By Type (6)

Deed of Trust – Secures a loan by transferring the borrower’s title to a trustee until their debt is settled. Deed of Trust – Secures a loan by transferring the borrower’s title to a trustee until their debt is settled.

|

General Warranty Deed – Warrants that the grantor holds title and will defend it against current and past claims. General Warranty Deed – Warrants that the grantor holds title and will defend it against current and past claims.

|

Lady Bird Deed – Names one or more beneficiaries to inherit property after the owner dies. Lady Bird Deed – Names one or more beneficiaries to inherit property after the owner dies.

|

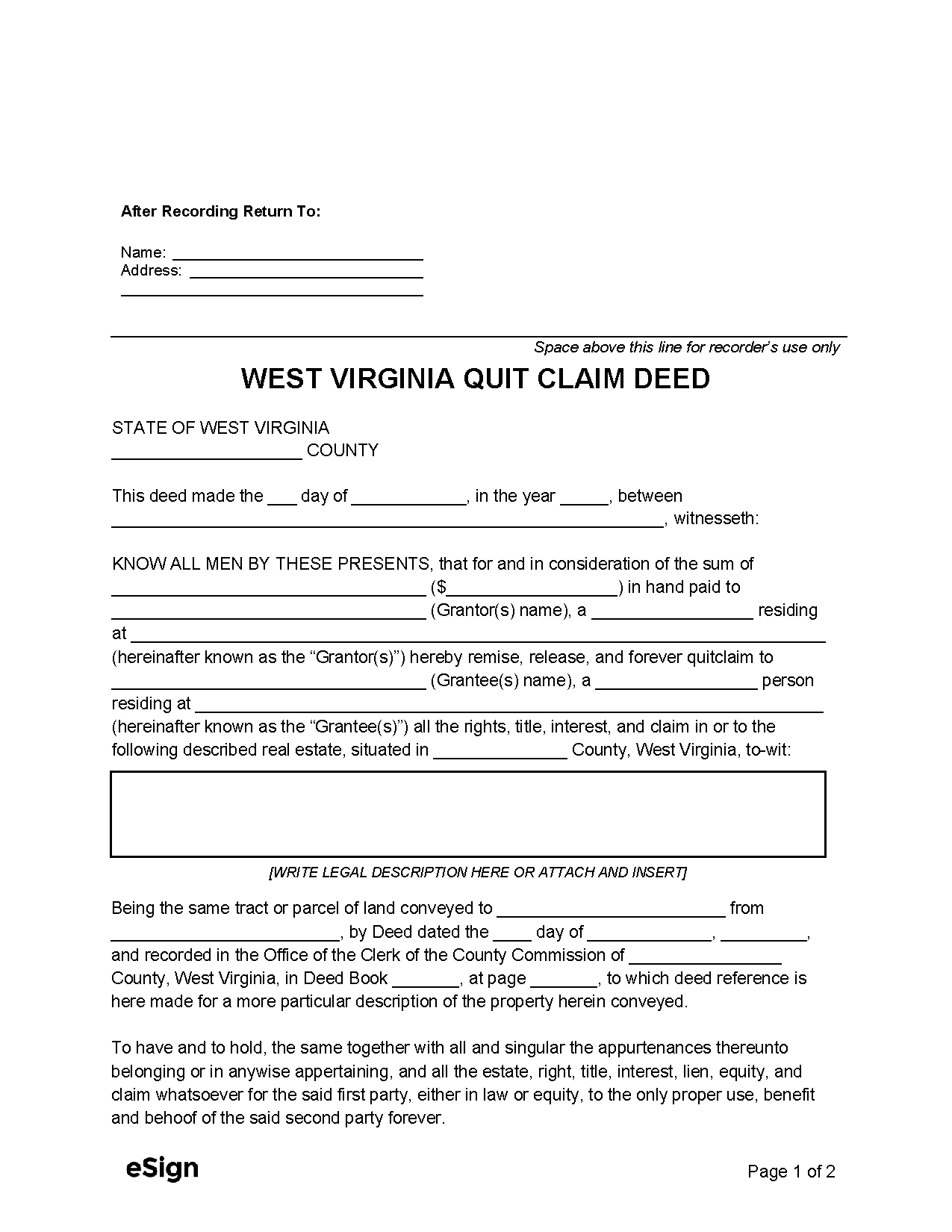

Quit Claim Deed – Provides no assurances about the title or the validity of the grantor’s right to transfer. Quit Claim Deed – Provides no assurances about the title or the validity of the grantor’s right to transfer.

