By Type (8)

Deed of Trust – A deed where a trustee retains an owner’s property title until their home loan is repaid in full. Deed of Trust – A deed where a trustee retains an owner’s property title until their home loan is repaid in full.

|

General Warranty Deed – States the grantor has the right to transfer and offers full protection against title encumbrances. General Warranty Deed – States the grantor has the right to transfer and offers full protection against title encumbrances.

|

Gift Deed – Used to transfer real estate without an exchange of payment between the grantor and the grantee. Gift Deed – Used to transfer real estate without an exchange of payment between the grantor and the grantee.

|

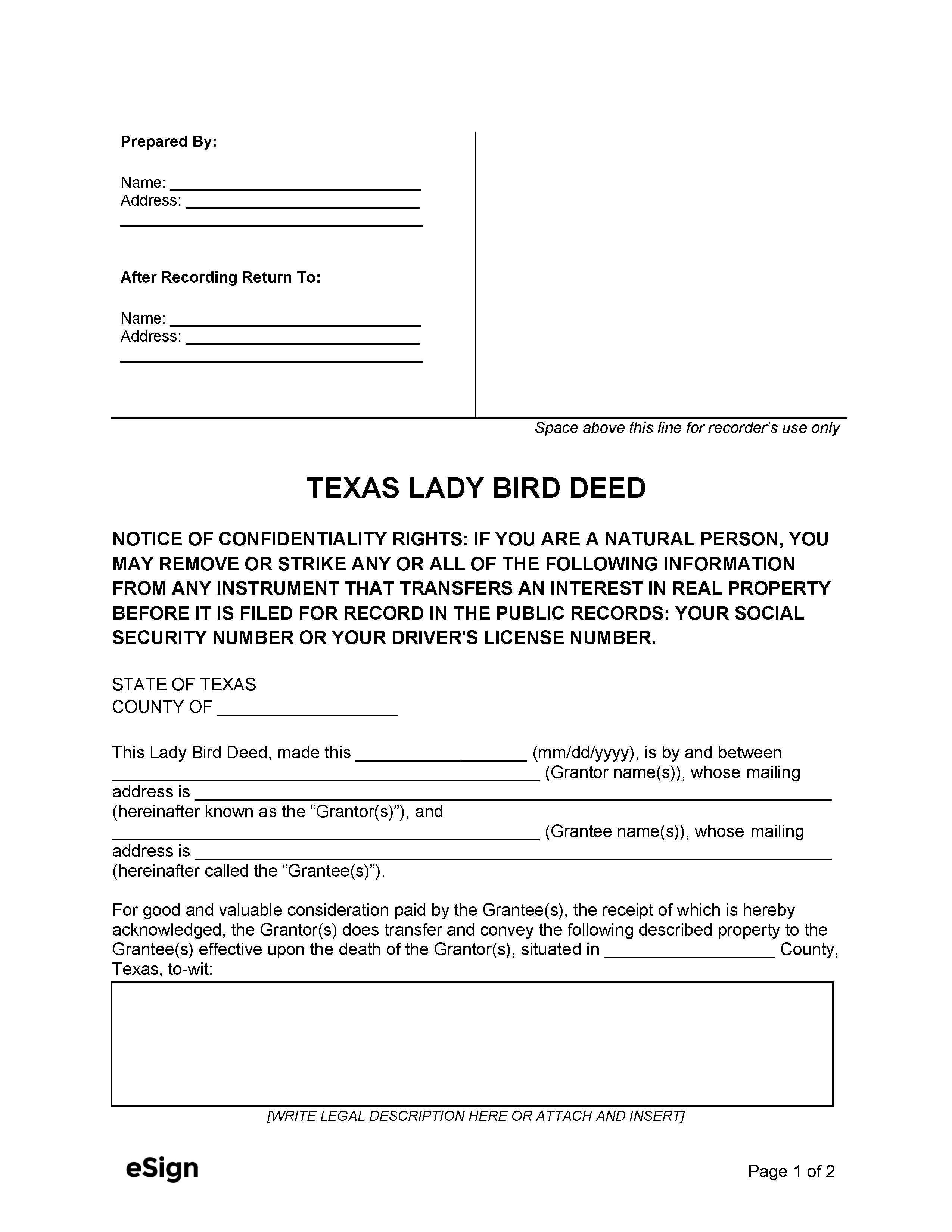

Lady Bird Deed – Allows property to pass to beneficiaries upon the grantor’s death without going through probate. Lady Bird Deed – Allows property to pass to beneficiaries upon the grantor’s death without going through probate.

