By Type (5)

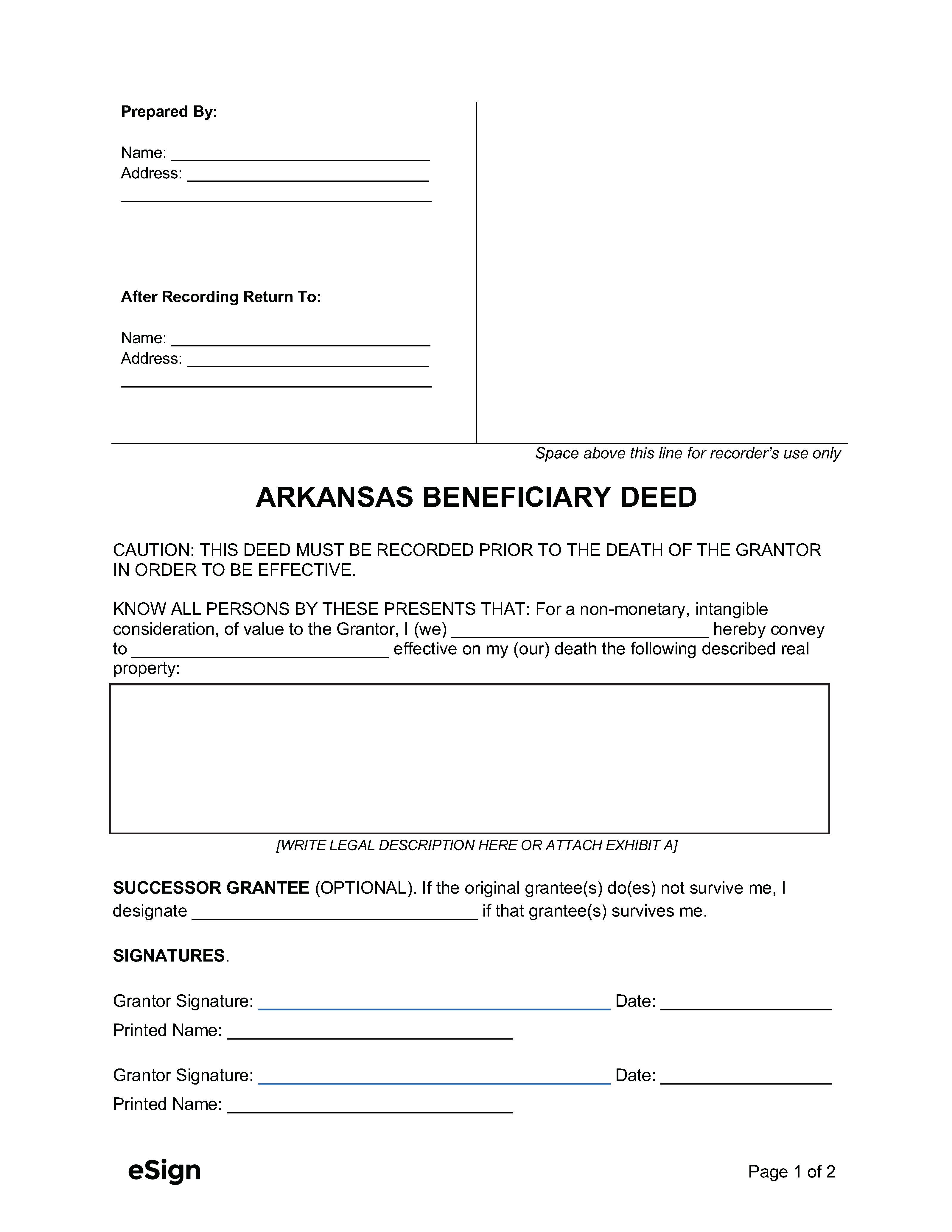

Beneficiary Deed – Transfers the title of a property to a designated beneficiary upon the current owner’s death. Beneficiary Deed – Transfers the title of a property to a designated beneficiary upon the current owner’s death.