|

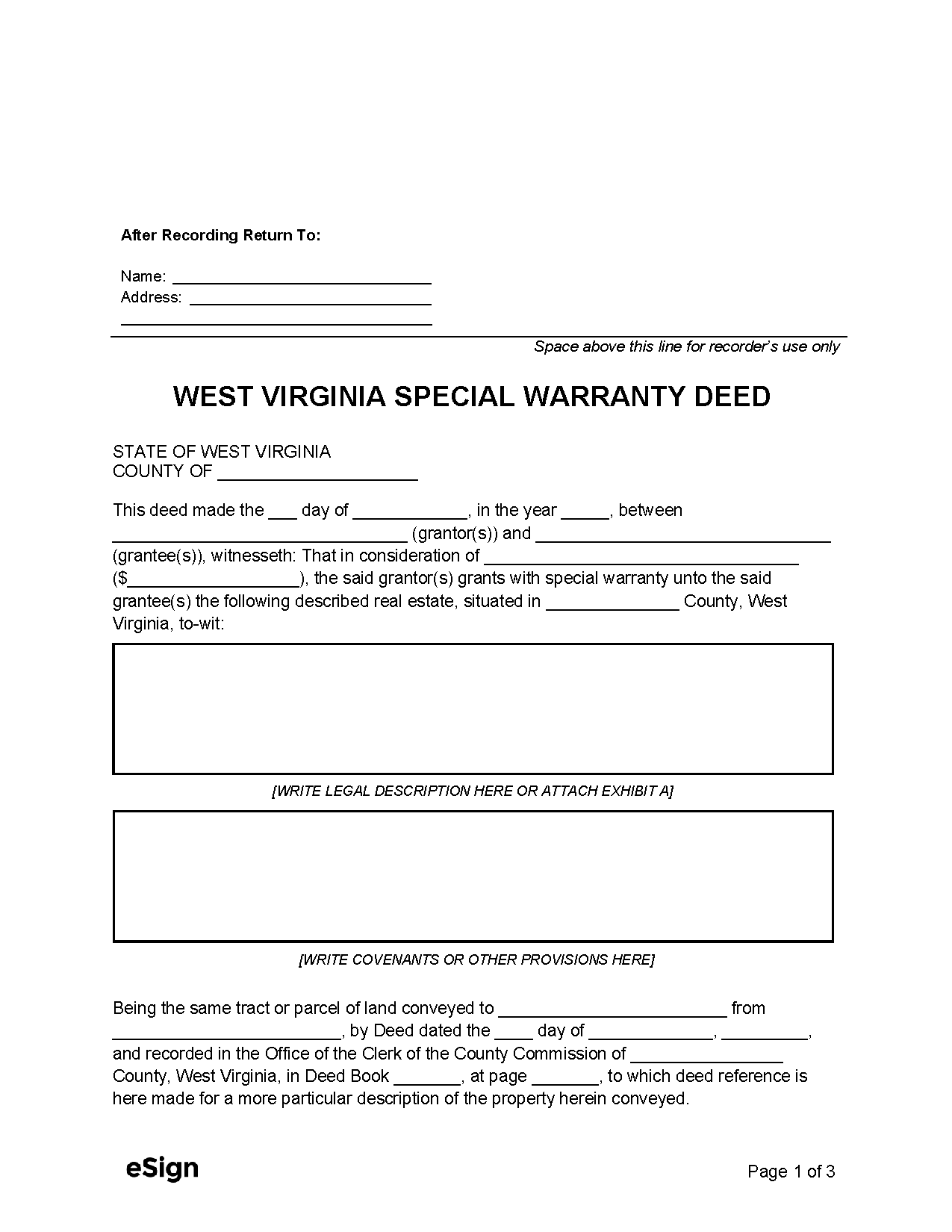

Special Warranty Deed – Guarantees no title claims arose while the grantor held title, but makes no promises about prior ownership periods. Special Warranty Deed – Guarantees no title claims arose while the grantor held title, but makes no promises about prior ownership periods.

