By Type (5)

Deed of Trust – Conveys a borrower’s real estate to a trustee as security for a financial obligation to a lender. Deed of Trust – Conveys a borrower’s real estate to a trustee as security for a financial obligation to a lender.

|

General Warranty Deed – Confirms the grantor’s ownership and provides full warranty against title defects. General Warranty Deed – Confirms the grantor’s ownership and provides full warranty against title defects.

|

Life Estate Deed – Enables the grantor to use the property during their lifetime. When they die, property automatically passes to the grantee. Life Estate Deed – Enables the grantor to use the property during their lifetime. When they die, property automatically passes to the grantee.

|

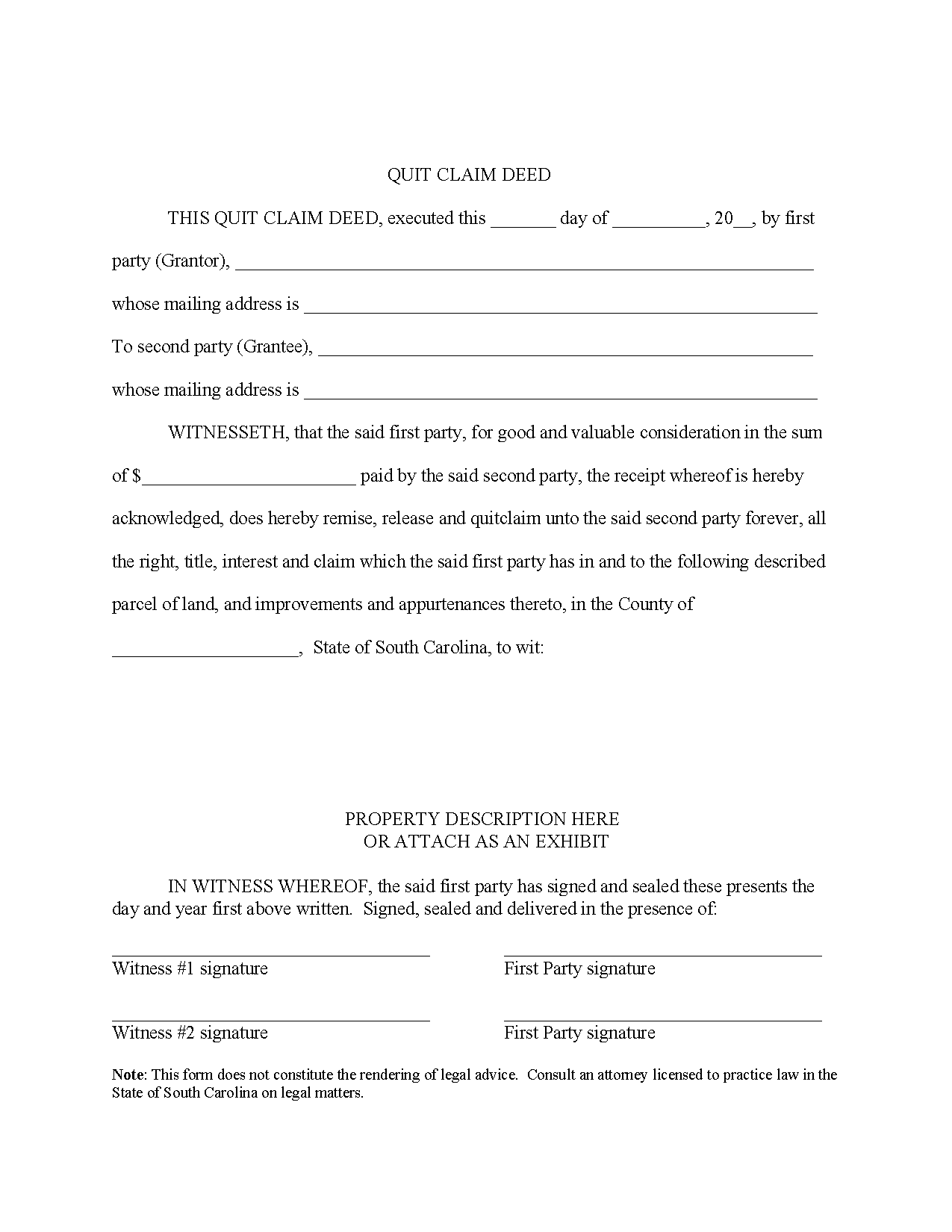

Quit Claim Deed – Provides no warranties and holds the grantee responsible for all title encumbrances. Quit Claim Deed – Provides no warranties and holds the grantee responsible for all title encumbrances.

