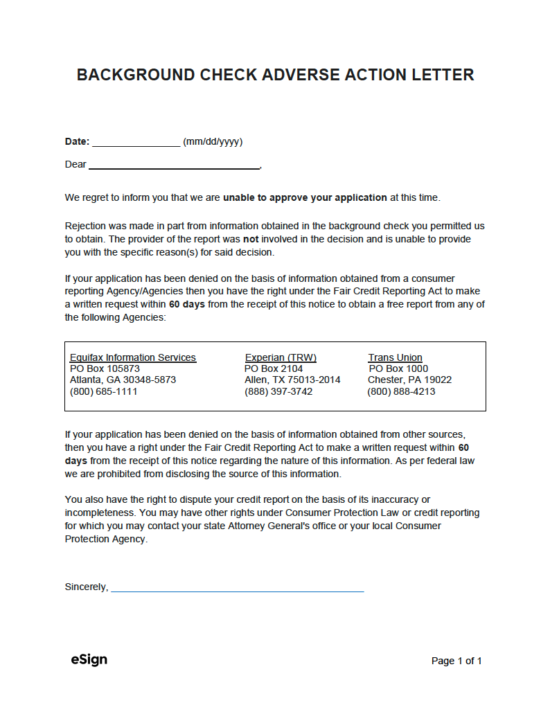

ADVERSE ACTION LETTER

As required by the Fair Credit Reporting Act (FCRA)

Date: [MM/DD/YYYY]

Applicant’s Name: [APPLICANT NAME]

Applicant’s Address: [APPLICANT ADDRESS]

Purpose of Application: [APPLICATION PURPOSE]

Description of Action Taken: [ACTION TAKEN]

Thank you for your recent application. We regret that we are unable to approve your application at this time for the following reason(s):

☐ Credit application incomplete

☐ Insufficient number of credit references provided

☐ Unacceptable type of credit references provided

☐ Unable to verify references

☐ Temporary or irregular employment

☐ Unable to verify employment

☐ Length of employment

☐ Income insufficient for amount of credit requested

☐ Excessive obligations in relation to income

☐ Unable to verify income

☐ Length of residence

☐ Temporary residence

☐ Unable to verify residence

☐ No credit on file

☐ Limited credit experience

☐ Poor credit performance with us

☐ Delinquent past or present credit obligations with others

☐ Collection action or judgment

☐ Garnishment or attachment

☐ Foreclosure or repossession

☐ Bankruptcy

☐ Number of recent inquiries on credit bureau report

☐ Value or type of collateral not sufficient

☐ Other, specify: [OTHER REASON, IF ANY]

☐ (Check if applicable). Our decision was based in whole or in part on information obtained in a report from the consumer reporting agency listed below. You have a right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency.

The reporting agency played no part in our decision and is unable to supply specific reasons why we have denied your application. You also have a right to a free copy of your report from the reporting agency, if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

Reporting Agency Name: [AGENCY NAME]

Reporting Agency Address: [AGENCY ADDRESS]

Reporting Agency Telephone number (Toll-Free): [AGENCY PHONE NUMBER]

We also obtained your credit score from this consumer reporting agency and used it in making our decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change depending on how the information in your consumer report changes.

Your credit score: [CREDIT SCORE]

Date: [MM/DD/YYYY]

Scores in your range are a low of [LOW SCORE (e.g., 300)] to a high of [HIGH SCORE (e.g., 850)].

Key factors that adversely affected your credit score:

1. [FACTOR #1]

2. [FACTOR #2]

3. [FACTOR #3]

4. [FACTOR #4]

5. Number of recent inquiries on your consumer report.

If you have any questions regarding your credit score, you should contact the entity that provided the credit score at:

Address: [AGENCY ADDRESS]

Telephone number (Toll-Free): [AGENCY PHONE]

(Check if applicable)

☐ Our decision was based in whole or in part on information obtained from an affiliate or from an outside source other than a consumer reporting agency. Under the Fair Credit Reporting Act, you have the right to make a written request, no later than 60 days after you receive this notice, for disclosure of the nature of this information.

If you have any questions regarding this notice, you should contact:

Creditor’s name: [CREDITOR NAME]

Creditor’s address: [CREDITOR ADDRESS]

Creditor’s telephone number: [CREDITOR PHONE NUMBER]

ECRA Notice: The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The Federal agency that administers compliance with this law concerning this creditor is (name and address as specified by the appropriate agency listed in appendix A).