|

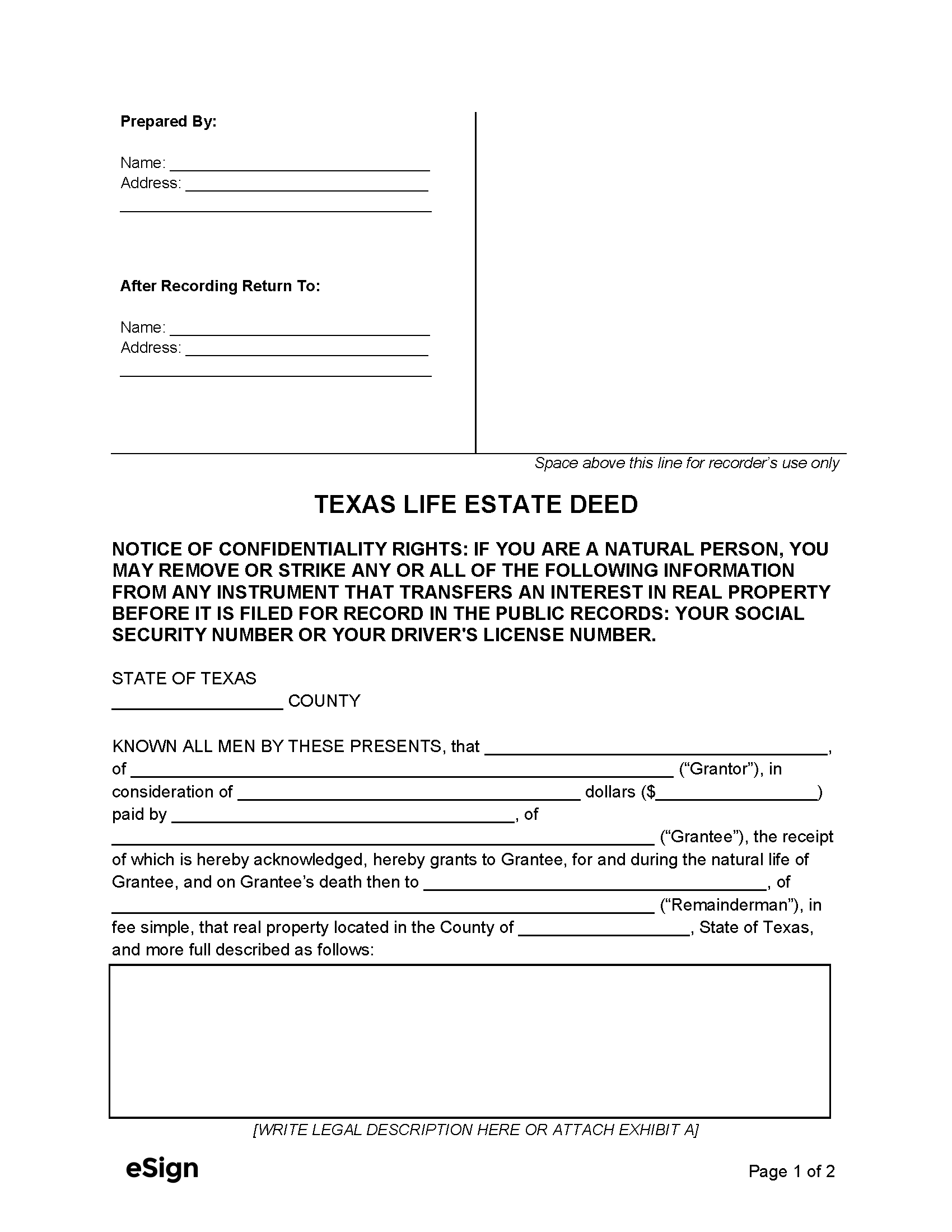

Life Estate Deed – Grants someone lifetime use of property, with ownership passing to another party automatically upon their death. Life Estate Deed – Grants someone lifetime use of property, with ownership passing to another party automatically upon their death.

