By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Common Uses for a Quit Claim Deed:

- Clearing title defects, such as boundary issues or errors in the deed that prevent a clear transfer.

- Removing someone from the title, often in divorce cases to take a spouse’s name off the deed.

- Transferring property to trusted parties, like family or friends.

How Quit Claim Deeds Work

A quit claim deed does nothing more than release whatever interest an individual (the grantor) has in real estate and transfer it to a grantee. This type of conveyance does not guarantee that the property title is clean (i.e., no liens or encumbrances) or that the grantor has the right to transfer title in the first place.

Because of the inherent risk involved, a quit claim deed is generally used between parties with an established level of trust, such as family members or divorcing spouses.

Quit Claim Deed vs. Warranty Deed

The main difference between quit claim and warranty deeds is the level of protection for the grantee:

- A quit claim deed offers no ownership guarantees, placing all risk on the grantee.

- A warranty deed confirms ownership and a clear title, holding the grantor liable for all title issues past and present.

How to Use a Quit Claim Deed1. Get the Correct FormEach state has specific deed formatting requirements, so it’s crucial to draft a deed in accordance with state standards. Incorrect formatting can lead to rejection by the county recorder/register of deeds.

2. Input InformationThe following information is typically needed:

3. Sign and AcknowledgeAll states require deeds to be notarized and/or witnessed by impartial parties. It’s crucial to check state-specific signing rules to ensure proper execution.

4. RecordOnce the deed has been completed, signed, and acknowledged by the appropriate parties, it must be filed with the recorder’s office in the same county where the property is located. A fee will be required to file the document.

|

Sample

Disclaimer

Deeds must be formatted according to state-specific standards to be accepted for recording.

Download: PDF (Blank) | PDF (Sample Data)

