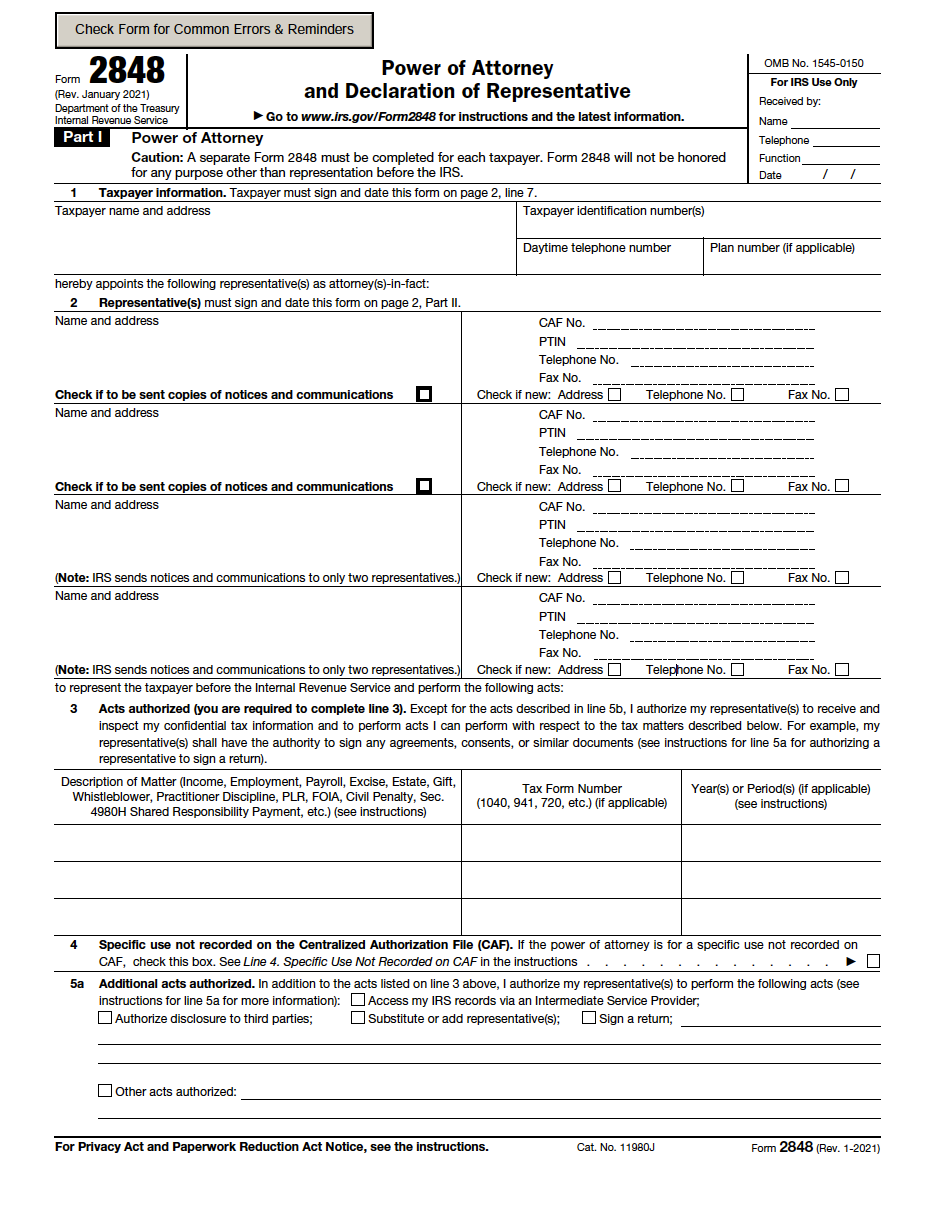

Document Features

- Representatives – Authorizes one or more representatives to act on behalf of the taxpayer before the IRS.

- Confidential Information – Grants the representative the power to access and handle the taxpayer’s confidential tax information.

- Specific Matters – Specifies which tax matters, forms, and years the taxpayer wishes their representative to oversee.

- Additional Acts – Outlines which additional acts the taxpayer does and does not authorize their representative to perform.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What a Tax Power of Attorney Authorizes

Depending on what powers the principal selects on the POA form, the agent may be authorized to:

- Inspect and receive sensitive tax documents and information

- Access electronic IRS records

- Authorize disclosure of tax information to third parties

- Substitute or add representatives

- Sign agreements, waivers, tax returns, and other documents

- Perform all acts the principal can perform

Supplemental Forms

- Form 2848 Instructions – Detailed instructions on how to complete the Power of Attorney and Declaration of Representative.

- Form 8821 (Tax Information Authorization) – Authorizes a person to inspect someone’s confidential tax information but does not grant powers of representation like Form 2848.

- Form 8821 Instructions – Instructions on how to complete the Tax Information Authorization Form 8821.

How to Use a Tax Power of Attorney

Step 1 – Select the Agent

- Certified public accountant (CPA)

- Tax attorney

- Enrolled agent

- Family member

- Close friend

Step 2 – Complete the Form

When authorizing a representative to complete state taxes, the principal must select the appropriate state form and complete and sign the document. The representative may also have to sign. In some states, notarization is required.

Step 3 – Send to Appropriate Address

Federal Taxes

If the principal lives in AL, AR, CT, DE, DC, FL, GA, IL, IN, KY, LA, ME, MD, MA, MI, MS, NH, NJ, NY, NC, OH, PA, RI, SC, TN, VT, VA, or WV, Form 2848 should be sent to the following address:

Internal Revenue Service

5333 Getwell Road, Stop 8423

Memphis, TN, 38118

If the principal lives in AK, AZ, CA, CO, HI, ID, IA, KS, MN, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WI, or WY, the form should be sent to the following address:

Internal Revenue Service

1973 Rulon White Blvd., MS 6737

Ogden, UT, 84201

Completed documents should be sent to the address as instructed on the form.