Lease Agreements: By Type (8)

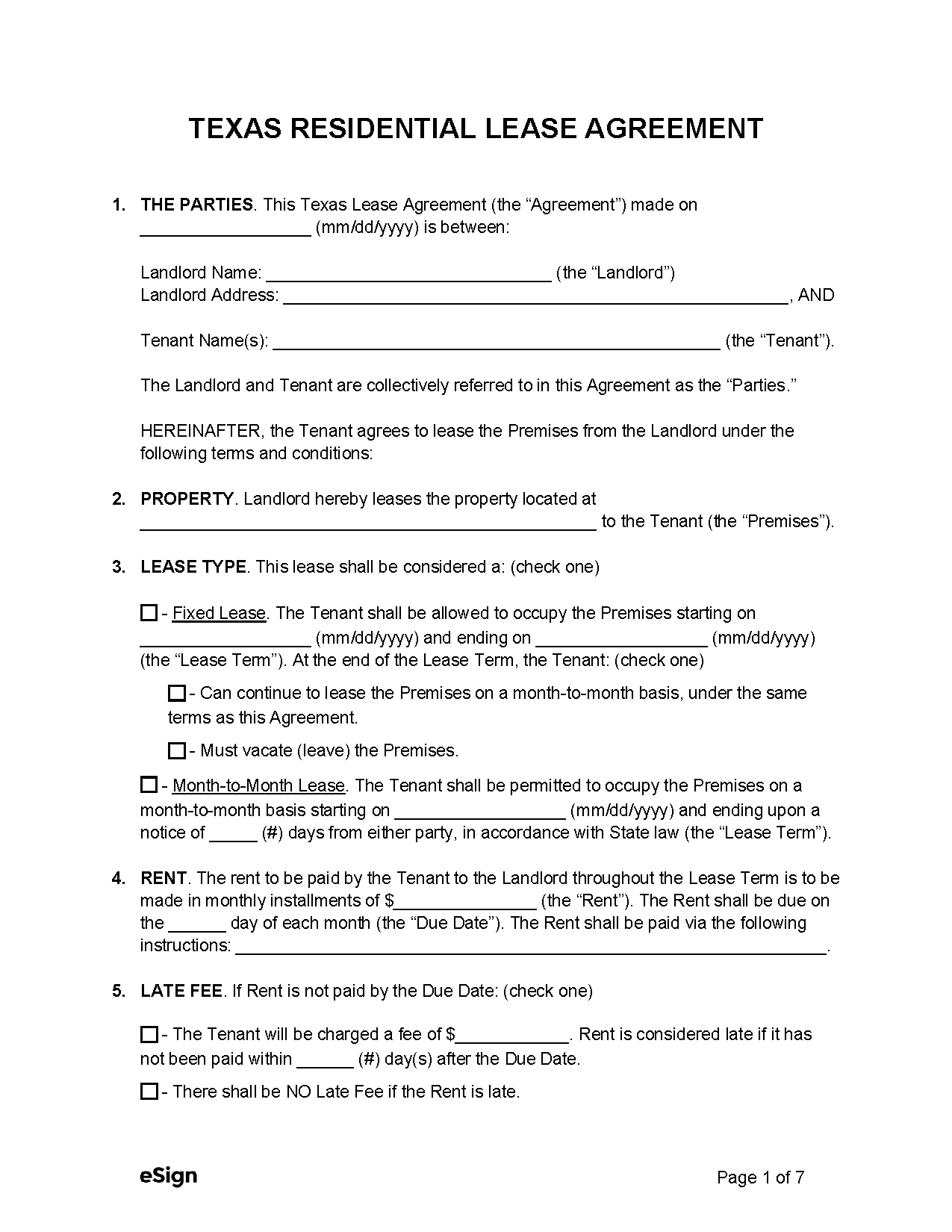

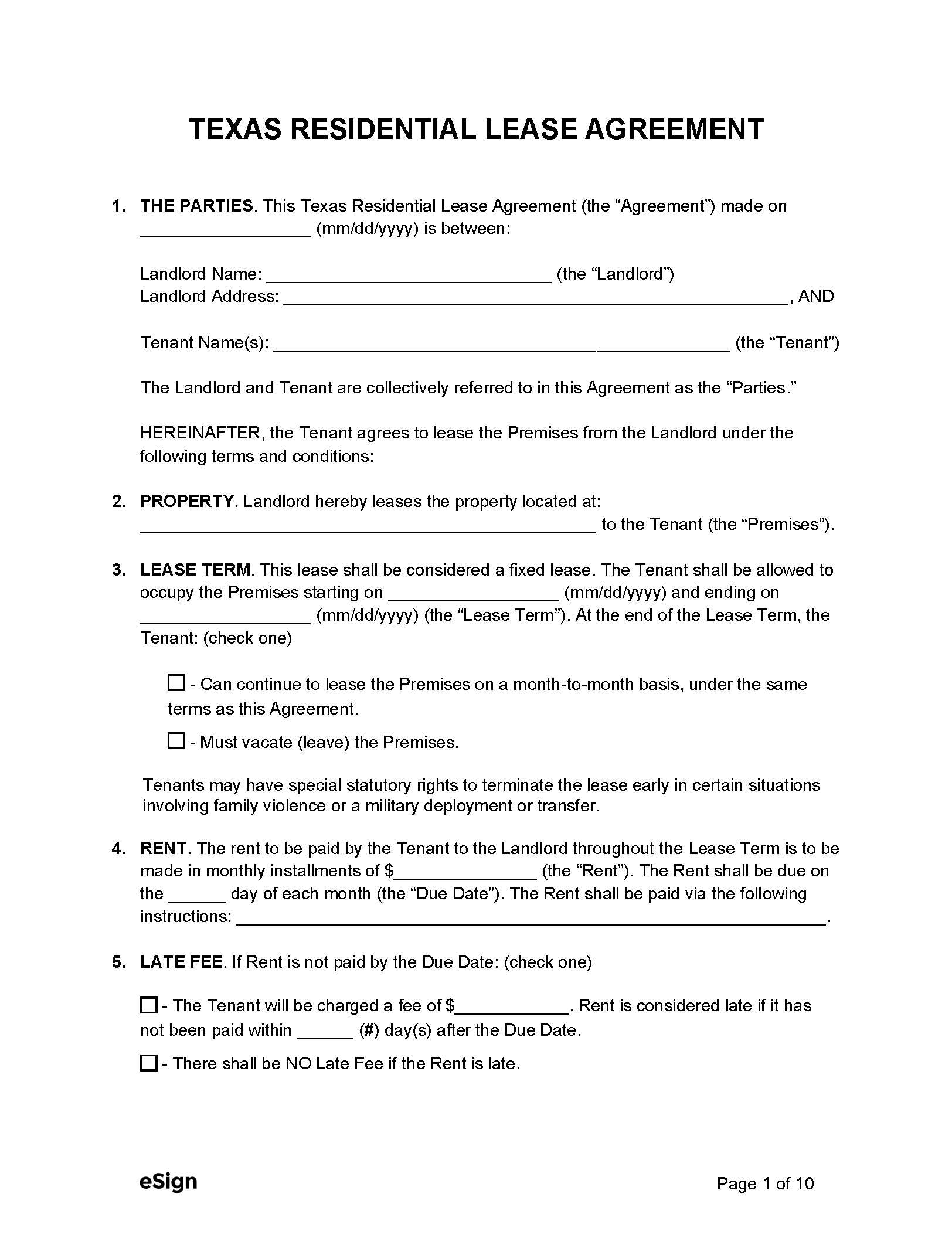

Standard (1-year) Lease Agreement – A lease that grants a tenancy term of one (1) year to a residential occupant. Standard (1-year) Lease Agreement – A lease that grants a tenancy term of one (1) year to a residential occupant.

Download: PDF |

Apartment Assoc. Lease Agreement – Provided by the Texas Apartment Association for dwellings located in multi-family properties. Apartment Assoc. Lease Agreement – Provided by the Texas Apartment Association for dwellings located in multi-family properties.

Download: PDF |

Assoc. of Realtors – Required to be used by a licensed real estate agent affiliated with the Association of Realtors. Assoc. of Realtors – Required to be used by a licensed real estate agent affiliated with the Association of Realtors.

