By Type (10)

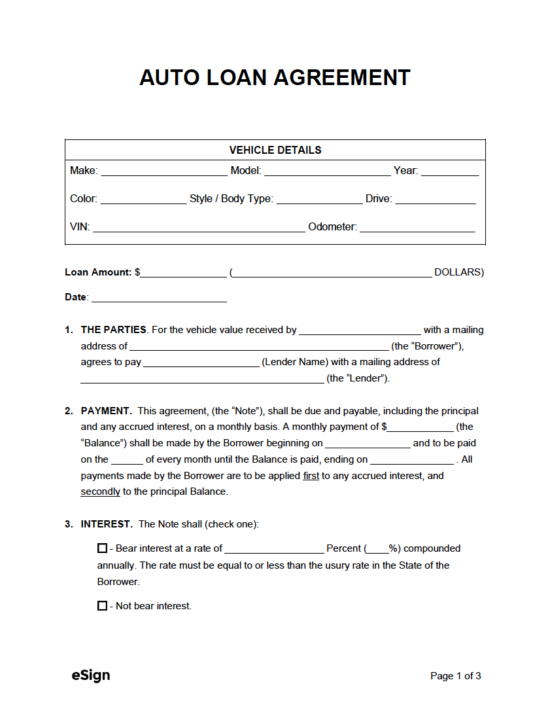

Download: PDF, Word (.docx), OpenDocument

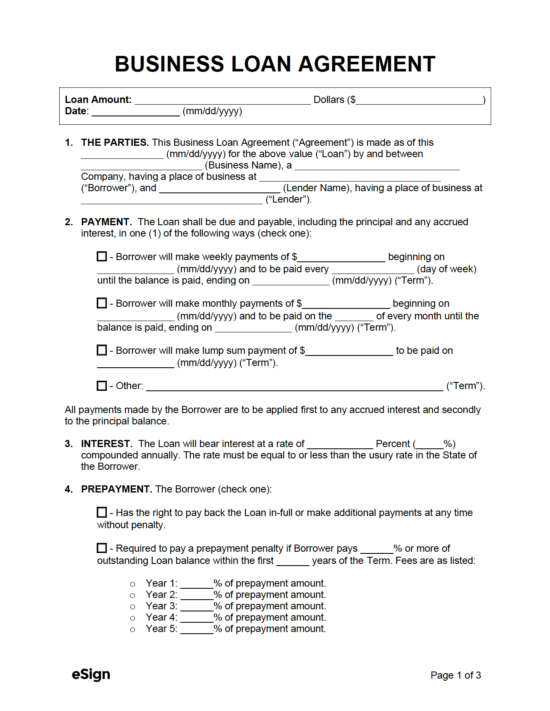

Download: PDF, Word (.docx), OpenDocument

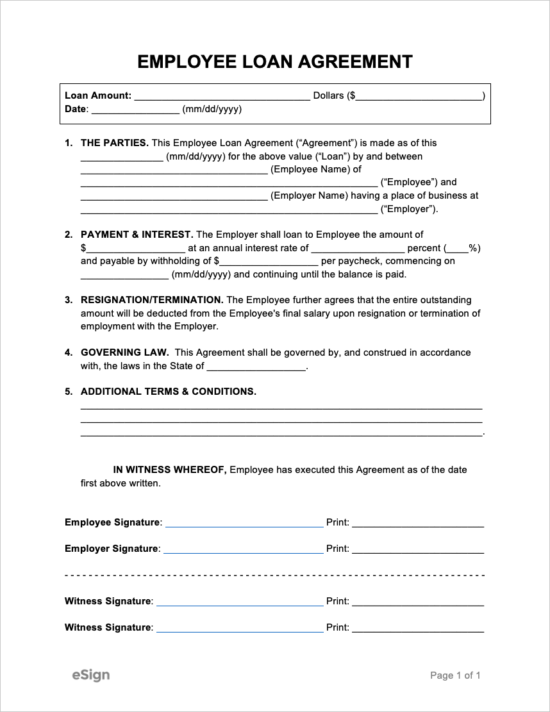

Download: PDF, Word (.docx), OpenDocument

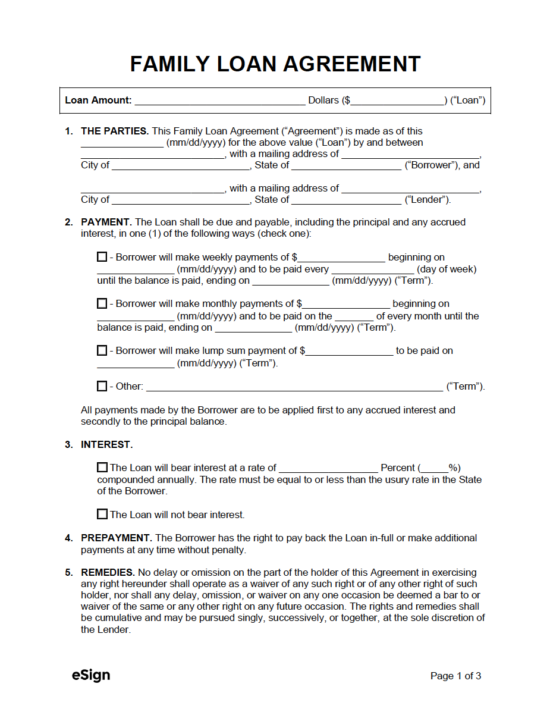

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Contents |

What is a Loan Agreement?

Definition: A written contract that provides verifiable proof that money was loaned from one entity to another.

