Summary

- A form used for “going around” the standard probate process.

- The estate must be under a certain value ($).

- Filed after the state-mandated waiting period has passed.

- Often used when there was no will.

- Cannot be used for transferring real property in most states.

- Must be filed upon completion.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Small Estate Affidavit?

A small estate affidavit is a sworn legal statement signed before a notary that is used to divide a decedent’s assets when the estate is small enough. Once filed with the county clerk, it can be presented to financial institutions and other parties in possession of the decedent’s belongings to transfer ownership.

The name of this document can vary from state to state; for example, it is sometimes referred to as a “petition for summary distribution” or “affidavit for collection of personal property.”

Who Can File

Generally speaking, only a person with a close relationship to the deceased can file, such as a spouse or child. If there’s a will, the named executor will be responsible for ensuring the estate gets distributed properly. If the decedent left a will, the named executor is responsible for distributing the remaining assets (after settling any dues).

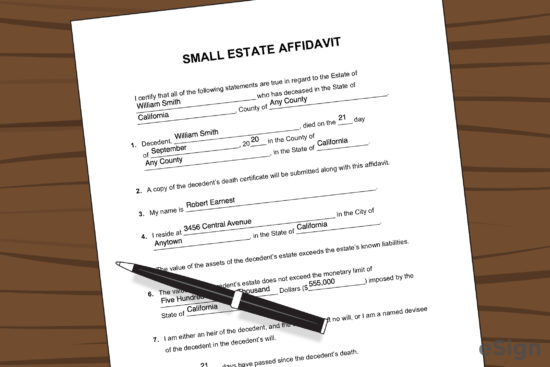

Sample

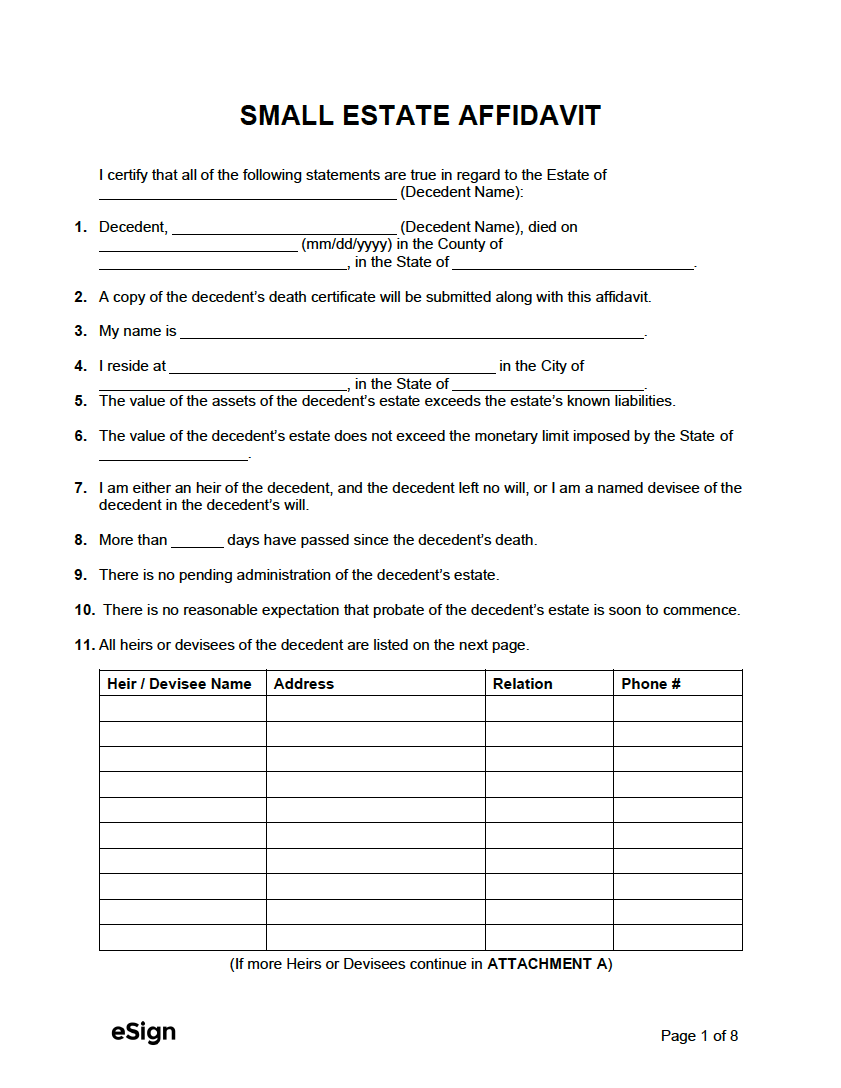

SMALL ESTATE AFFIDAVIT

I certify that all of the following statements are true regarding the Estate of [DECEDENT NAME]:

1. THE DECEDENT. Decedent, [DECEDENT NAME], died on [MM/DD/YYYY] in the County of [COUNTY], in the State of [STATE]. A copy of the decedent’s death certificate will be submitted along with this affidavit.

