By Type (6)

Deed of Trust – Transfers a loan recipient’s property title to a trustee as debt collateral. Deed of Trust – Transfers a loan recipient’s property title to a trustee as debt collateral.

|

General Warranty Deed – Provides a guarantee that no issues affect the property’s title. General Warranty Deed – Provides a guarantee that no issues affect the property’s title.

|

Limited Warranty Deed – Contains a title warranty covering the grantor’s term of ownership. Limited Warranty Deed – Contains a title warranty covering the grantor’s term of ownership.

|

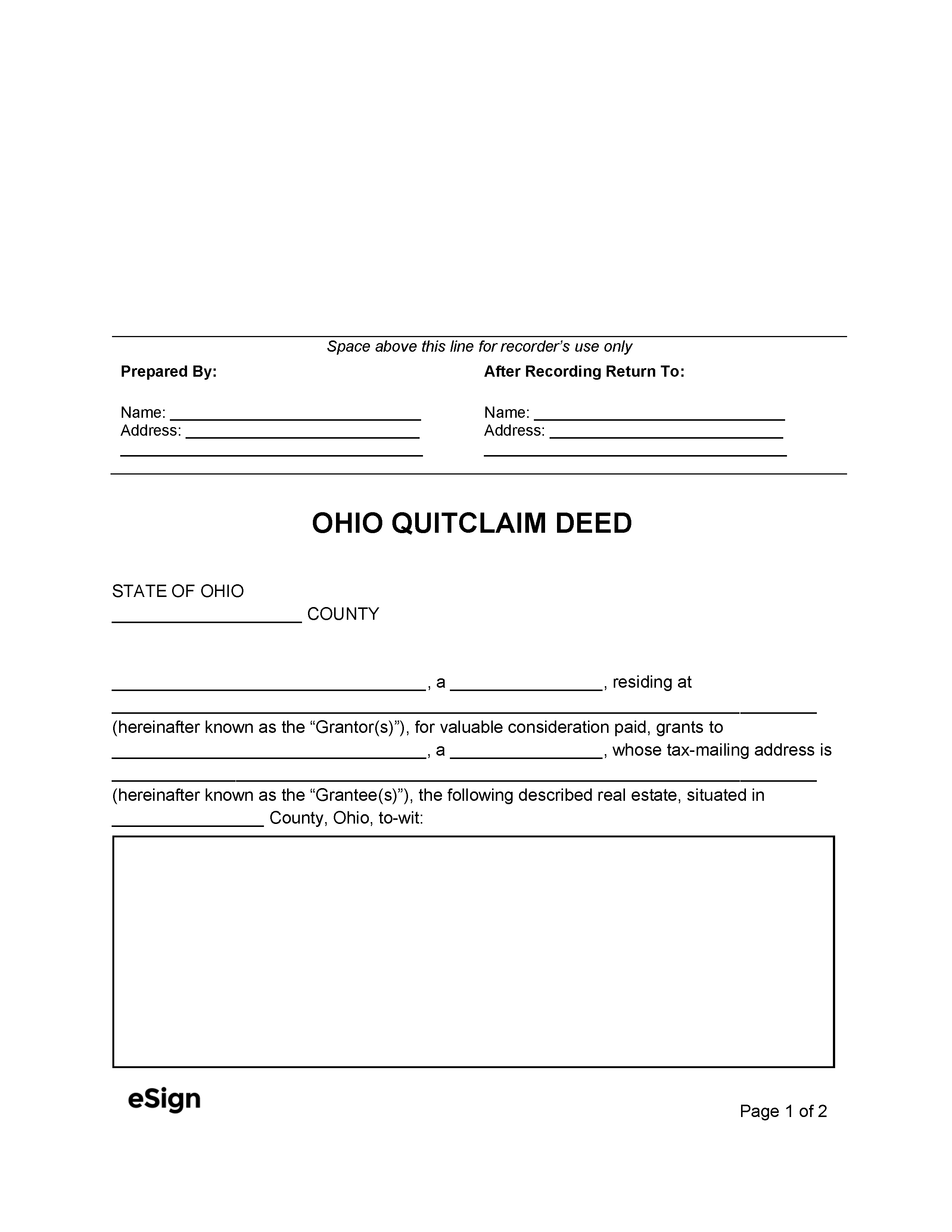

Quit Claim Deed – Transfers the grantor’s interest in a property without title warranties. Quit Claim Deed – Transfers the grantor’s interest in a property without title warranties.

