By Type (4)

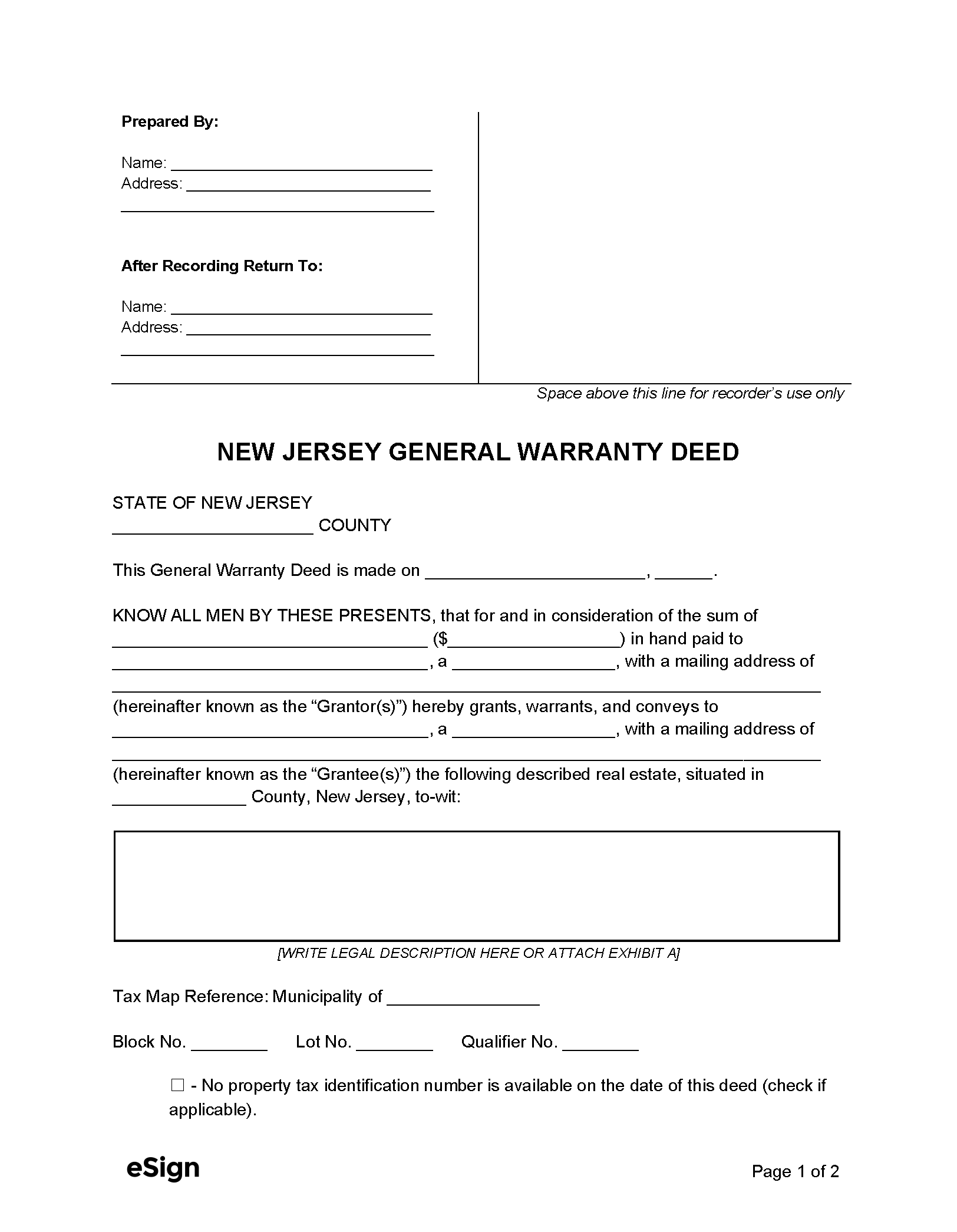

General Warranty Deed – Promises the grantee a clear title and protection against all third-party claims. General Warranty Deed – Promises the grantee a clear title and protection against all third-party claims.