2. THE AFFIANT. My name is [AFFIANT NAME]. I reside at [AFFIANT ADDRESS]. I am either an heir of the decedent, and the decedent left no will, or I am a named devisee of the decedent in the decedent’s will.

3. ESTATE VALUE. The value of the assets of the decedent’s estate exceeds the estate’s known liabilities. The value of the decedent’s estate does not exceed the monetary limit imposed by the State of [DECEDENT STATE].

4. DAYS SINCE DEATH. More than [#] days have passed since the decedent’s death. There is no pending administration of the decedent’s estate. There is no reasonable expectation that probate of the decedent’s estate will soon commence.

5. HEIRS. All heirs or devisees will be notified of this affidavit within 30 days of filing. The heirs or devisees of the decedent are listed as follows:

Heir: [HEIR NAME]

Address: [HEIR ADDRESS]

Relation: [RELATION TO DECEDENT]

Phone: [PHONE NUMBER]

Heir: [HEIR NAME]

Address: [HEIR ADDRESS]

Relation: [RELATION TO DECEDENT]

Phone: [PHONE NUMBER]

(Add additional Heirs or Devisees as necessary)

6. ASSETS. All assets of the decedent’s estate (whether real property or personal property, whether community property or separate property) and the value of such assets are listed below:

DESCRIPTION VALUE

[DESCRIPTION] [VALUE ($)]

[DESCRIPTION] [VALUE ($)]

[DESCRIPTION] [VALUE ($)]

(Add additional Assets as necessary)

7. LIABILITIES. All liabilities and debts of the decedent’s estate and what the estate owes each creditor are listed below:

DESCRIPTION VALUE

[DESCRIPTION] [VALUE ($)]

[DESCRIPTION] [VALUE ($)]

[DESCRIPTION] [VALUE ($)]

(Add additional Liabilities or Debts as necessary)

8. PROPERTY TO BE TRANSFERRED. The following heirs or devisees are entitled to the following property:

HEIR NAME PROPERTY

[FULL NAME] [PROPERTY DESCRIPTION]

[FULL NAME] [PROPERTY DESCRIPTION]

[FULL NAME] [PROPERTY DESCRIPTION]

(Add additional Heirs or Devisees as necessary)

9. STATE LAW. This document is governed under the laws in the State of [STATE NAME].

10. EXECUTION.

Affiant (Preparer) Signature: _________________________ Date: [MM/DD/YYYY]

Subscribed and sworn to before me on [MM/DD/YYYY], [COUNTY AND STATE].

My commission expires: [MM/DD/YYYY] Signature: _________________________

Notary public, [COUNTY AND STATE (WHERE COMMISSIONED)].

How to Use a Small Estate Affidavit

Step 1 – File the Will (if applicable)

If the decedent died with a will, it will need to be filed in the courthouse of the county in which the person lived. It is legally required that the will be filed within the grace period set by state law.

Step 2 – Calculate the Estate Value

The net estate value is calculated by subtracting the decedent’s liabilities from the value of their assets. Assets include real estate, stocks, mortgages, life insurance, and annuities, among other items. Liabilities can include funeral expenses, debts, mortgages, and liens.

The values of each item must be reported on the affidavit; as long as the total sum within state requirements, the affidavit can be used.

Step 3 – Complete the Affidavit

The small estate affidavit must be completed by the decedent’s personal representative or executor. If there is no named personal representative or executor, it may be completed by an heir to the estate.

Step 4 – Contact Heirs

The person preparing the small estate affidavit should contact each beneficiary named in the will by certified mail. If the decedent died without a will, the person preparing the form should get in touch with the heirs in accordance with the state’s intestate succession laws. The order of priority is usually:

- Spouses & children

- Grandchildren

- Parents & siblings

- Aunts, uncles, nieces, nephews, & cousins

Step 5 – Attach Required Forms

Step 6 – File Forms and Collect Possessions

The completed affidavit must be filed with the court with jurisdiction over the estate. Once filed and accepted, the affidavit can be presented to parties that are in possession of the decedent’s property to claim those assets.