|

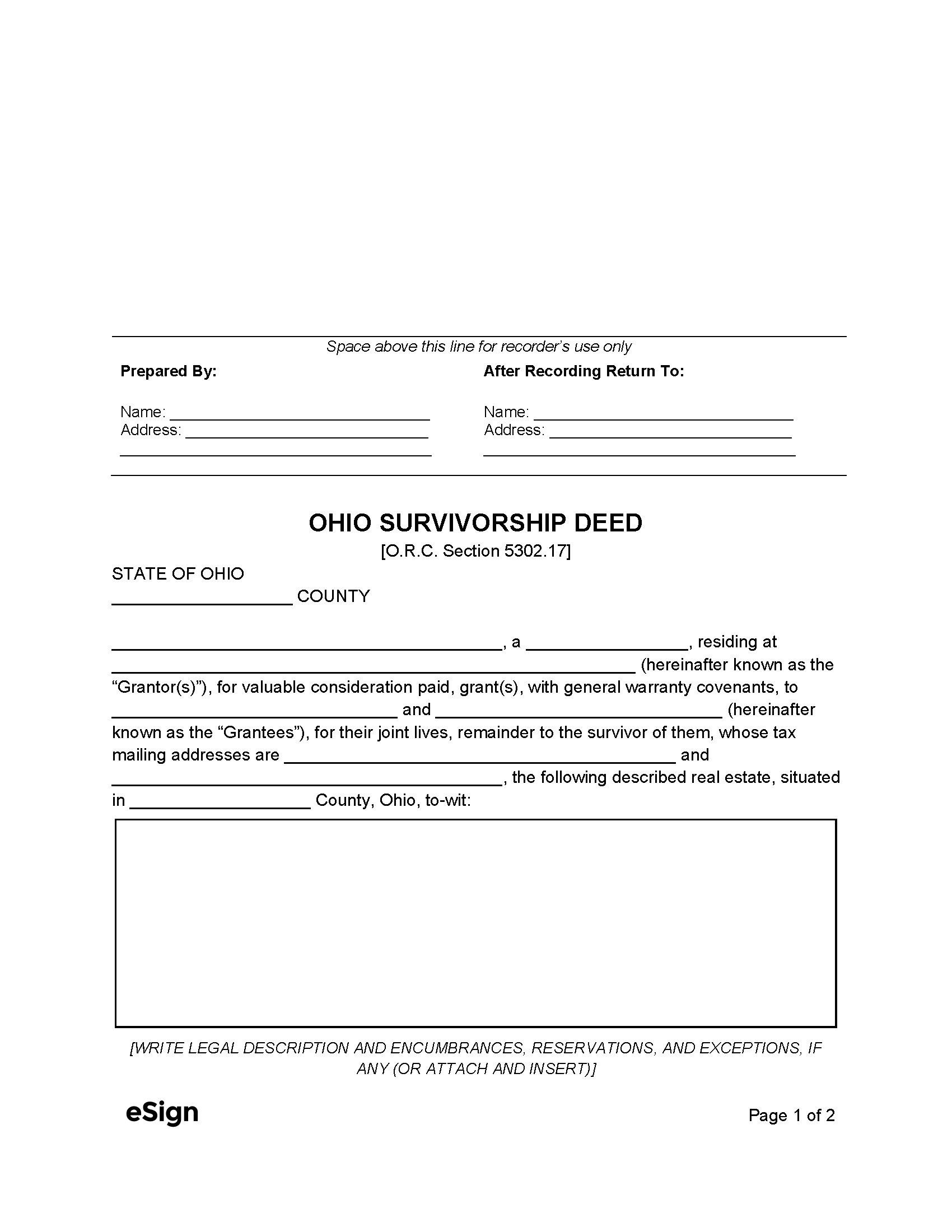

Survivorship Deed – Transfers ownership to multiple grantees. When a grantee dies, their share is divided among the surviving owners. Survivorship Deed – Transfers ownership to multiple grantees. When a grantee dies, their share is divided among the surviving owners.