|

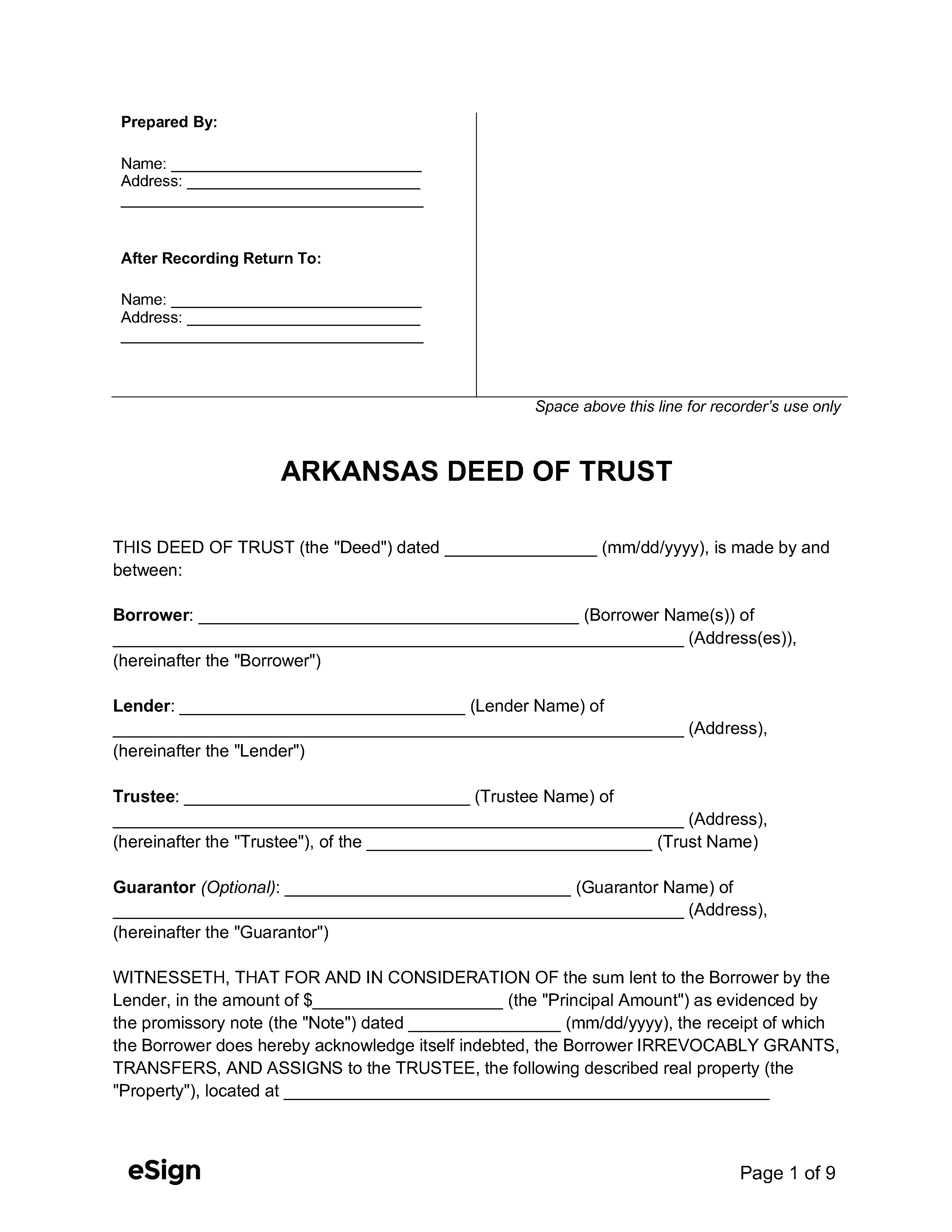

Deed of Trust – Conveys property title to an impartial third party until a loan to finance the grantee’s property purchase is repaid in full. Deed of Trust – Conveys property title to an impartial third party until a loan to finance the grantee’s property purchase is repaid in full.