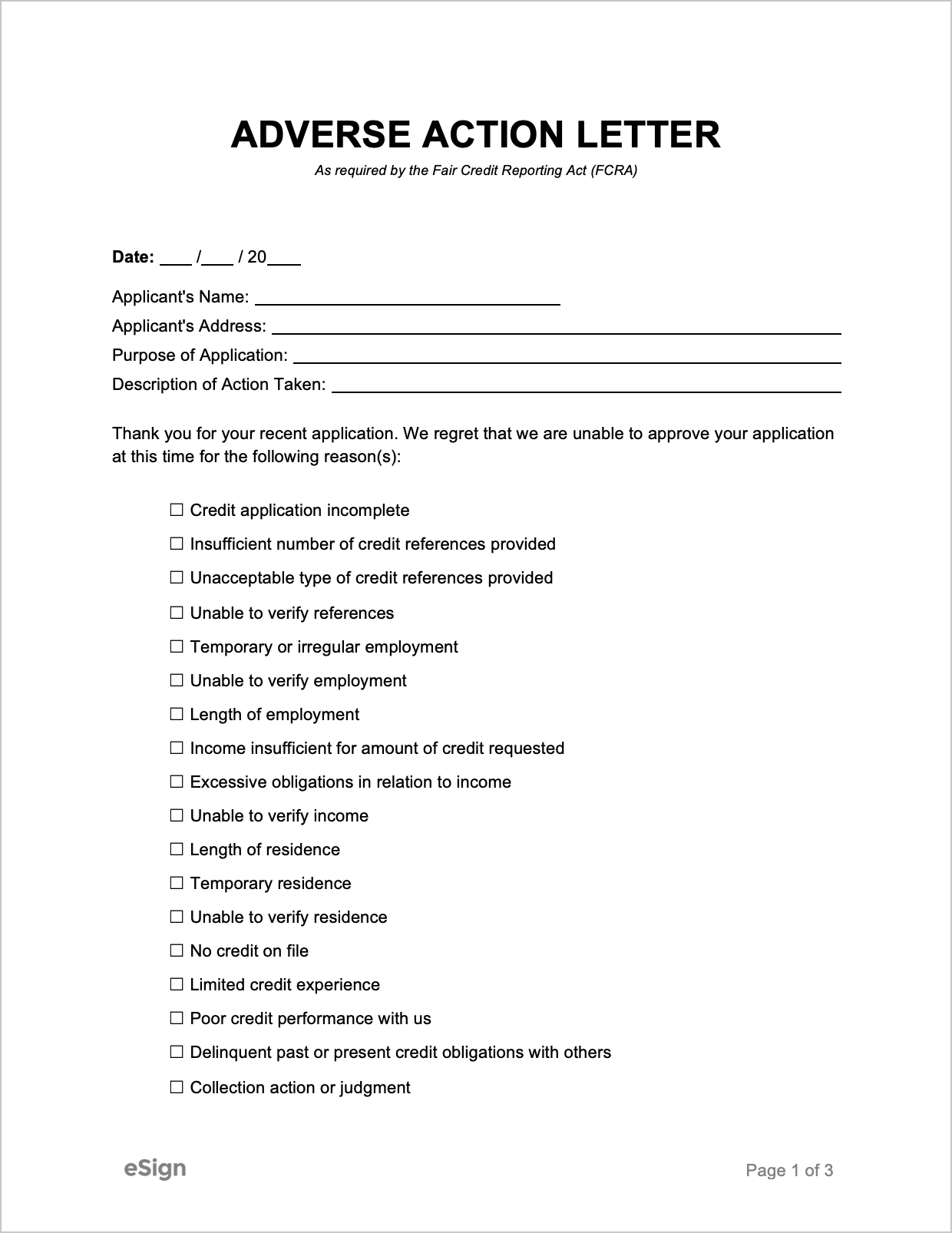

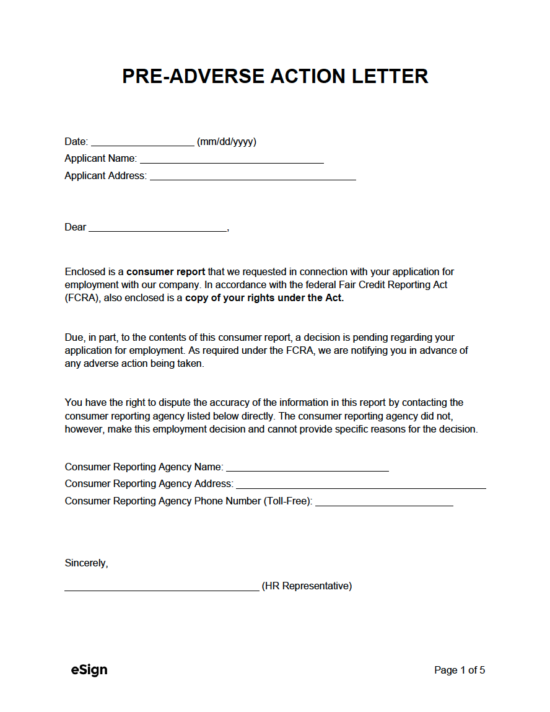

Pre-Adverse Action vs Adverse Action

A pre-adverse action letter is sent before the consumer report is generated.

- Requests for consent to perform the consumer check on the individual and provides a copy of their Rights Under the Fair Credit Reporting Act.

An adverse action letter is sent after the consumer report is generated.

- Must provide details where the individual may download a copy of the report in accordance with FCRA Requirements.

Understanding the FCRA & ECUA

The two (2) laws that govern consumer reports are the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECUA). These laws hold consumer reporting agencies accountable for how they handle consumer information.

The FCRA

Laws – Title 15, Chapter 41 (Fair Credit Reporting Act)

Originally passed in 1970, the FCRA ensures consumers have the means of obtaining (and disputing) information collected on them. The law also protects who can view one’s report, limiting it to the individual themselves and entities and persons with a necessary and justifiable reason for doing so. It covers all the major consumer report types, including background, criminal, and credit checks.

The ECUA

Laws – 15 USC Ch. 41, Sub. Ch. IV

The Equal Credit Opportunity Act applies to businesses and consumers, providing transparency regarding the credit scoring process. This aids in helping consumers to understand the factors that went into their score and the exact reasons they were denied credit.

How to Send

An adverse action letter must be sent within a “reasonable amount of time” after the decision has been made (15 U.S. Code § 1681im(b)(1)).

Step 1 – Complete the Adverse Action Letter

Download: PDF, Word (.docx), OpenDocument

All the appropriate fields must be completed, and it is a good gesture for the rejecting party to personally sign the document (although this is not mandatory).

Step 2 – Send via First (1st) Class Mail

Send via USPS First (1st) Class Mail or equivalent to the individual. The party sending the letter may choose to send a certified copy (with return receipt) so the sender has proof the receiving party got the letter (this is recommended but not a requirement).