By Type (5)

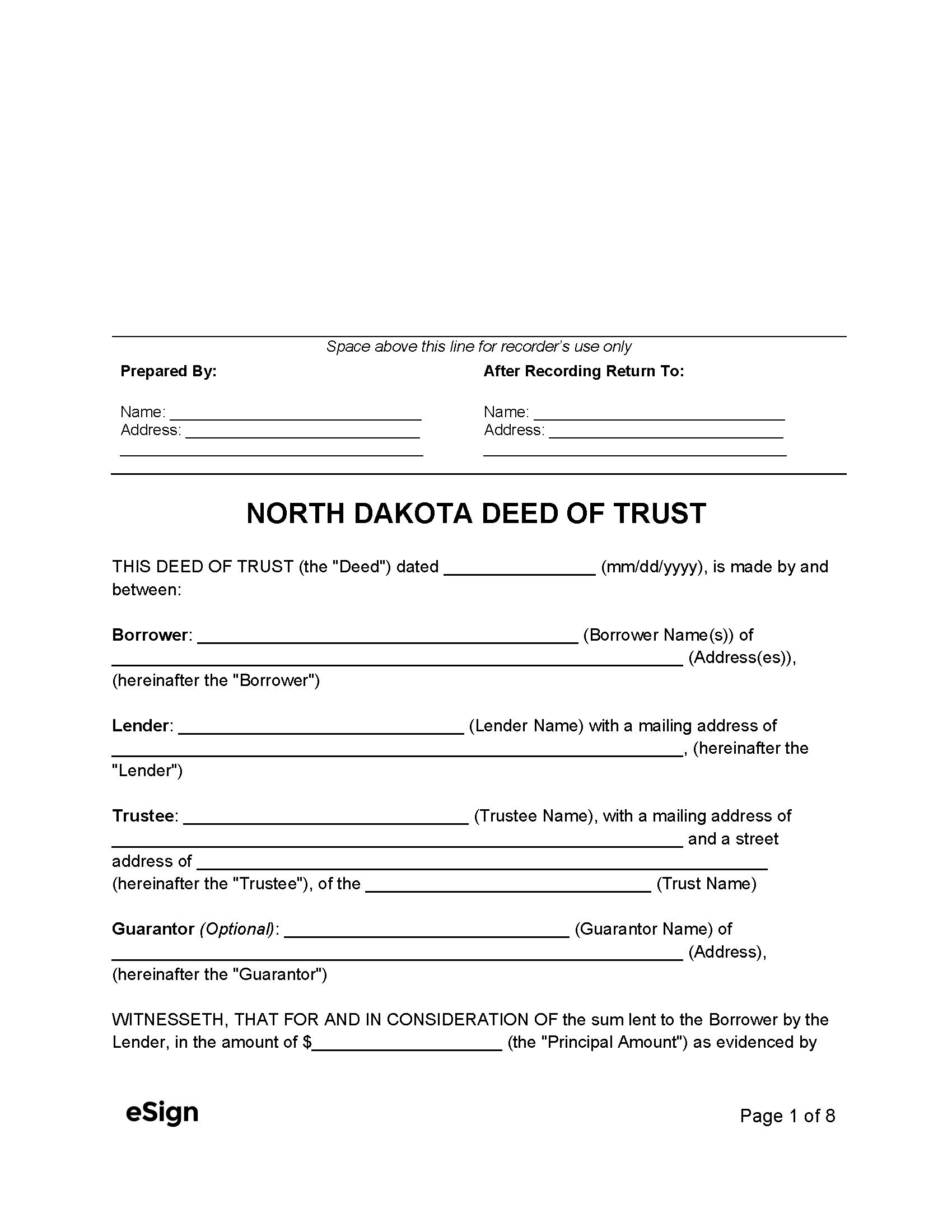

Deed of Trust – Temporarily conveys a borrower’s property to a trustee as collateral for a home loan. Deed of Trust – Temporarily conveys a borrower’s property to a trustee as collateral for a home loan.