Download: PDF |

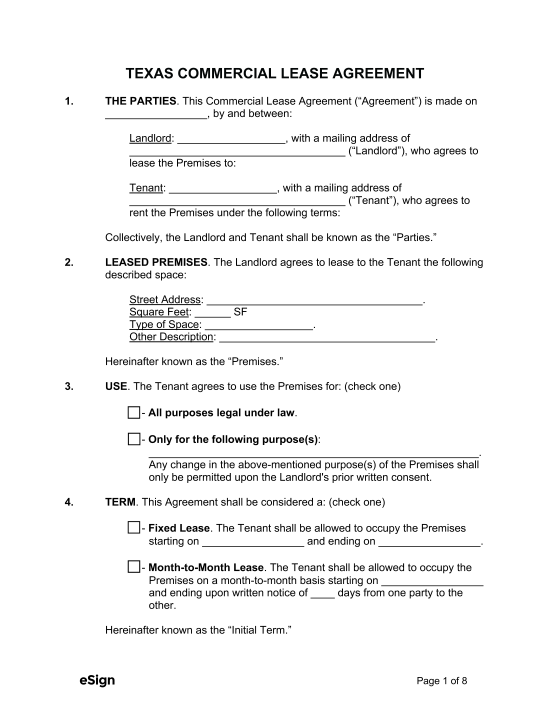

Commercial Lease Agreement – Used by landlords when leasing property to a business for retail, industrial, or office purposes. Commercial Lease Agreement – Used by landlords when leasing property to a business for retail, industrial, or office purposes.

Download: PDF, Word (.docx), OpenDocument |

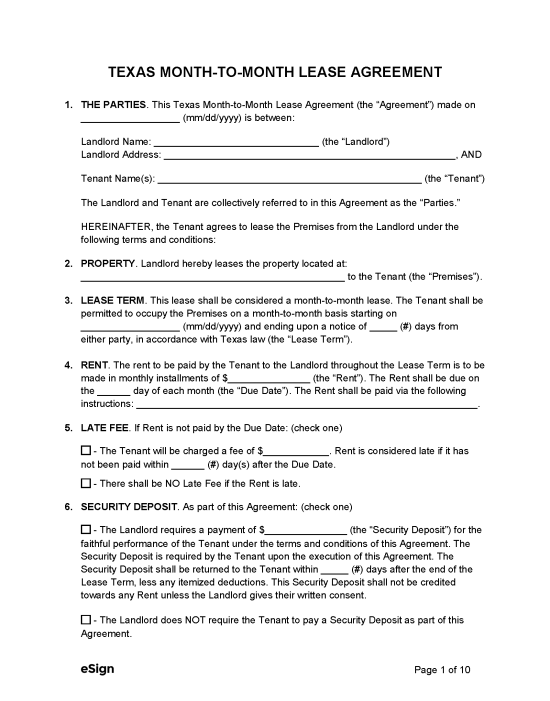

Month-to-Month Lease Agreement – A rental arrangement with no end date that remains in effect until the lessee or lessor decides to terminate. Month-to-Month Lease Agreement – A rental arrangement with no end date that remains in effect until the lessee or lessor decides to terminate.