A loan agreement is a document used to structure the terms and conditions of borrowed money. It establishes when (and for how long) the borrower needs to make payments on the loan. The contract can be used for principal-only loans (no interest) and many other types of lending.

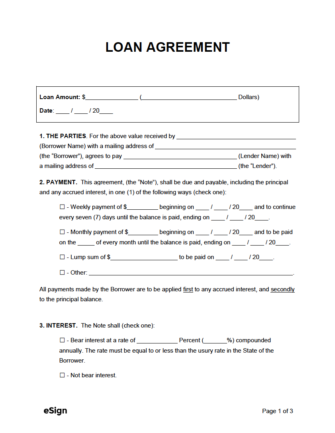

Sample

- Download (Blank): PDF, Word (.docx), OpenDocument

- Download (Sample Data): PDF, Word (.docx)

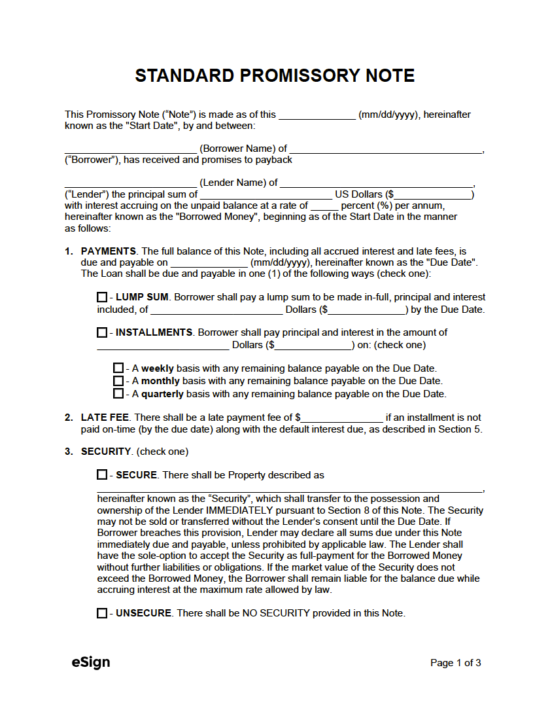

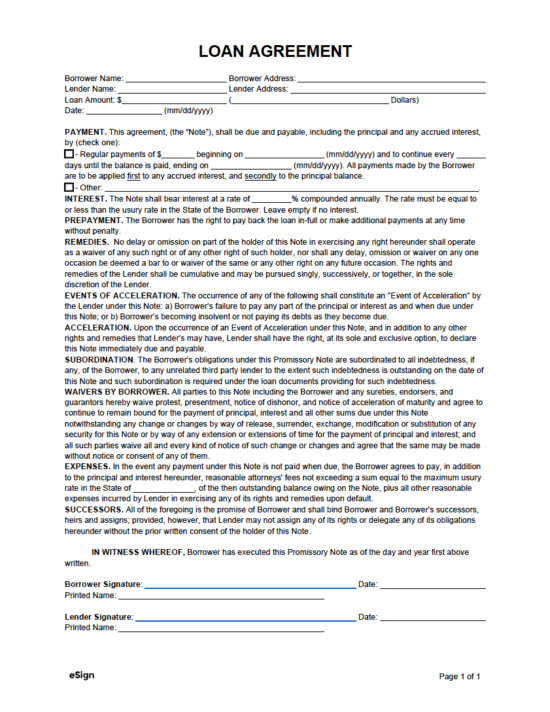

LOAN AGREEMENT

Loan Amount: [AMOUNT (IN WORDS)] Dollars ($[AMOUNT (NUMERICALLY)])