Download: PDF |

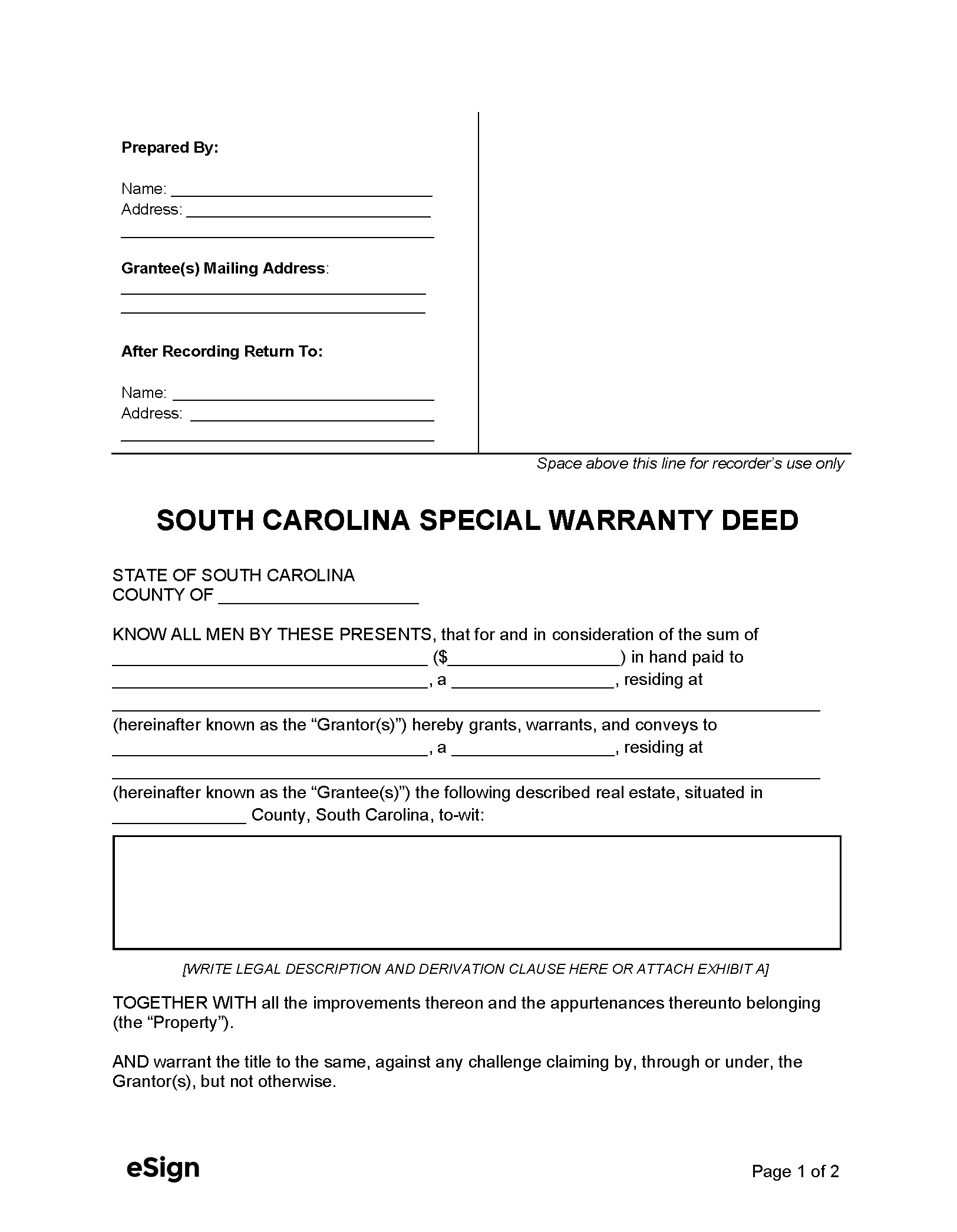

Special Warranty Deed – Includes a warranty against title defects from the grantor’s period of ownership exclusively. Special Warranty Deed – Includes a warranty against title defects from the grantor’s period of ownership exclusively.

|

Formatting

Exact formatting requirements vary by county. Individuals should check with their county’s land records office to confirm local standards regarding margins, font, paper size, and the like.

Recording

Signing Requirements – Deeds require signatures from the grantor, two witnesses, and a notary public (the notary may sign as one of the witnesses).[1]

Where to Record – The Clerk of Court or Register of Deeds is responsible for recording property deeds.[2]

Cost – $15 (at the time of this writing)[3]

Additional Forms

Affidavit for Taxable or Exempt Transfers – Must be included when filing a deed to assess the property’s value and determine the transfer tax.[4]