|

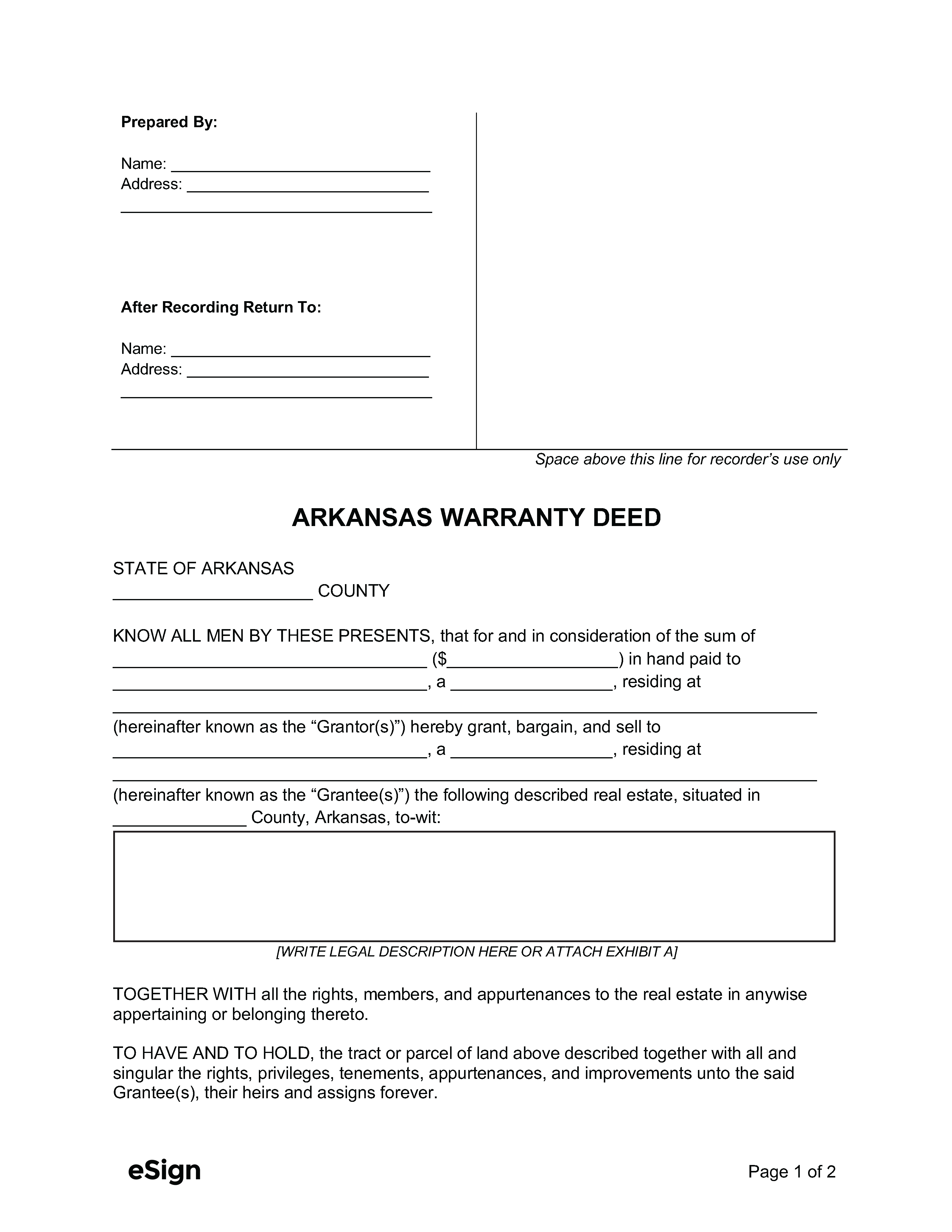

General Warranty Deed – Guarantees that the grantor holds legal title and that it is clear of encumbrances. General Warranty Deed – Guarantees that the grantor holds legal title and that it is clear of encumbrances.