|

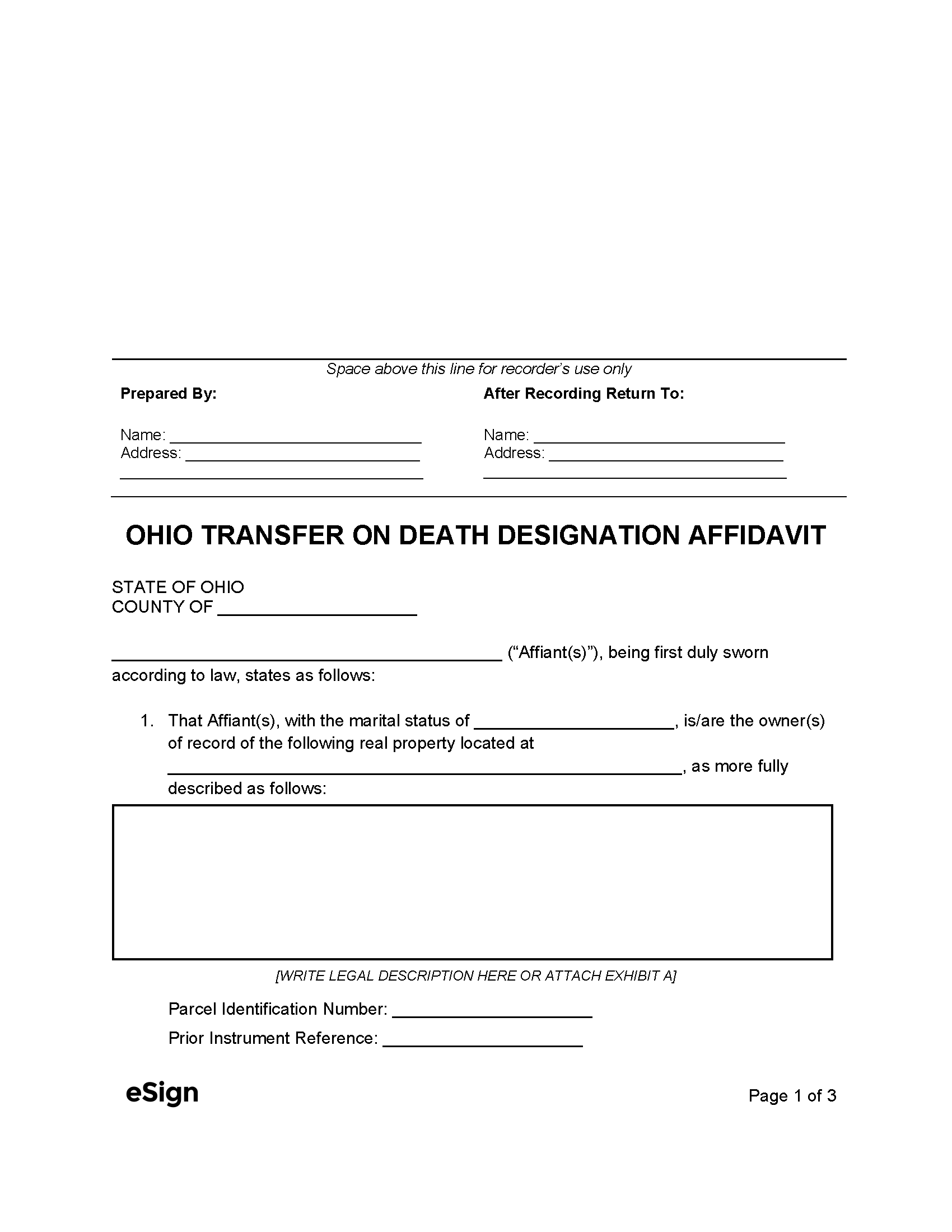

Transfer on Death Affidavit – Automatically conveys property to a beneficiary when the grantor dies. Transfer on Death Affidavit – Automatically conveys property to a beneficiary when the grantor dies.

|

Formatting

Paper – 8.5″ x 11″ minimum, 8.5″ by 14″ maximum

Margins – 3″ space on top of the first page, 1.5″ space on top of remaining pages, 1″ space on all sides and bottoms

Font – Black or blue ink, 10-point font[1]

Recording

Signing Requirements – A notary public, clerk, or other official must notarize the grantor’s signature.[2] If married, the grantor’s spouse must sign to waive their dower rights.[3]

Where to Record – Once a deed is signed and notarized, it can be recorded with the County Recorder’s office in the county where the property is situated.[4]

Cost – $34 for the first two pages, $8 for each additional page (at the time of this writing)[5]

Additional Forms

The following documents are to be filed with the County Auditor:

- Real Property Conveyance Fee Statement of Value (DTE 100) – Used to assess the property’s value and calculate the conveyance fee.[6]

- Statement of Reason for Exemption from Real Property Conveyance Fee (DTE 100EX) – If the transfer qualifies for a conveyance fee exemption, this form must be filed in place of Form DTE 100.

- Statement of Conveyance Homestead Property (DTE 101) – Required if the grantor has received or will receive a homestead exemption.