|

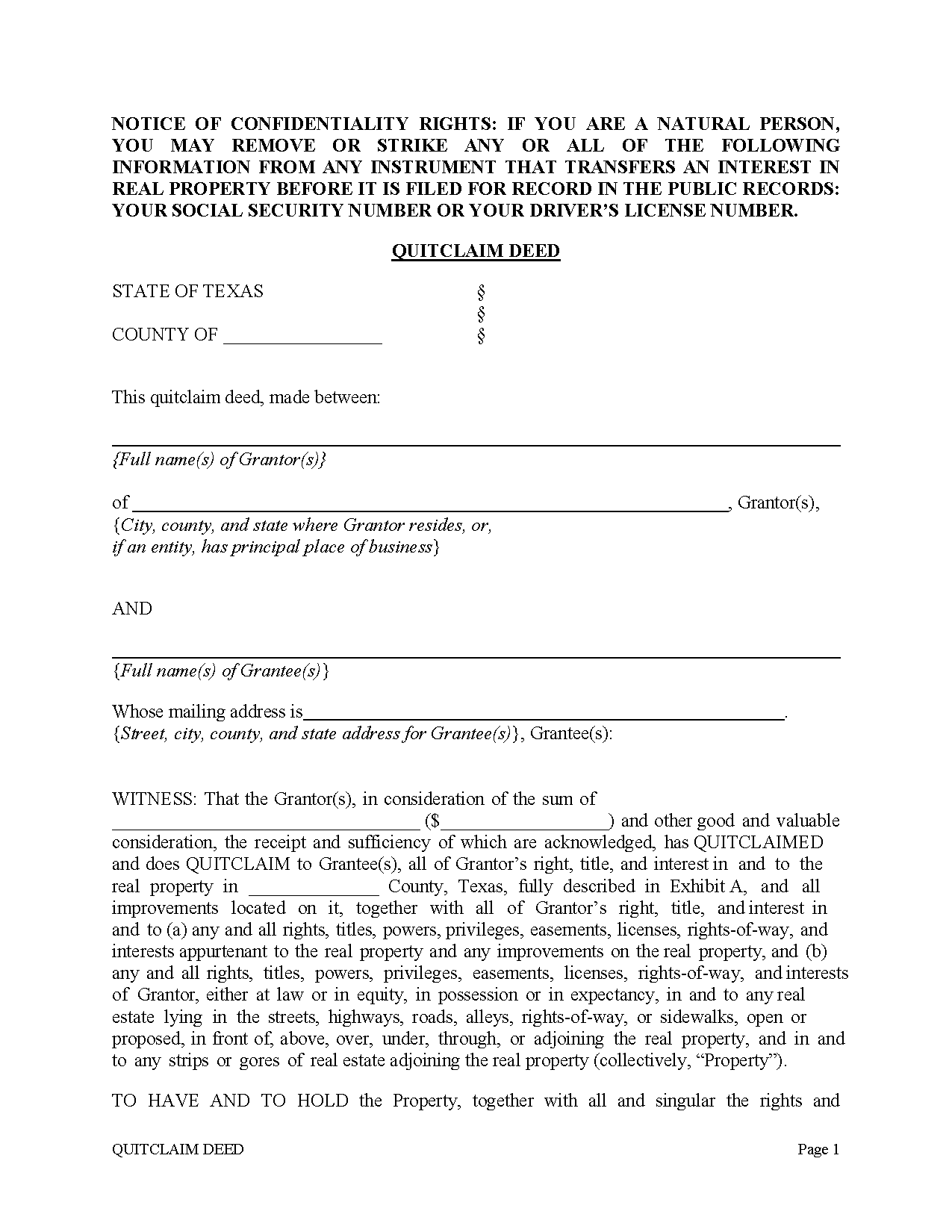

Quit Claim Deed – Offers no warranties against title encumbrances and does not state the grantor’s right to transfer. Quit Claim Deed – Offers no warranties against title encumbrances and does not state the grantor’s right to transfer.