Date: [MM/DD/YYYY]

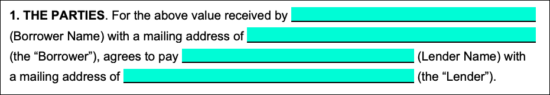

1. THE PARTIES. For the above value received by [BORROWER’S NAME] with a mailing address of [BORROWER’S ADDRESS] (the “Borrower”), agrees to pay [LENDER’S NAME] (Lender Name) with a mailing address of [LENDER’S ADDRESS] (the “Lender”).

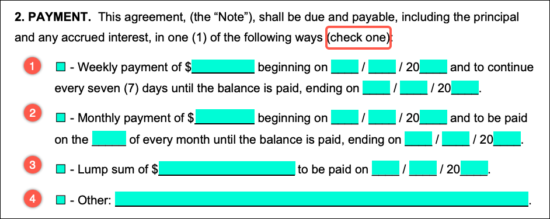

2. PAYMENT. This agreement (the “Note”) shall be due and payable, including the principal and any accrued interest, in one (1) of the following ways (check one):

☐ – Weekly payment of [AMOUNT] beginning on [MM/DD/YYYY] and to continue every seven (7) days until the balance is paid, ending on [MM/DD/YYYY].

☐ – Monthly payment of [AMOUNT] beginning on [MM/DD/YYYY] and to be paid on the [FREQUENCY] of every month until the balance is paid, ending on [MM/DD/YYYY].

☐ – Lump sum of [AMOUNT] to be paid on [MM/DD/YYYY].

☐ – Other: [OTHER].

All payments made by the Borrower are to be applied first to any accrued interest and secondly to the principal balance.

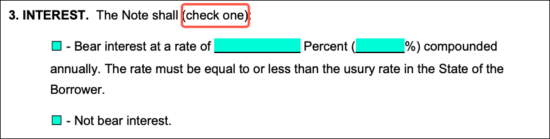

3. INTEREST. The Note shall (check one):

☐ – Bear interest at a rate of [INTEREST RATE] Percent compounded annually. The rate must be equal to or less than the usury rate in the State of the Borrower.

☐ – Not bear interest.

4. PREPAYMENT. The Borrower has the right to pay back the loan in full or make additional payments at any time without penalty.

5. REMEDIES. No delay or omission on part of the holder of this Note in exercising any right hereunder shall operate as a waiver of any such right or of any other right of such holder, nor shall any delay, omission, or waiver on any one occasion be deemed a bar to or waiver of the same or any other right on any future occasion. The rights and remedies of the Lender shall be cumulative and may be pursued singly, successively, or together, at the sole discretion of the Lender.

6. EVENTS OF ACCELERATION. The occurrence of any of the following shall constitute an “Event of Acceleration” by the Lender under this Note:

a) Borrower’s failure to pay any part of the principal or interest as and when due under this Note; or

b) Borrower’s becoming insolvent or not paying its debts as they become due.

7. ACCELERATION. Upon the occurrence of an Event of Acceleration under this Note, and in addition to any other rights and remedies that the Lender may have, the Lender shall have the right, at its sole and exclusive option, to declare this Note immediately due and payable.

8. SUBORDINATION. The Borrower’s obligations under this Promissory Note are subordinated to all indebtedness, if any, of the Borrower, to any unrelated third party lender to the extent such indebtedness is outstanding on the date of this Note, and such subordination is required under the loan documents providing for such indebtedness.

9. WAIVERS BY BORROWER. All parties to this Note, including the Borrower and any sureties, endorsers, and guarantors, hereby waive protest, presentment, notice of dishonor, and notice of acceleration of maturity and agree to continue to remain bound for the payment of principal, interest and all other sums due under this Note notwithstanding any change or changes by way of release, surrender, exchange, modification or substitution of any security for this Note or by way of any extension or extensions of time for the payment of principal and interest; and all such parties waive all and every kind of notice of such change or changes and agree that the same may be made without notice or consent of any of them.