Small Estate Requirements: By State

The information in the table below is accurate as of November 2024.

View State Requirements |

||||

| STATE | MAX ESTATE VALUE ($) | MIN. REQUIRED WAIT TIME | STATUTE | |

| Alabama | $36,030 (adjusted annually by the State Finance Director) | N/A | § 43-2-692 | |

| Alaska | $50k in personal property; $100k in vehicles | 30 days | § 13.16.680 | |

| Arizona | $75k in personal property; $100k in real property | 30 days | 6 months | § 14-3971 | |

| Arkansas | $100,000 | 45 days | § 28-41-101 | |

| California | $184,500 in real and personal property; or $61,500 in real property only | 40 days | 6 months | §§ 13100, 13200(h)(2), 890(c) | |

| Colorado | $82,000 | 10 days | § 15-12-1201 | |

| Connecticut | $40,000 | N/A | § 45a-273 | |

| Delaware | $30,000 | 30 days | § 2306 | |

| Florida | $75,000 | N/A | § 735.201 | |

| Georgia | N/A | N/A | § 53-2-40 | |

| Hawaii | $100,000 | N/A | § 560:3-1201 | |

| Idaho | $100,000 | 30 days | § 15-3-1201 | |

| Illinois | $100,000 | N/A | § 755 ILCS 5/9-8 | |

| Indiana | $100,000 | 45 days | § 29-1-8-1 | |

| Iowa | $50,000 | 40 days | § 633.356(1) | |

| Kansas | $40,000 | N/A | § 59-1507b | |

| Kentucky | $30,000 | N/A | § 391.030 | |

| Louisiana | $125,000 | N/A | § 3421 | |

| Maine | $40,000 | 30 days | § 3-1201 | |

| Maryland | Spouse – $100k; Other heirs – $50k |

N/A | § 5601 | |

| Massachusetts | $25,000 | 30 days | § 3-1201 | |

| Michigan | $50,000 | 28 days | § 700.3983, § 700.1210 | |

| Minnesota | $75,000 | 30 days | § 524.3-1201 | |

| Mississippi | $75,000 | 30 days | § 91-7-322 | |

| Missouri | $40,000 | 30 days | § 473.097 | |

| Montana | $100,000 | 30 days | § 72-3-1101 | |

| Nebraska | $100,000 | 30 days | § 30-24,129 | |

| Nevada | Spouse – $100k; Other heirs – $25k |

40 days | § 146.080 | |

| New Hampshire | N/A | N/A | § 553:32 | |

| New Jersey | Spouse – $50k; Other heirs – $20k |

N/A | § 3B:10-3 & § 3B:10-4 | |

| New Mexico | $50,000 | 30 days | § 45-3-1201 | |

| New York | $50,000 | N/A | § 1301 | |

| North Carolina | $20,000 | 30 days | § 28A-25-1 | |

| North Dakota | $50,000 | 30 days | § 30.1-23-01 | |

| Ohio | Spouse – $100k; Other heirs – $35k |

N/A | § 2113.03 | |

| Oklahoma | $50,000 | 10 days | § 58-393 | |

| Oregon | Real property – $200k; Personal property – $75k |

30 days | §§ 114.510, 114.515 | |

| Pennsylvania | $50,000 | N/A | § 3102 | |

| Rhode Island | $15,000 | 30 days | § 33-24-1 | |

| South Carolina | $45,000 | 30 days | § 62-3-1201 | |

| South Dakota | $100,000 | 30 days | § 29A-3-1201 | |

| Tennessee | $50,000 | 45 days | § 30-4-102 & § 30-4-103 | |

| Texas | $75,000 | 30 days | § 205.001 | |

| Utah | $100,000 | 30 days | § 75-3-1201 | |

| Vermont | $45,000 | N/A | § 1901 | |

| Virginia | $50,000 | 60 days | § 64.2-601 | |

| Washington | $100,000 | 40 days | § 11.62.010 | |

| West Virginia | $50k in personal property; $100k in real property |

30 days | 60 days | § 44-1A-2 | |

| Wisconsin | $50,000 | N/A | § 867.03 | |

| Wyoming | $200,000 | 30 days | § 2-1-201 | |