Download: PDF |

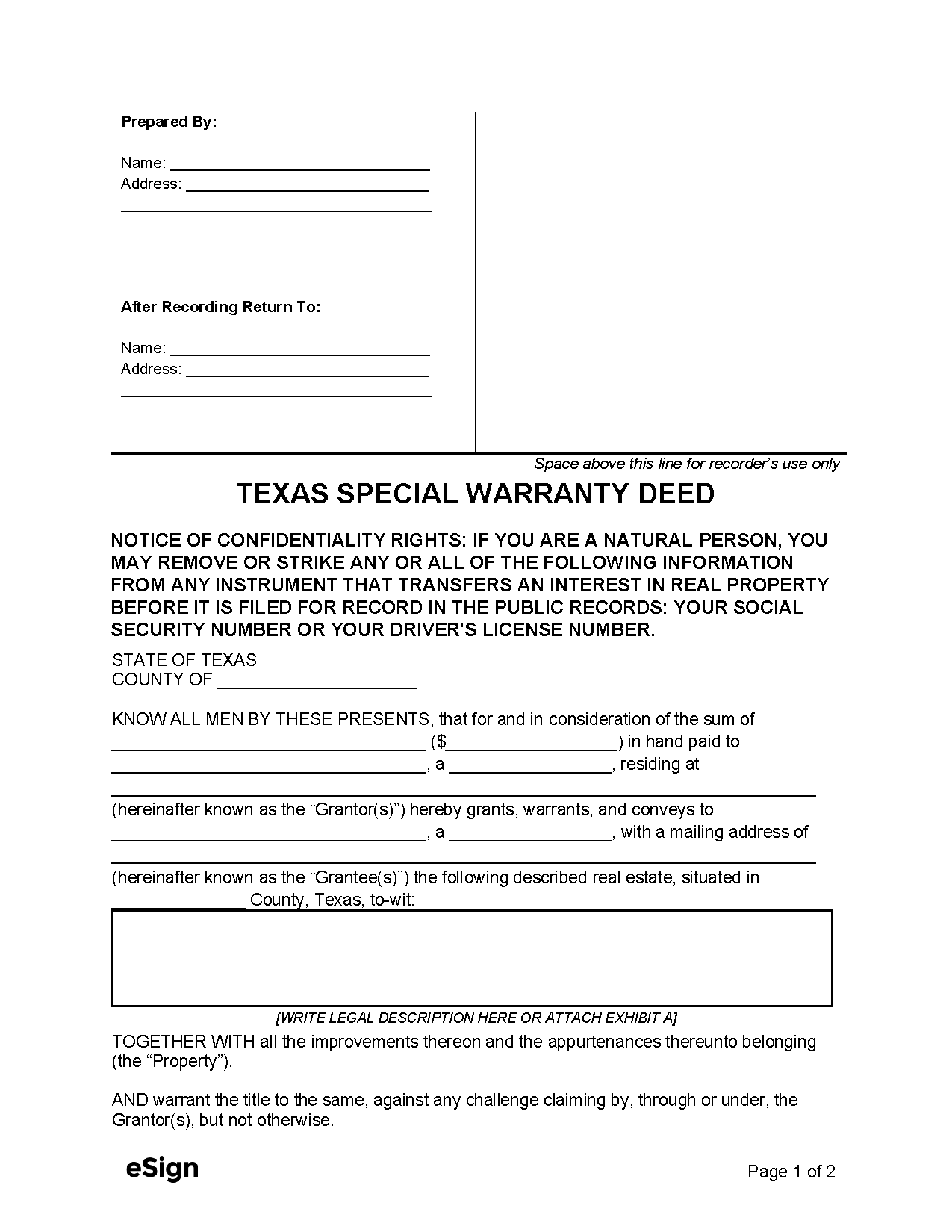

Special Warranty Deed – Protects the title against encumbrances occurring after the current grantor took possession, but not before. Special Warranty Deed – Protects the title against encumbrances occurring after the current grantor took possession, but not before.

