By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

When to Use

A general warranty deed is generally used in the following in the following circumstances:

- The buyer will be purchasing the property (not receiving it as a gift).

- The buyer will need to obtain financing or title insurance.

- The buyer wants the highest level of protection against any title issues.

General Warranty vs. Special Warranty

Under a general warranty deed, the grantee (buyer) receives a guarantee that the property is free of any issues dating back to the very first owner. If any title issues do come to light, the grantor is legally obligated to defend the grantee against them.

With a special warranty deed, the buyer is only promised that the title is free and clear of issues from the current owner (grantor). In other words, the deed does not provide guarantees or protection for title issues from previous owners.

Both deed types provide significantly more protection for the buyer than a quitclaim deed, which provides no guarantees to the grantee.

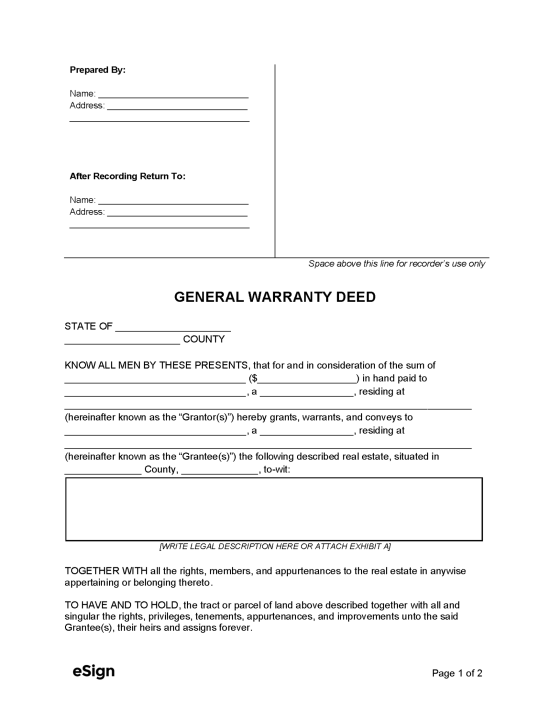

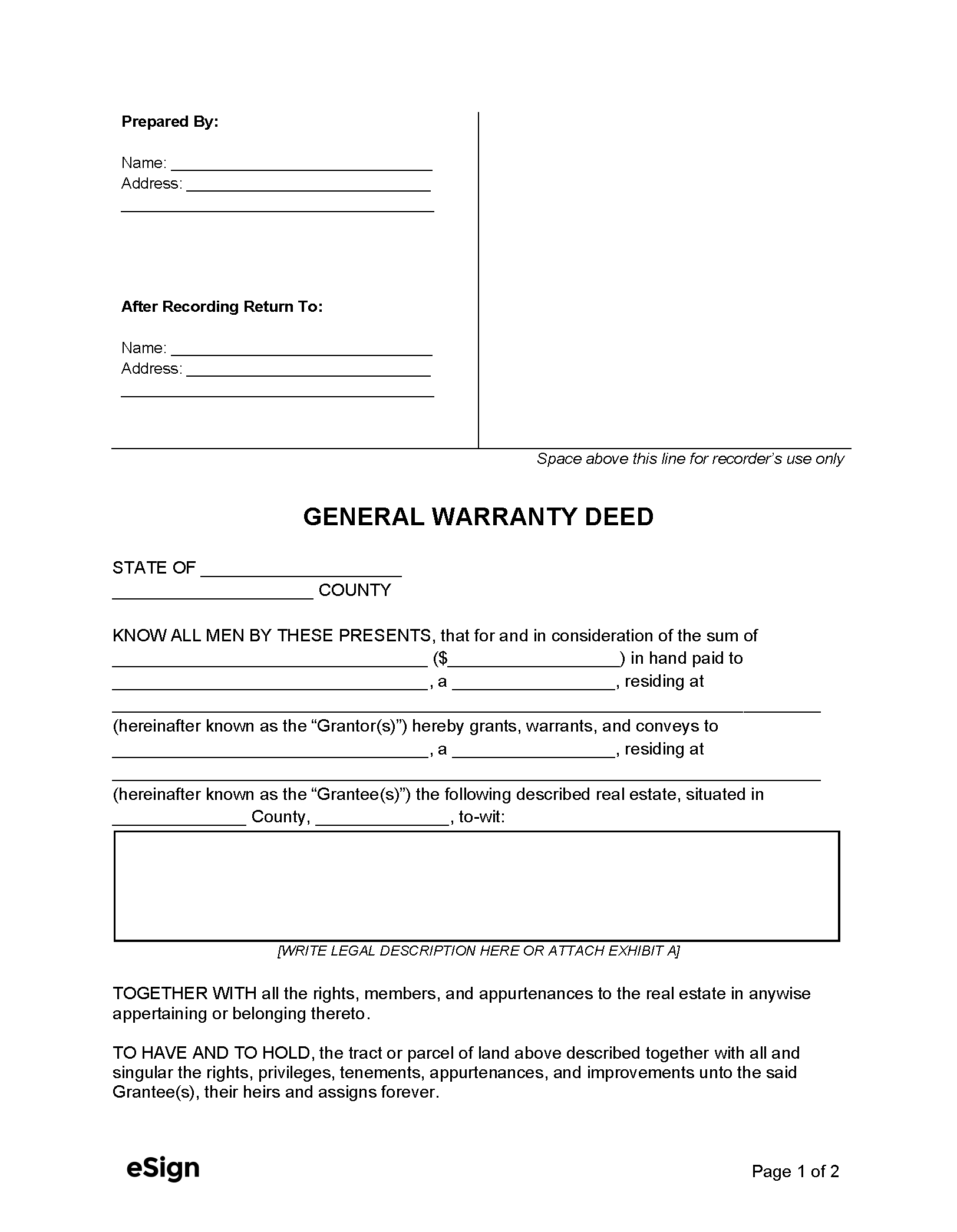

Sample

Download: PDF, Word (.docx), OpenDocument

Name: [PREPARER NAME]

Address: [PREPARER ADDRESS]

After Recording Return To:

Name: [RECIPIENT NAME]

Address: [RECIPIENT ADDRESS]

STATE OF [STATE NAME]

COUNTY OF [COUNTY NAME]KNOW ALL MEN BY THESE PRESENTS, that for and in consideration of the sum of [AMOUNT (IN WORDS)] ($[AMOUNT (AS A NUMBER)]) in hand paid to [GRANTOR NAME(S)], a [GRANTOR(S) MARITAL STATUS], residing at [GRANTOR(S) STREET ADDRESS] (hereinafter known as the “Grantor(s)”) hereby grants, warrants, and conveys to [GRANTEE NAME(S)], a [GRANTEE(S) MARITAL STATUS], residing at [GRANTEE(S) STREET ADDRESS] (hereinafter known as the “Grantee(s)”) the following described real estate, situated in [COUNTY NAME] County, [STATE], to-wit:[ENTER THE PROPERTY’S LEGAL DESCRIPTION HERE, OR ATTACH EXHIBIT A].TOGETHER