Download: PDF, Word (.docx), OpenDocument

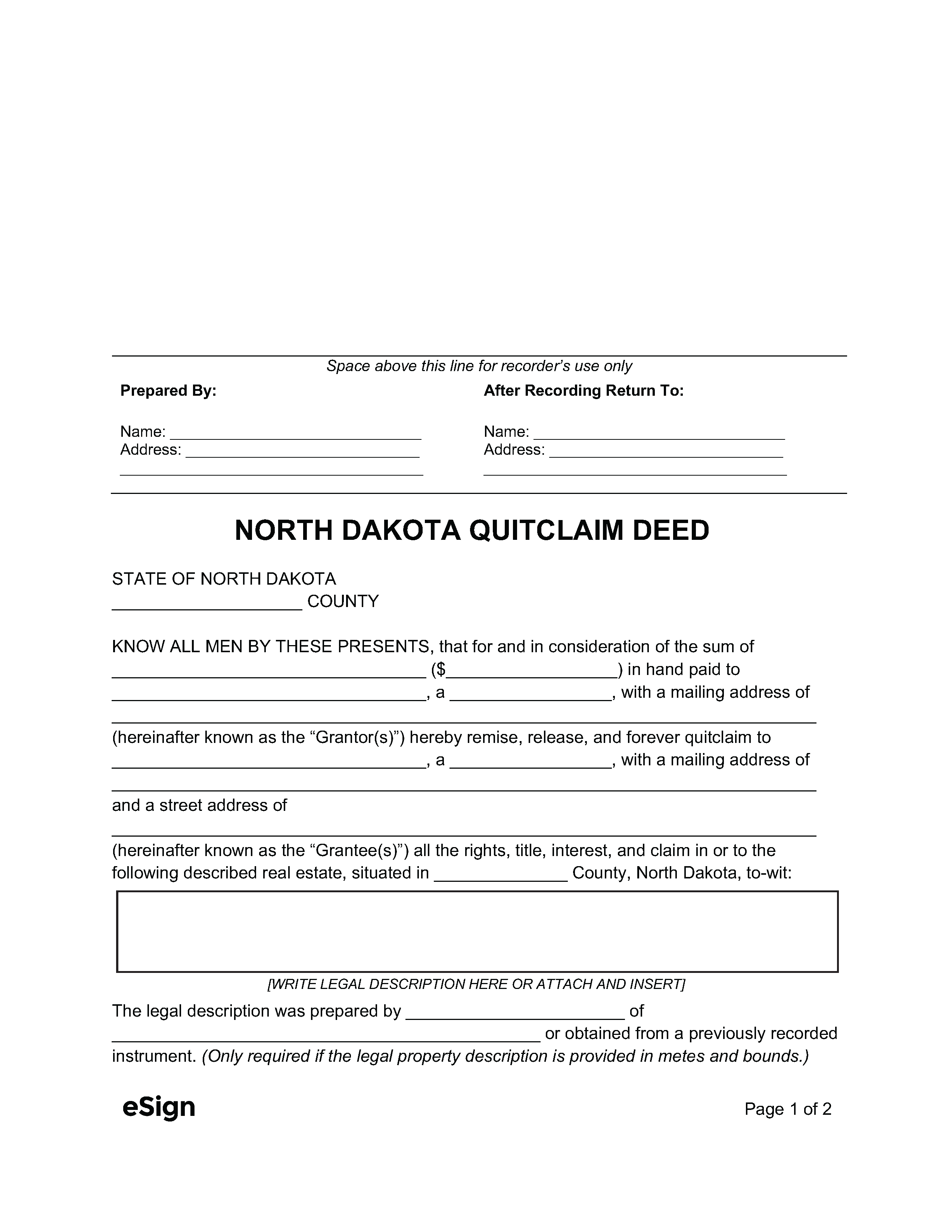

Quit Claim Deed – Does not protect the title or promise that the grantor legally owns the property.