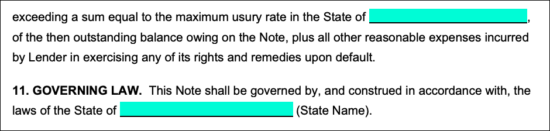

10. EXPENSES. In the event any payment under this Note is not paid when due, the Borrower agrees to pay, in addition to the principal and interest hereunder, reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate in the State of [STATE NAME], of the then outstanding balance owing on the Note, plus all other reasonable expenses incurred by Lender in exercising any of its rights and remedies upon default.

11. GOVERNING LAW. This Note shall be governed by, and construed in accordance with, the laws of the State of [STATE NAME].

12. SUCCESSORS. All of the foregoing is the promise of Borrower and shall bind Borrower and Borrower’s successors, heirs and assigns; provided, however, that Lender may not assign any of its rights or delegate any of its obligations hereunder without the prior written consent of the holder of this Note.

IN WITNESS WHEREOF, Borrower has executed this Promissory Note as of the day and year first above written.

Borrower Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [BORROWER NAME]

Lender Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [LENDER NAME]

Witness Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

Witness Signature: _______________________ Date: [MM/DD/YYYY]

Printed Name: [WITNESS NAME]

The Lending Process

Step 1 – Identify Needs

While the loan process is similar from one type to the next, the financial institution you contact for a quote will vary based on your needs. The types of loans are endless, but most fall into one of the major categories listed below.

| Loan Type | Avg. Interest Rate | Avg. Term Range |

| Personal Loans | 9.41% (Source) | 1-5 years (Source) |

| SBA (Business) Loans | 7-9.5% (Source) | 5-25 years (Source) |

| Student Loans | 5.8% (Source) | 10-20 years |

| Auto Loans | 4.07-8.62% (Source) | 6 years (Source) |

| Mortgage (Home) Loans | 5.11% (Source) | 15-30 years |

| Payday Loans | 391% (Source) | 2-4 weeks (Source) |

Check your Credit Score

Before shopping around for quotes, the borrower should get an idea of how their financial resume looks in the eyes of lenders. The majority of one’s financial history is found in a credit report. This is a report that lenders request from consumer reporting agencies to help decide whether or not it’s worth lending to an individual. Anyone can obtain a free report from AnnualCreditReport.com (the only website authorized by the FTC for obtaining free reports). Unlike the hard inquiries that are run when a person applies for credit, obtaining one’s own credit report does not impact their credit score.

If the individuals finds anything that is incorrect in the report, they’ll need to contact all three (3) reporting agencies to have it corrected. The overall health of a credit report will greatly impact whether a person is accepted for a loan, as well as the terms thereof. The majority of lenders will deny an application if a credit score is under a certain level. If the applicant is currently holding too much debt or their score is impacted by previous bankruptcies, missed payments, etc., it may be in their best interest to work on their credit before applying.

Step 2 – Find a Lender

There are several types of lenders that offer loans, including the following options:

- Credit unions

- Banks

- Mortgage lenders

- Peer-to-peer lenders

- Online lenders

The most common types of lenders for personal loans are banks and credit unions. When looking for a loan, an important takeaway is to never settle for the first lender. Unless the borrower is certain that the rate is fair (or they have no other options), it is sensible to shop around to get an idea of what other lenders charge.

When shopping for a loan, it’s best to try and get the quotes within a 30-45 day span. This is because the majority of lenders will run a hard check on the applicant’s credit to determine the appropriate rate (which will chip away at their credit score). By receiving multiple rates in a specific time period, the checks can appear as a single grouped credit check.

Step 3 – Apply for a Loan

Once a suitable lender has been found, the borrower will need to submit an application. The application process is unique to each lender; some provide an online application process in addition to in-person applications. The following is a list of information that is generally required on an application:

- Full name

- Mailing address

- Income

- Employer

- Reason for the loan

Including the reason for requesting the loan is important, as the lender will often customize the loan to the borrower’s exact needs (which can often result in paying a lower interest rate).

After the application process has started, the lender will require further documentation to prove the applicant’s identity and financial standing. This may include some (or all) of the following records:

- Pay stubs from the past thirty (30) days.

- W2 forms.

- Bank statements.

- Tax returns.

- Social Security Number (SSN).

- Proof of identity (e.g., driver’s license).

Step 4 – Accept and Sign

The loan could be approved in as little as seventy-two (72) hours. Before receiving the money, the borrower will need to finalize the loan process by accepting the terms and signing the loan agreement.