|

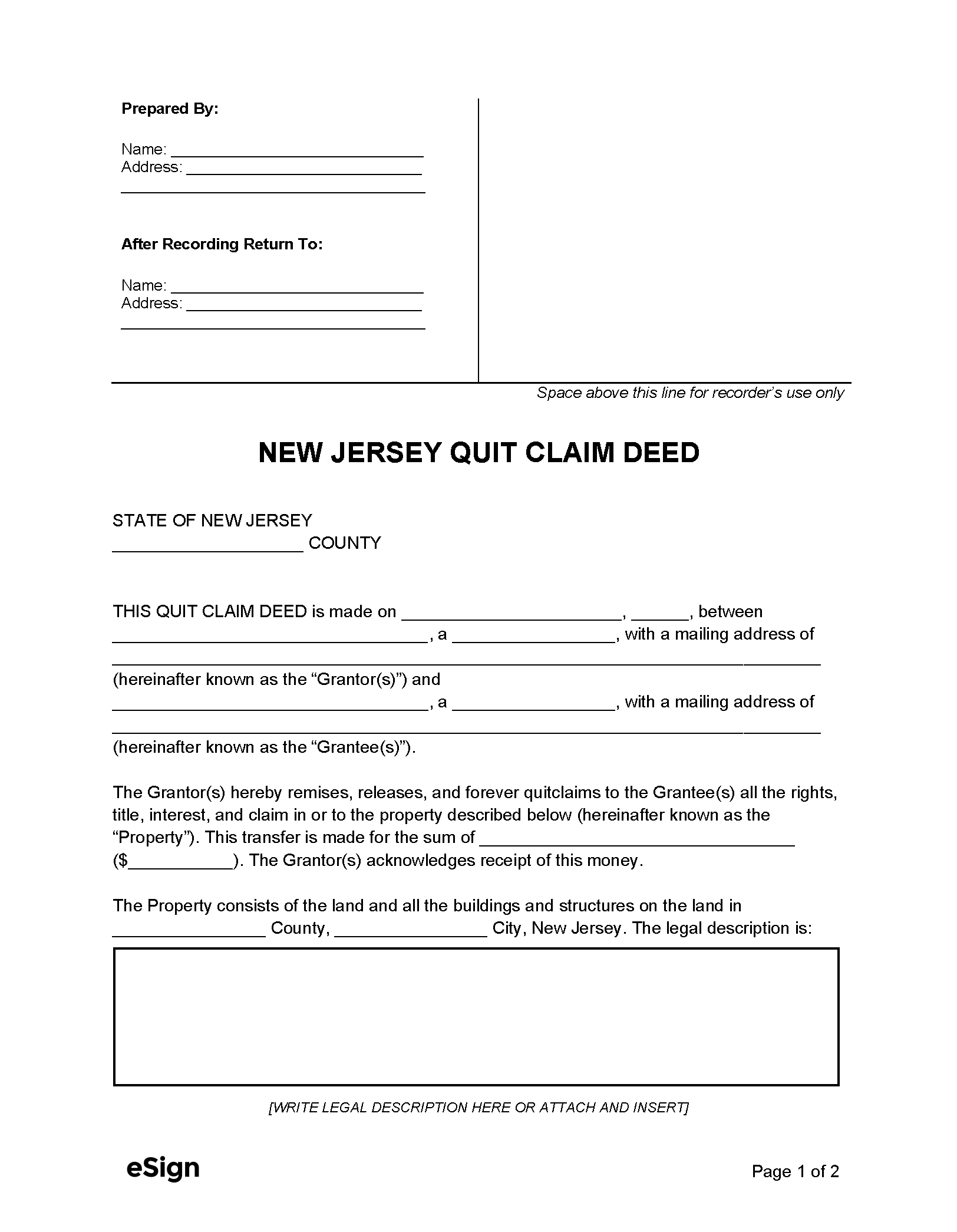

Quit Claim Deed – Makes no assurances as to the quality of the property title or validity of the grantor’s ownership. Quit Claim Deed – Makes no assurances as to the quality of the property title or validity of the grantor’s ownership.