|

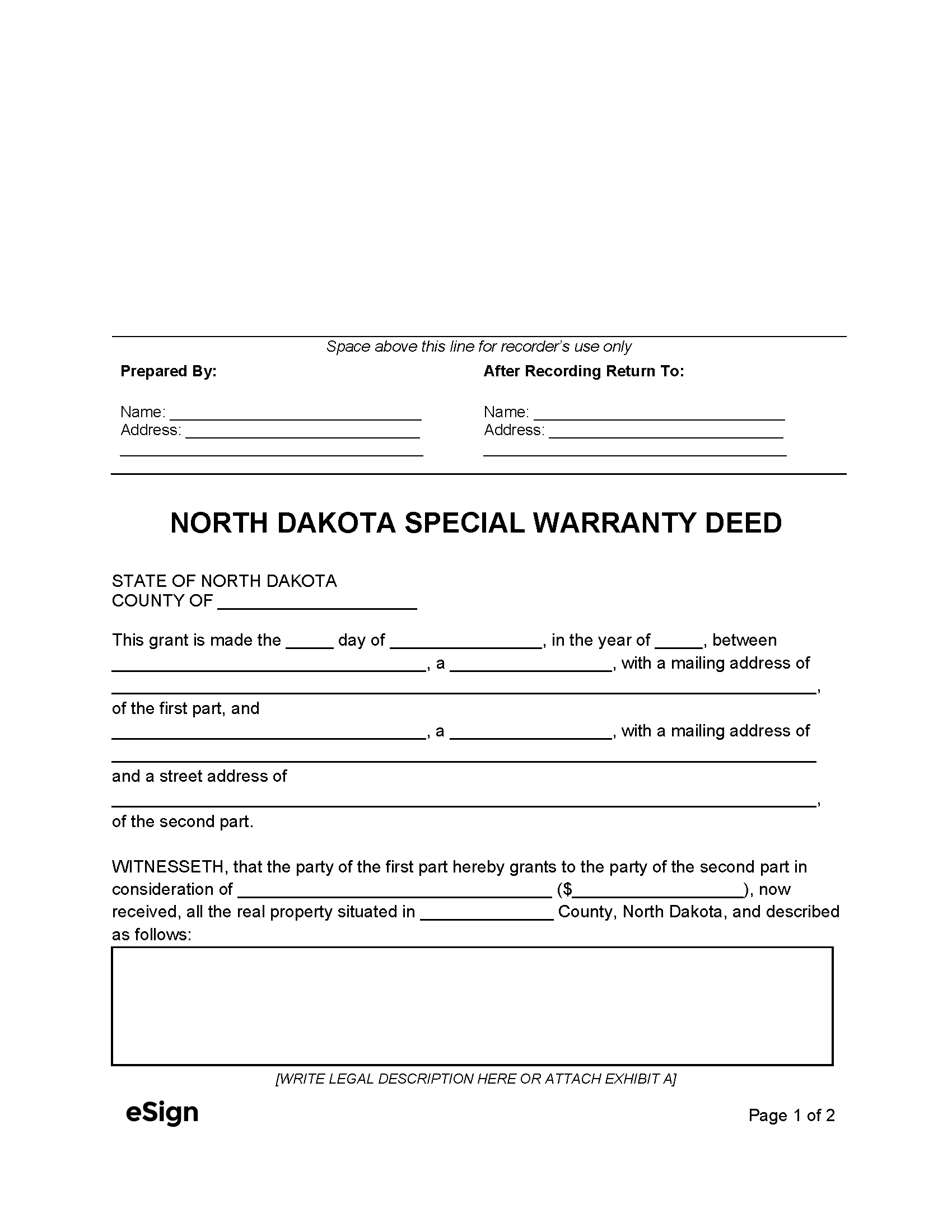

Special Warranty Deed – Conveys property with a warranty that no title issues occurred during the grantor’s ownership. Special Warranty Deed – Conveys property with a warranty that no title issues occurred during the grantor’s ownership.