Once the agreement has been signed, the money should arrive between one (1) to fourteen (14) days. Once in possession of the money, the borrower will need to make consistent payments on a weekly or monthly basis. The agreement should contain all of the details regarding payment, including how interest and principal are distributed in each payment, how the borrower can make payments (online, by mail, in person, etc.), and the date of the last payment.

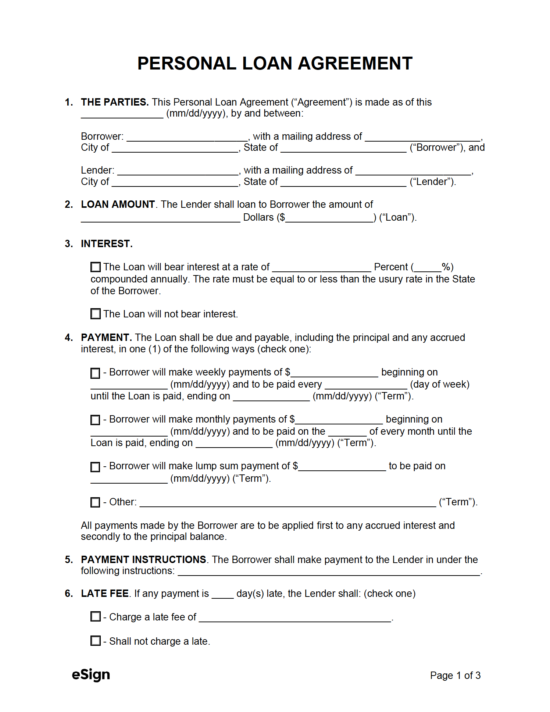

Instructions (How to Write)

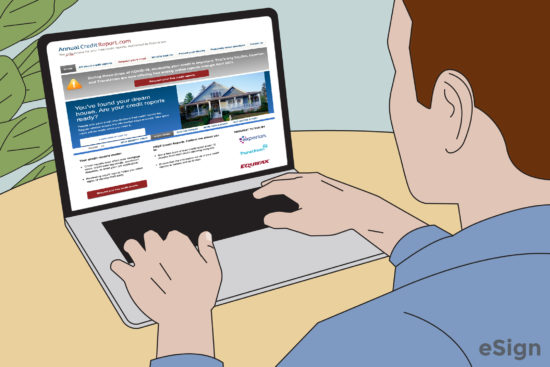

Step 1 – Loan Overview

In the box at the top of the agreement, enter the amount of the loan. The first field is for the numerical value (e.g., “$2,000.00”), and the second field is for the written amount (e.g., “Two-thousand dollars”). Beneath the amount, provide the date the agreement is being completed (most likely today’s date).

Step 2 – Borrower & Lender

In the section titled “The Parties,” the following information will need to be entered:

- Full name of the borrower.

- Borrower’s mailing address.

- Full name of the lender (can be a company or a person’s name).

- Mailing address of the lender.

Step 3 – Payment

There are four (4) payment options listed; weekly, monthly, lump sum, or “other” (for creating alternative payment options). Select one of the four by placing a checkmark in the appropriate box.

- If “Weekly payment” was selected: Enter the amount ($) the borrower needs to pay each week, followed by the date of the first payment, and the date on which the last payment will be due.

- If “Monthly payment” was selected: Enter the amount ($) the borrower will need to pay on a monthly basis, followed by the day, month, and year of the first payment, the day of the month on which payments will be due (e.g., “1st”), and the date on which the last payment will be due.

- If “Lump sum” was selected: Enter the full amount ($) the borrower will need to pay (including interest, if applicable), followed by the date (day, month, and year) on which payment will be due.

- If “Other” was selected: Provide the specific terms of the payment plan, including the amount of the payments and the frequency with which payments must be made.

Step 4 – Interest

If the loan will accrue interest, select the first checkbox and enter the written interest rate (e.g., “three”) followed by the numerical rate (e.g., “3.0%”). If interest will not be charged, select the second checkbox.

Step 5 – State Name

At the top of the last page, provide the name of the state in which the maximum usury rate was referenced. This should be the state in which the parties reside (or at least the lender). Under “Governing Law,” enter the name of the state in which state law will apply. This should be the same state that was written for the usury rate.

Step 6 – Signatures

At a minimum, the agreement needs to contain the signatures of the borrower and the lender. However, witness fields have been included if the parties would like additional proof that the document was signed by the actual parties and that they did so not under duress. The parties will each need to complete the following steps:

- Inscribe their signature (by hand or with eSign);

- Enter the date (mm/dd/yyyy) they signed; and

- Write their printed name.