|

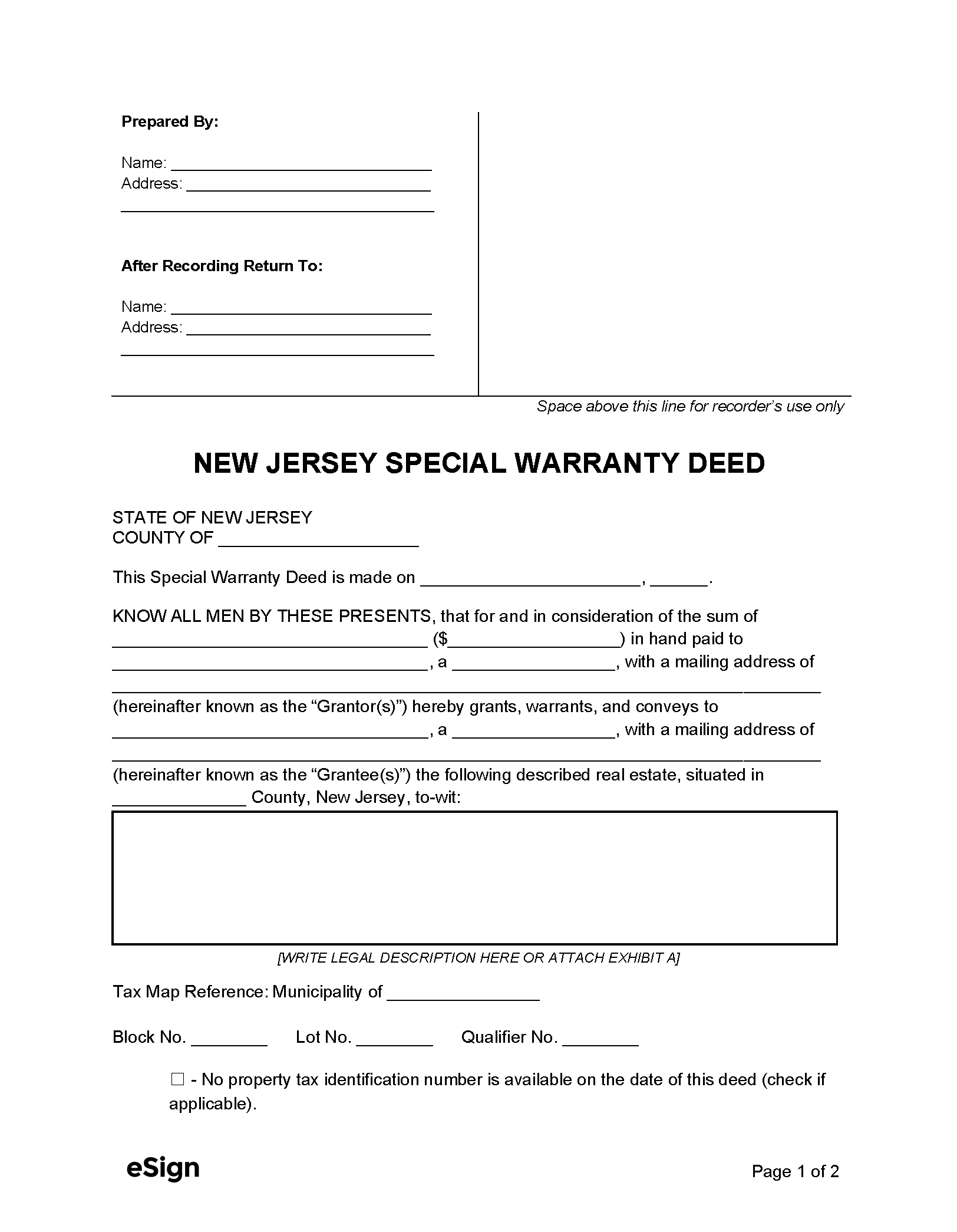

Special Warranty Deed – Similar to a general warranty deed, but only covers title issues arising out of the grantor’s ownership. Special Warranty Deed – Similar to a general warranty deed, but only covers title issues arising out of the grantor’s ownership.

|

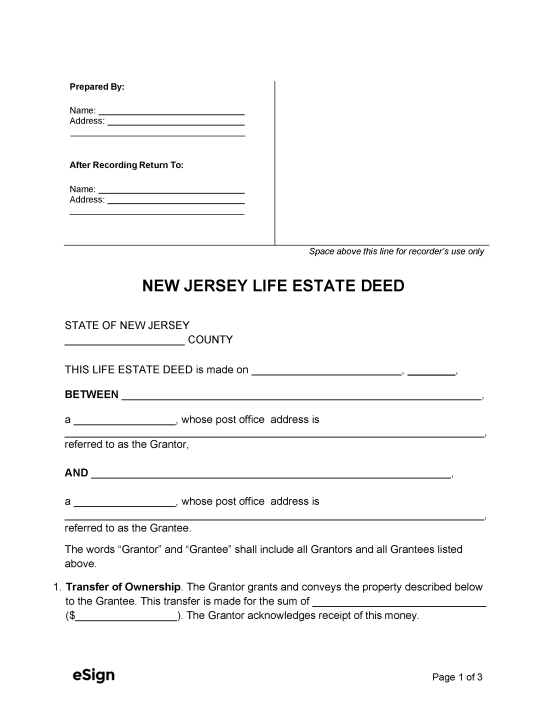

Life Estate Deed – Names a grantee to inherit the property title upon the grantor’s death. Life Estate Deed – Names a grantee to inherit the property title upon the grantor’s death.

|

Formatting

New Jersey deeds must be written in legible text on paper no larger than 8.5 inches by 14 inches.[1]

Recording

Signing Requirements – Deeds must be signed by the grantor and acknowledged in the presence of a notary public.[2]

Where to Record – A completed deed will be recorded with the County Clerk or Register of Deeds.[3]

Cost – $40 for the first page, $10 for each additional page (as of this writing)[4]

Additional Forms

Recording offices require a cover sheet when presented with a deed for recording.[5] These forms may also be needed depending on the circumstances[6]:

- GIT/REP-3: Seller’s Residency Certification/Exemption – Required for grantors exempt from the Gross Income Tax estimated payment requirements.

- GIT/REP-1: Nonresident Seller’s Tax Declaration – Grantors who don’t live in New Jersey are required to complete this form to declare the estimated tax due at closing.

- GIT/REP-2: Nonresident Seller’s Tax Prepayment Receipt – If the grantor lives out of state, this form must be completed alongside the Nonresident Seller’s Tax Declaration.

- RTF-1: Affidavit of Consideration for Use by Seller – Must be filed if the deed does not state the full sale price, the seller claims a Realty Transfer Fee exemption, or the property is commercial, industrial, an apartment, or newly built.

Before recording, grantors should contact the County Clerk or Register of Deeds office to confirm the form requirements for their county.