|

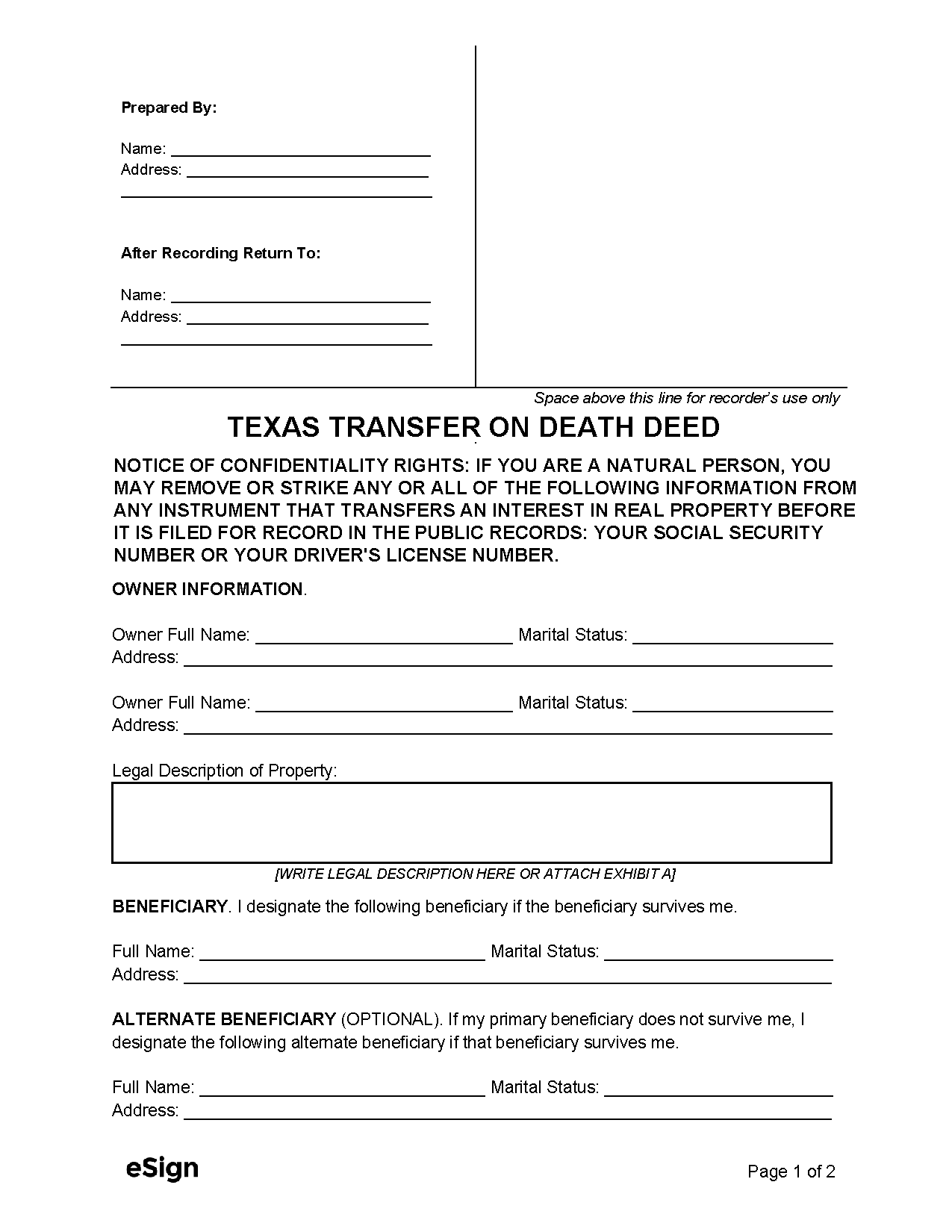

Transfer on Death Deed – Allows a beneficiary to receive title upon the grantor’s death without involvement from the probate court. Transfer on Death Deed – Allows a beneficiary to receive title upon the grantor’s death without involvement from the probate court.

|

Formatting

Paper – Maximum size of 8.5″ x 14″

Font – At least 8 points[1]

Recording

Signing Requirements – Either a notary public or two witnesses must be present when the grantor provides their signature.[2]

Where to Record – Completed deeds are recorded at the Clerk’s Office in the county where the property is located.[3]

Cost – $25 for the first page, $4 for each additional page (as of this writing)[4]