WITH all the rights, members, and appurtenances to the real estate in anywise appertaining or belonging thereto.TO HAVE AND TO HOLD, the tract or parcel of land above described together with all and singular the rights, privileges, tenements, appurtenances, and improvements unto the said Grantee(s), their heirs and assigns forever.

And said Grantor(s), for said Grantor(s), their heirs, successors, executors, and administrators, covenants with Grantee(s), and with their heirs and assigns, that Grantor(s) are lawfully seized in fee simple of the said real estate; that said real estate is free and clear from all Liens and Encumbrances, except as herein set forth, and except for taxes due for the current and subsequent years, and except for any Restrictions pertaining to the real estate of record in the Probate Office of said County; and that Grantor(s) will, and their heirs, executors, and administrators shall warrant and defend the same to said Grantee(s), and their heirs and assigns, forever against the lawful claims of all persons.

IN WITNESS WHEREOF, the Grantor(s) has executed and delivered this Lady Bird Deed under seal as of the day and year first above written.

Grantor’s Signature: _____________________________

Grantor’s Name: [GRANTOR NAME]

Witness’s Signature: _____________________________

Witness’s Name: [WITNESS NAME]

Witness’s Signature: _____________________________

Witness’s Name: [WITNESS NAME]

STATE OF [NOTARY: STATE]

COUNTY OF [NOTARY: COUNTY]

I, the undersigned, a Notary Public in and for said County, in said State, hereby certify that [NOTARY: GRANTOR(S)] whose names are signed to the foregoing instrument, and who is known to me, acknowledged before me on this day that, being informed of the contents of the instrument, they, executed the same voluntarily on the day the same bears date.

Given under my hand this [MM/DD/YYYY].

_____________________________

Notary Public

My Commission Expires: ________________