|

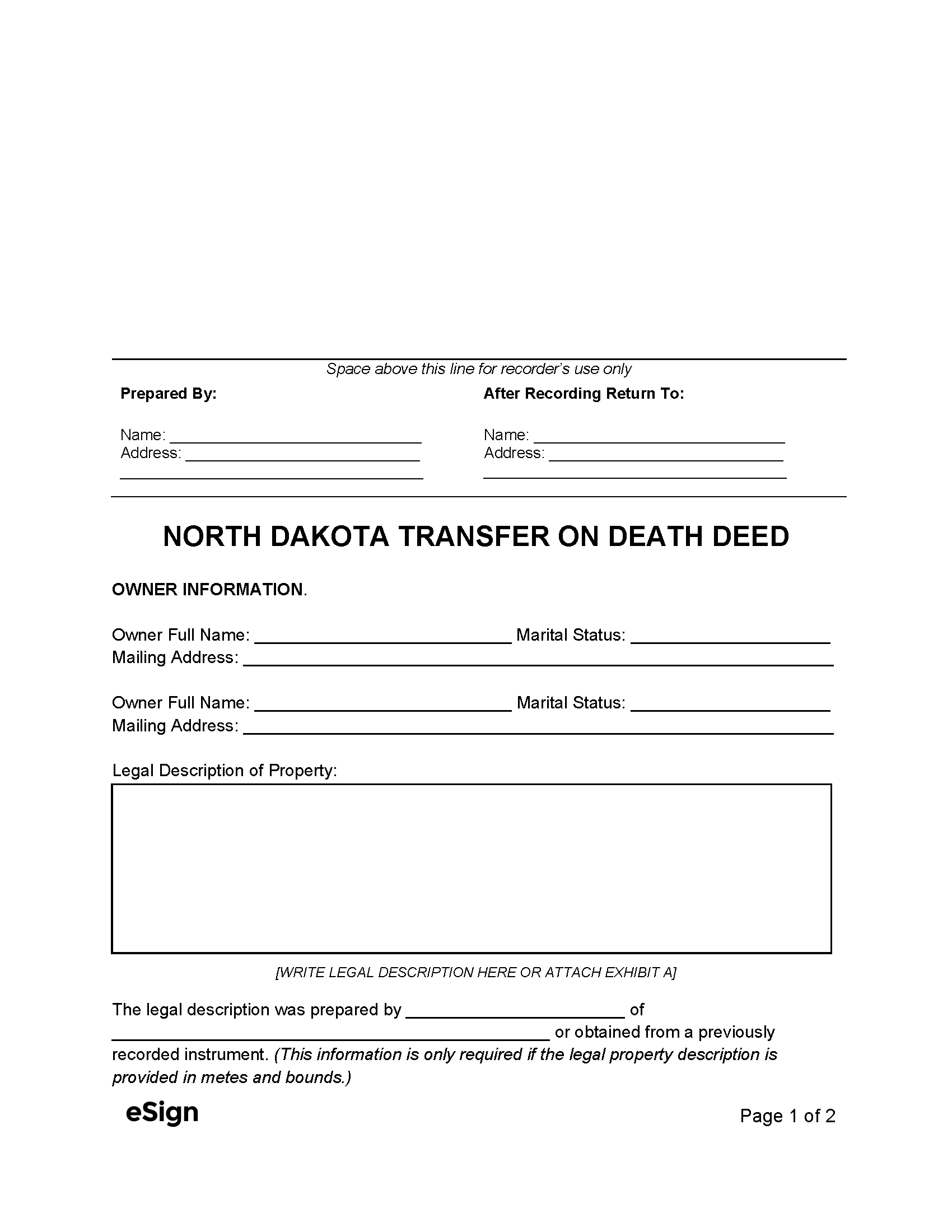

Transfer on Death Deed – An estate planning document allowing the quick transfer of property to heirs upon the grantor’s death. Transfer on Death Deed – An estate planning document allowing the quick transfer of property to heirs upon the grantor’s death.