Download: PDF, Word (.docx), OpenDocument |

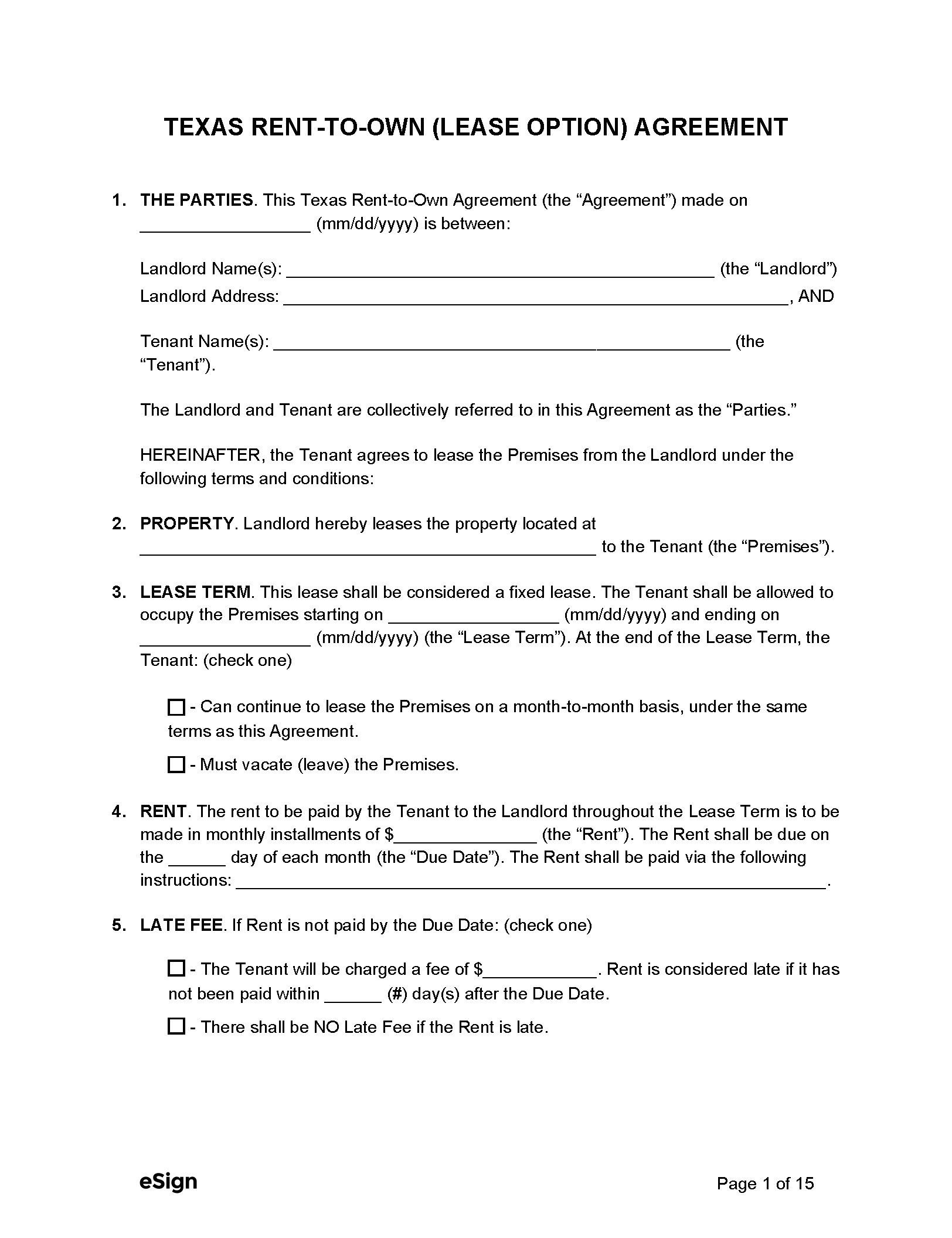

Rent-to-Own Agreement (Lease Option) – A rental contract that grants the tenant the right to purchase the property under specific conditions after the tenancy expires. Rent-to-Own Agreement (Lease Option) – A rental contract that grants the tenant the right to purchase the property under specific conditions after the tenancy expires.

Download: PDF |

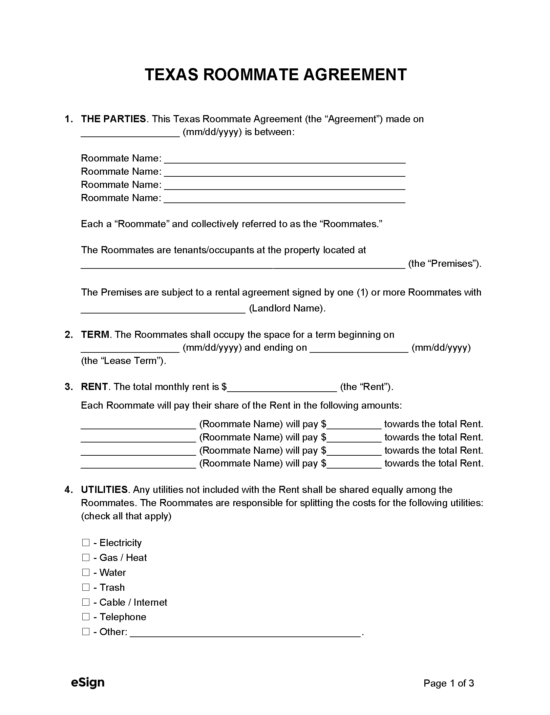

Roommate Agreement – Used to establish the rights and responsibilities of multiple individuals occupying the same living space. Roommate Agreement – Used to establish the rights and responsibilities of multiple individuals occupying the same living space.

Download: PDF, Word (.docx), OpenDocument |

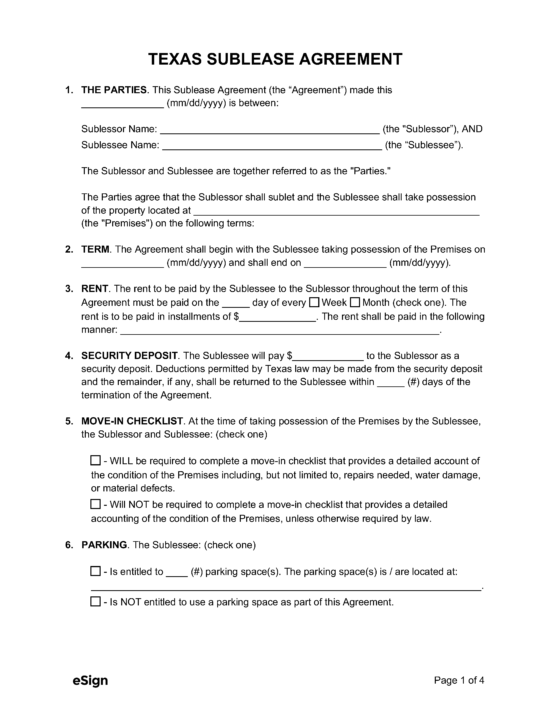

Sublease Agreement – Used by tenants who want to lease their rented space to another person with permission from their landlord. Sublease Agreement – Used by tenants who want to lease their rented space to another person with permission from their landlord.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (7)