|

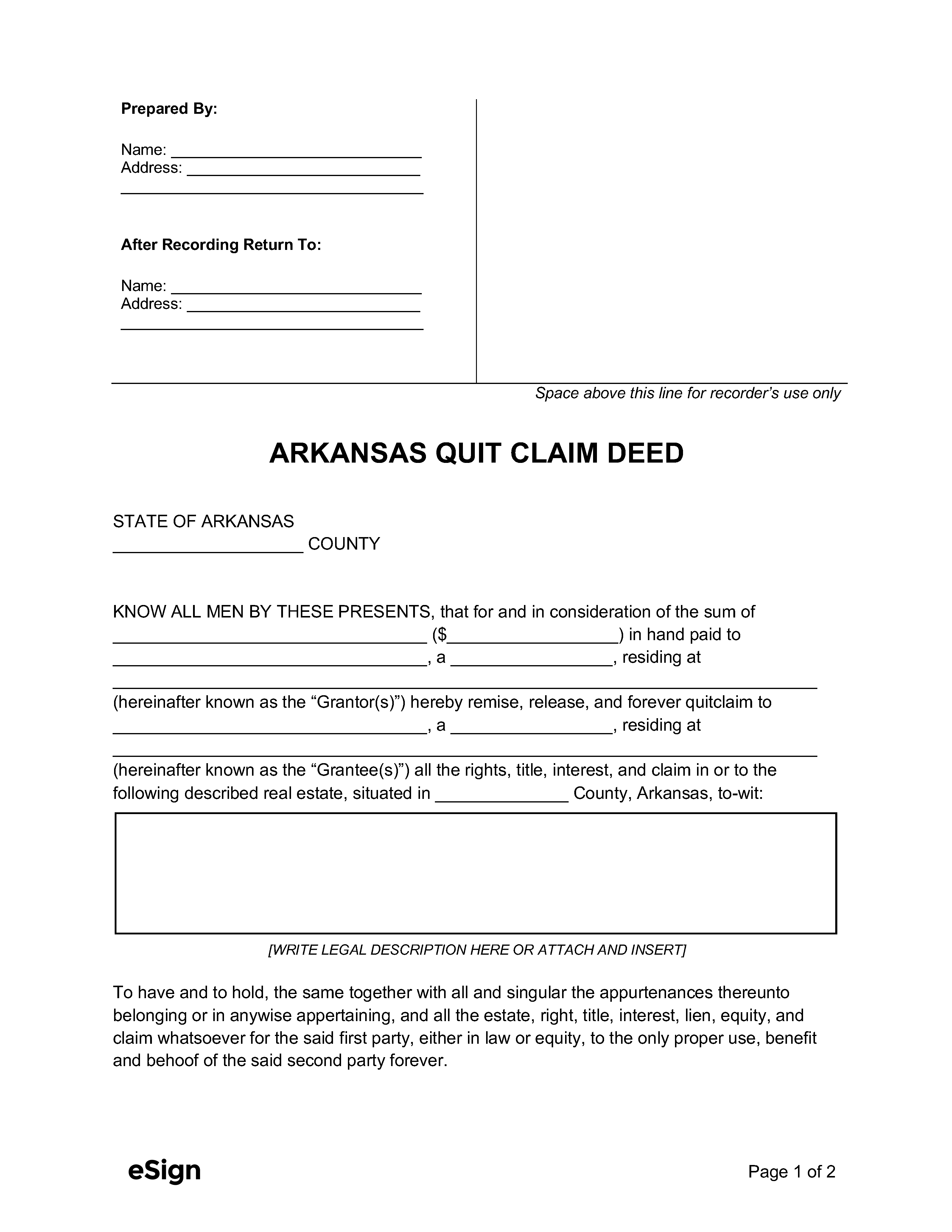

Quit Claim Deed – Under this deed, the grantee accepts the property as-is and accepts responsibility for title claims. Quit Claim Deed – Under this deed, the grantee accepts the property as-is and accepts responsibility for title claims.