|

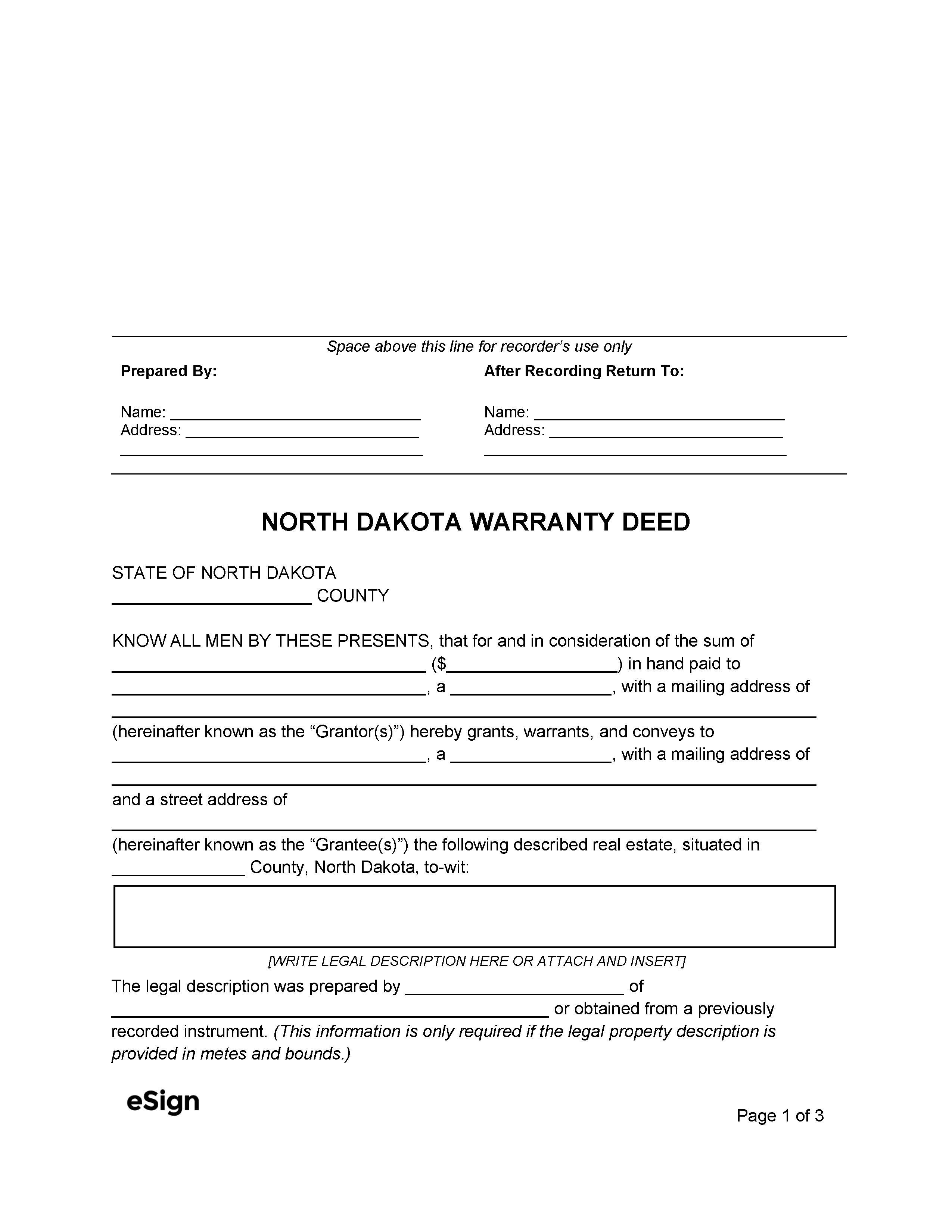

Warranty Deed – Guarantees no title defects and fully protects the new owner against existing encumbrances. Warranty Deed – Guarantees no title defects and fully protects the new owner against existing encumbrances.

|

Formatting

Paper – No larger than 8.5 inches by 14 inches

Margins – 3″ space across the top of the first page, 1″ space for all other margins

Font – Must be equal to or larger than 10-point Calibri[1]

Recording

Signing Requirements – A North Dakota deed needs to be signed by the grantor and notarized.[2]

Where to Record – Grantors must visit the County Recorder’s Office in the county where the property is located to submit the deed for recording.[3]

Cost – At the time of this writing, the recording fees are $20 for deeds containing 1-6 pages, $65 for deeds containing 7-25 pages, and $3 for each additional page.[4]

- If a deed lists more than 10 sections of land, a $1 fee is required for each additional section.