- 100-Year Flood Plain (PDF) – The landlord must provide notice to the tenant to state whether or not the property is located in a 100-year flood plain.[1]

- Lead-Based Paint Disclosure (PDF) – If a rental property was constructed before 1978, the landlord must complete this disclosure and have the tenant sign it.[2]

- Ownership and Management – The landlord must provide the name and address of the owner and, if applicable, the management company of the property.[3]

- Right to Interrupt Utilities – If landlords want to reserve the right to shut off electricity for nonpayment by a tenant, they must disclose this right in the lease agreement and provide a notice before interruption occurs.[4]

- Special Conditions to Cancel Agreement – Lease agreements must disclose a tenant’s right to terminate the lease under special circumstances using the following statement or similar language: “Tenants may have special statutory rights to terminate the lease early in certain situations involving family violence or a military deployment or transfer.”[5]

- Texas Parking Rules Addendum (PDF) – For landlords of a multi-unit complex, tenants must be given a written disclosure before a lease is signed that familiarizes them with the parking and towing policies.[6]

- Tenant’s Remedies – A lease must inform a tenant of the available remedies under law pertaining to repairs of the premises.[7]

Security Deposits

Maximum Amount ($) – There are no Texas statutes that impose a maximum security deposit limit.

Collecting Interest – State statutes do not mention the collection of interest on security deposits.

Returning to Tenant – Security deposits must be returned 30 days after the tenant gives up possession of the property to the landlord.[8]

- Note: A landlord does not have to return a security deposit until the tenant provides a forwarding address. Failing to provide an address, however, does not obstruct the tenant’s right to their deposit.[9]

Itemized List Required? – Yes, if the landlord uses some or all of the security deposit to fix damages other than normal wear and tear, they must provide the tenant with a list of all deductions.[10]

- Exception: If the tenant still owes rent, the landlord is not obligated to send an itemized list.

Separate Bank Account? – No, state law does not specify whether security deposits must be kept in a separate bank account, only that landlords must maintain accurate records.[11]

Landlord’s Entry

General Access – Texas property code doesn’t specifically mention the need to notify tenants before a landlord enters the premises.

Immediate Access – Not mentioned in state statutes. The Tenants Rights Handbook (page 6), however, states that it is acceptable for a landlord to enter a tenant’s rental unit only in emergency situations and for routine inspections/repairs. In the latter case, notice is still recommended.

Rent Payments

Grace Period – There is a two-day grace period before a landlord can collect a late fee from a tenant. Furthermore, the fee must be reasonable and written in the lease agreement.[12]

Maximum Late Fee ($) – A late fee is considered reasonable if it is 12% of the rent amount when the rental property has four units or less. When the building has more than four units, 10% is considered reasonable.[13]

- Exception: Landlords may charge more than the mentioned percentages but only for expenses or costs associated with collecting the late rent payment.[14]

Bad Check (NSF) Fee – Fees charged to tenants for bounced checks are not covered by state law.

Withholding Rent – A tenant cannot legally withhold rent payments. If they do, the landlord can recover damages equal to one month’s rent plus $500 after proper notice has been delivered.[15]

Breaking a Lease

Non-Payment of Rent – If a tenant fails to pay rent, the landlord must give them three days’ notice to pay or vacate the premises before starting an eviction suit.[16]

Non-Compliance – If a tenant breaches their lease agreement, the landlord must deliver a 3-day notice to comply or quit before they can file for eviction.

Landlord Repairs – Besides normal wear and tear caused by the tenant, the landlord should be notified by the tenant of any necessary repairs that affect their health or safety.[17]

Lockouts – Landlords cannot lock a tenant out of their rental property without proper judicial process or for legitimate reasons listed under state law.[18]

Leaving Before the End Date – A landlord’s remedies for a tenant abandoning rental property before the lease has terminated are not mentioned in state statutes.

Lease Termination

Month-to-Month – In order to end a month-to-month tenancy, either party must deliver a 1-month notice to quit to the other.[19]

Unclaimed Property – If a tenant leaves their property in the rental unit, the landlord may remove it. No storage or timeframe for recovery is mentioned in state statutes.[20]