|

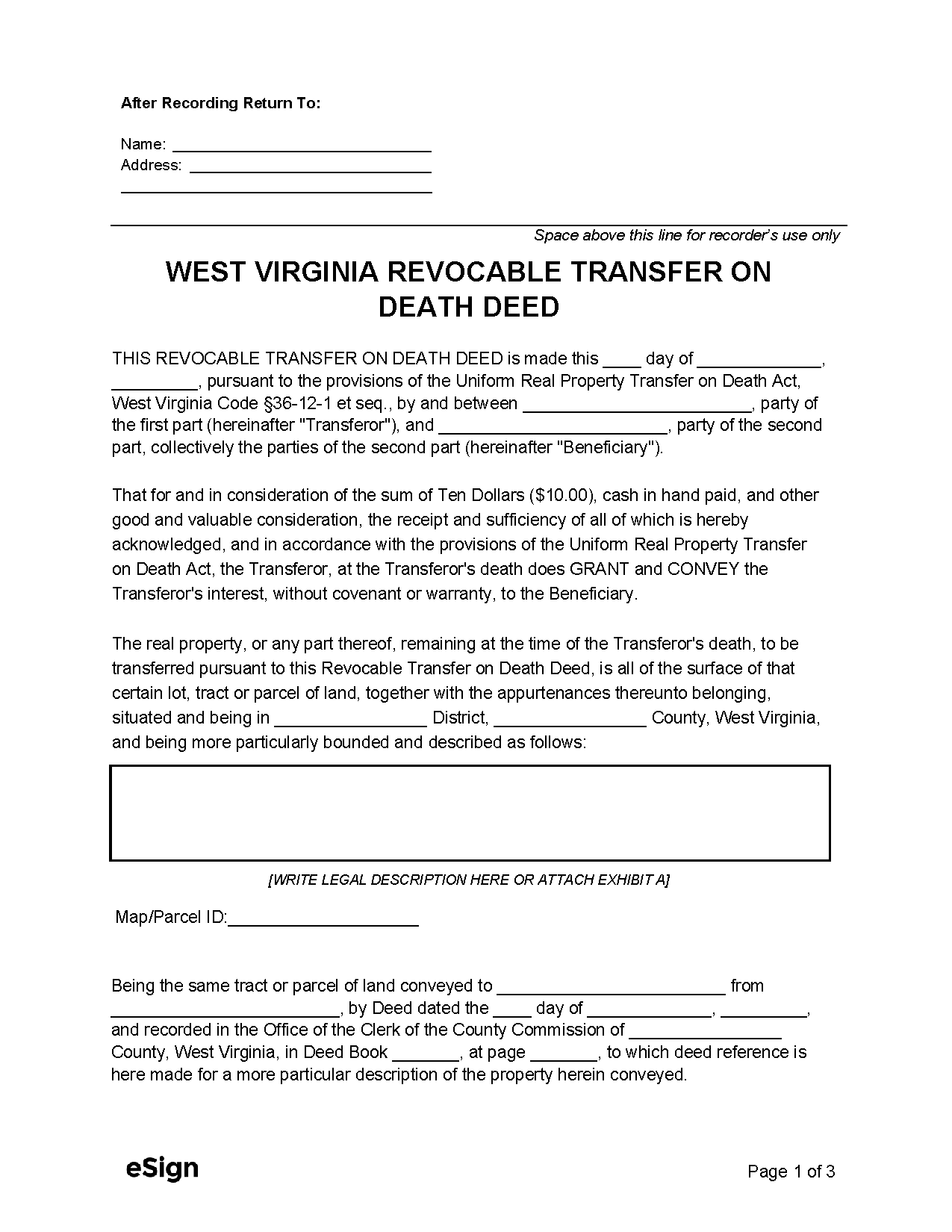

Transfer on Death Deed – Allows property to be conveyed (without warranty) to a beneficiary upon the owner’s death. Transfer on Death Deed – Allows property to be conveyed (without warranty) to a beneficiary upon the owner’s death.

|

Recording

Signing Requirements – The grantor’s signature must be notarized.[4]

Where to Record – Completed deeds are recorded with the County Clerk’s Office.[5]

Cost – Around $32 for the first five pages, plus $1 for each additional page (as of this writing)[6]

Additional Forms

Declaration of Consideration or Value Statement – For conveyances subject to transfer tax, this declaration must be attached to the deed to report the purchase price and true property value.[7]

Sales Listing Form (Form STC 12:39) – Used to relay various transfer details when presenting a deed for recording.