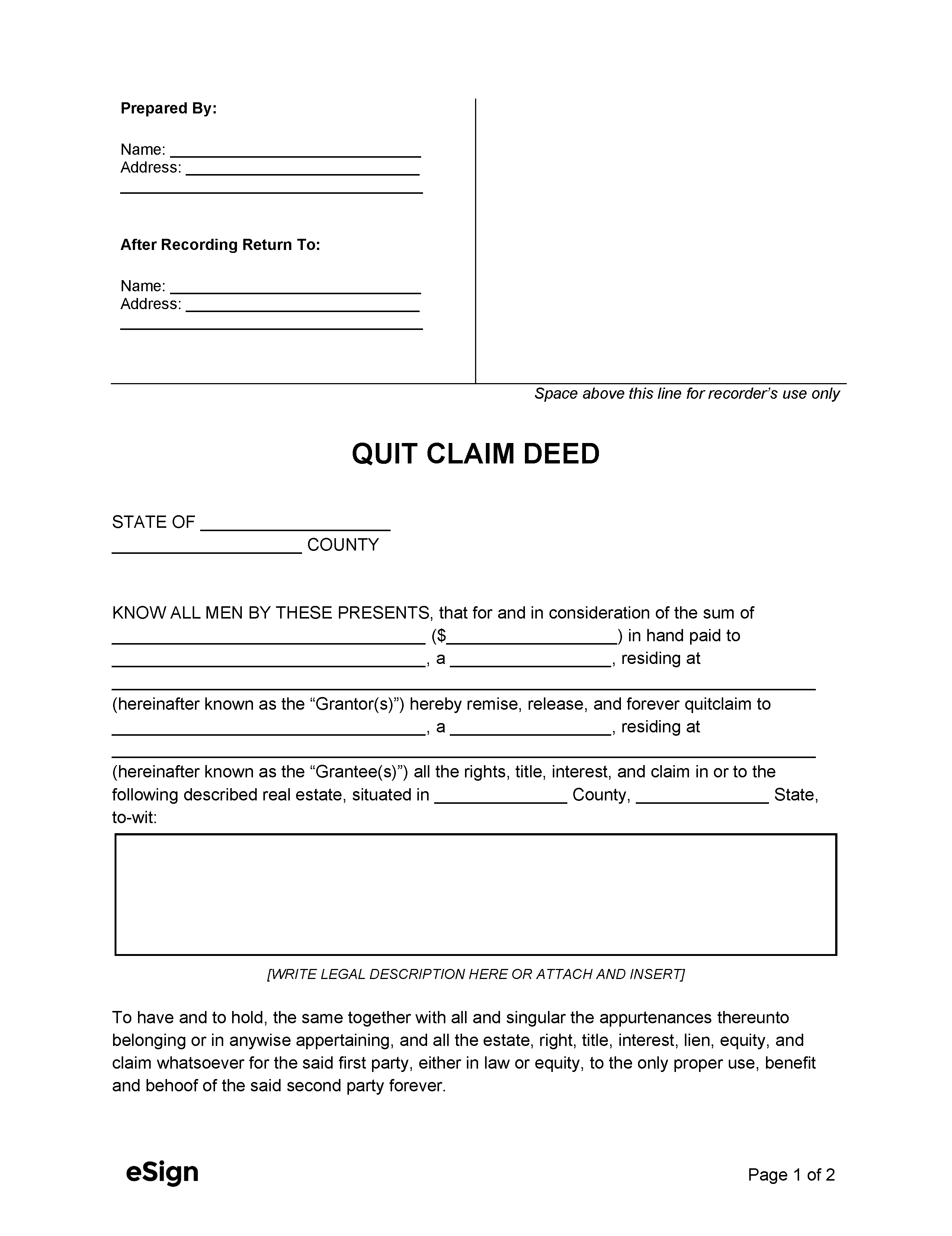

Prepared By:

Name: [PREPARER NAME]

Address: [PREPARER ADDRESS]

After Recording Return To:

Name: [RECIPIENT NAME]

Address: [RECIPIENT ADDRESS]

Space above this line for recorder’s use only

QUIT CLAIM DEED

STATE OF [STATE NAME]

COUNTY OF [COUNTY]

Know all men by these presents, that for and in consideration of the sum of [AMOUNT (IN WORDS)] ($[AMOUNT (AS A NUMBER)]) in hand paid to [GRANTOR NAME(S)], a [GRANTOR(S) MARITAL STATUS], residing at [GRANTOR(S) STREET ADDRESS] (hereinafter known as the “Grantor(s)”) hereby remise, release, and forever quitclaim to [GRANTEE NAME(S)], a [GRANTEE(S) MARITAL STATUS], residing at [GRANTEE(S) STREET ADDRESS] (hereinafter known as the “Grantee(s)”) all the rights, title, interest, and claim in or to the following described real estate, situated in [COUNTY NAME] County, [STATE NAME] State, to-wit:

[ENTER PROPERTY LEGAL DESCRIPTION (OR ATTACH AS SEPARATE PAGE)].

To have and to hold, the same together with all and singular the appurtenances thereunto belonging or in anywise appertaining, and all the estate, right, title, interest, lien, equity, and claim whatsoever for the said first party, either in law or equity, to the only proper use, benefit and behoof of the said second party forever.

Grantor Signature: _________________________

Grantor Name: [GRANTOR NAME]

Grantor Signature: _________________________

Grantor Name: [GRANTOR NAME]

Witness Signature: _________________________

Witness Name: [WITNESS NAME]

Witness Signature: _________________________

Witness Name: [WITNESS NAME]

STATE OF [STATE]

COUNTY OF [COUNTY]

I, the undersigned, a Notary Public in and for said County, in said State, hereby certify that [GRANTOR NAME(S)], whose name is signed to the foregoing instrument and who is known to me, acknowledged before me on this day that, being informed of the contents of the instrument, they executed the same voluntarily on the day the same bears date.

Given under my hand, this [MM/DD/YYYY]

_________________________

Notary Public

My Commission Expires: [MM/DD/YYYY]