|

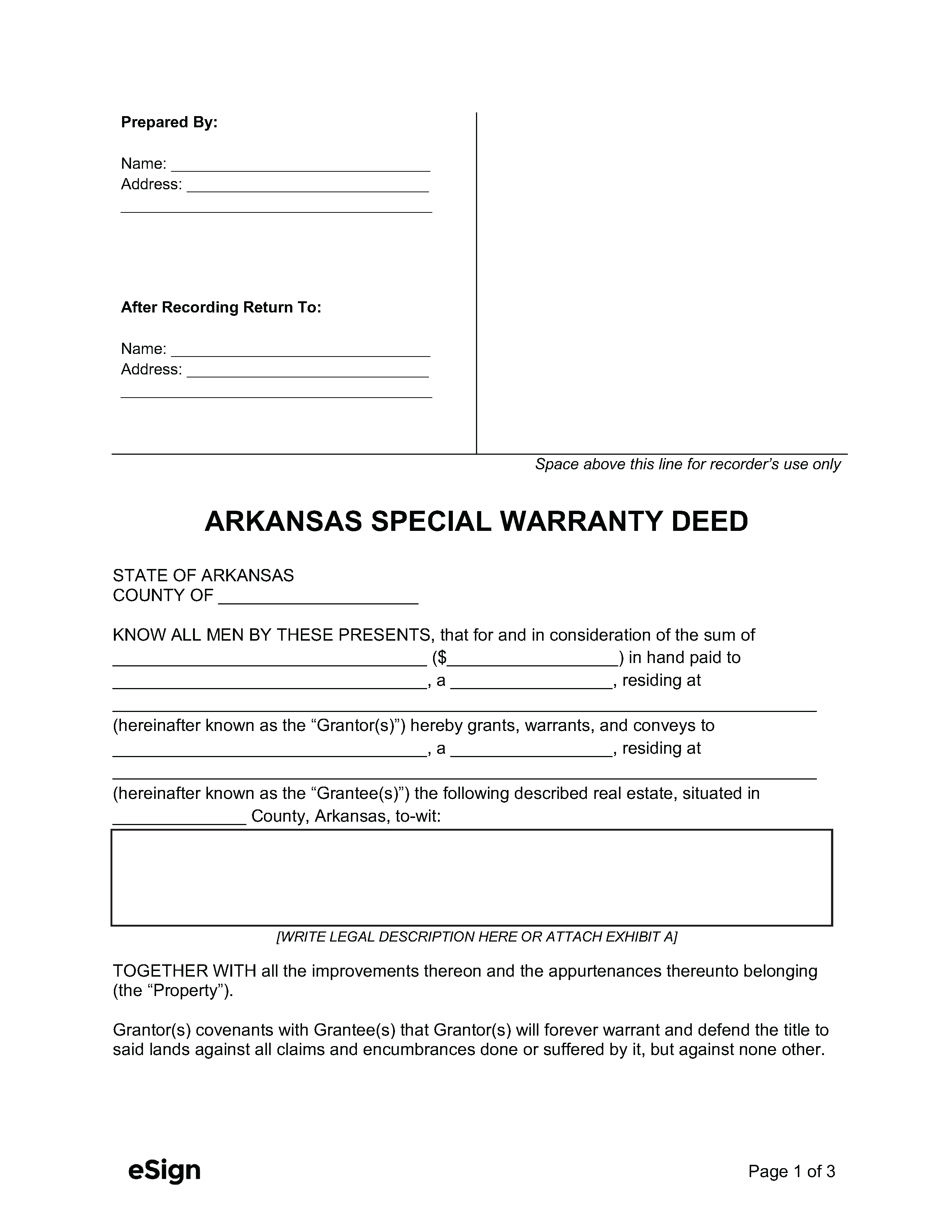

Special Warranty Deed – Guarantees that the property is free of any title issues during the grantor’s ownership period. Special Warranty Deed – Guarantees that the property is free of any title issues during the grantor’s ownership period.

|

Formatting

Paper – 8.5″ x 11″

Margins – 2.5″ blank space in the top-right corner of first page, 1/2″ margins on all pages, 2.5″ bottom margin of last page[1]

Recording

Signing Requirements – Deeds must be signed by the grantor and two disinterested witnesses, with notary acknowledgment.[2]

Where to Record – To make a property transfer official, the deed of conveyance must be recorded at the County Recorder’s Office.[3]

Cost – $15 for the first page, $5 for each additional page.[4]

Additional Forms

Arkansas Real Property Tax Affidavit of Compliance Form – The Department of Finance and Administration states that the Real Property Transfer Tax must be paid on each deed that conveys real property. The rate is $3.30 per $1000 and must be paid and submitted with this document.