By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

By Type (12)

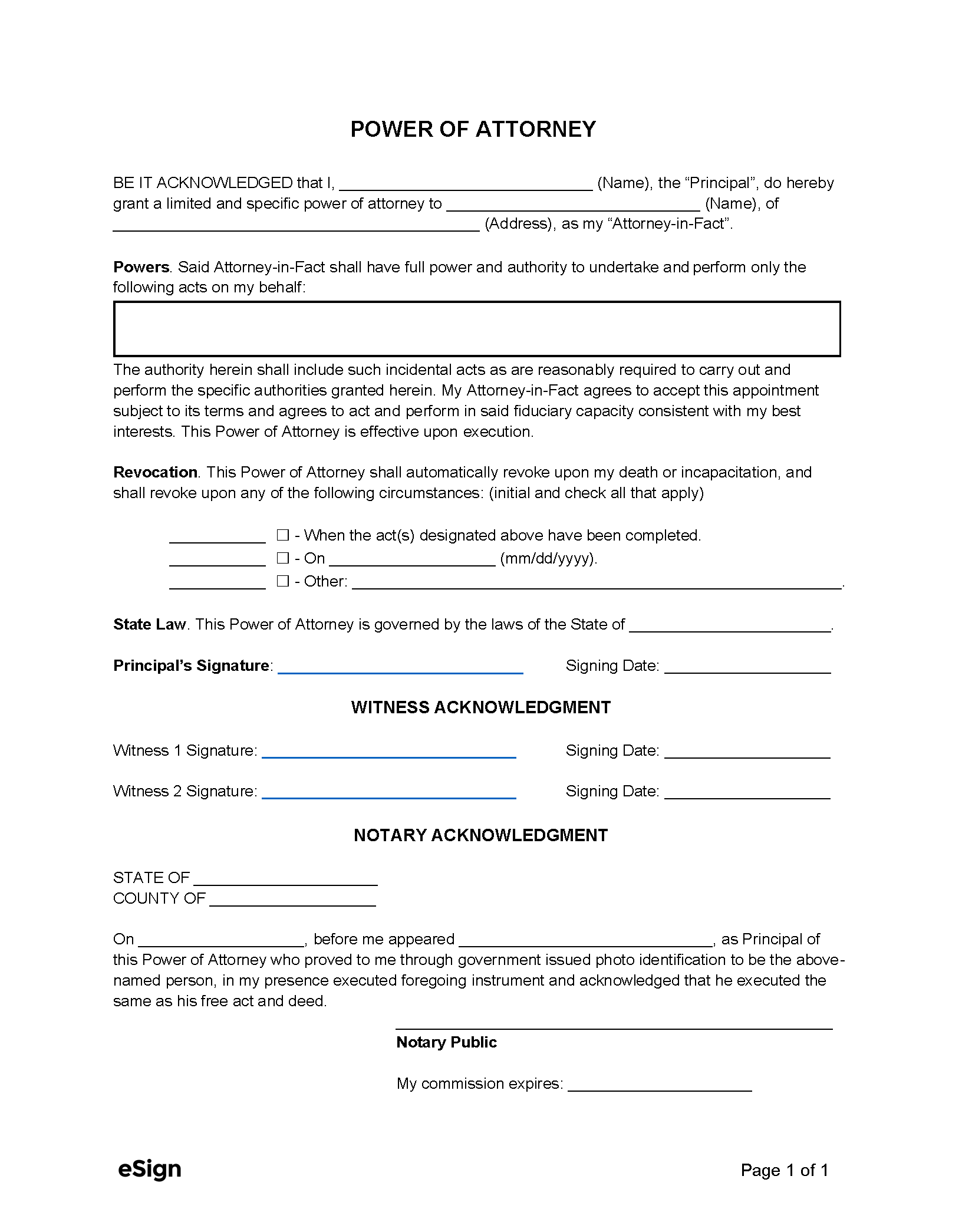

Simple (1 page) Power of Attorney – A condensed POA that’s typically used to authorize everyday tasks, such as cashing checks. Simple (1 page) Power of Attorney – A condensed POA that’s typically used to authorize everyday tasks, such as cashing checks.

|

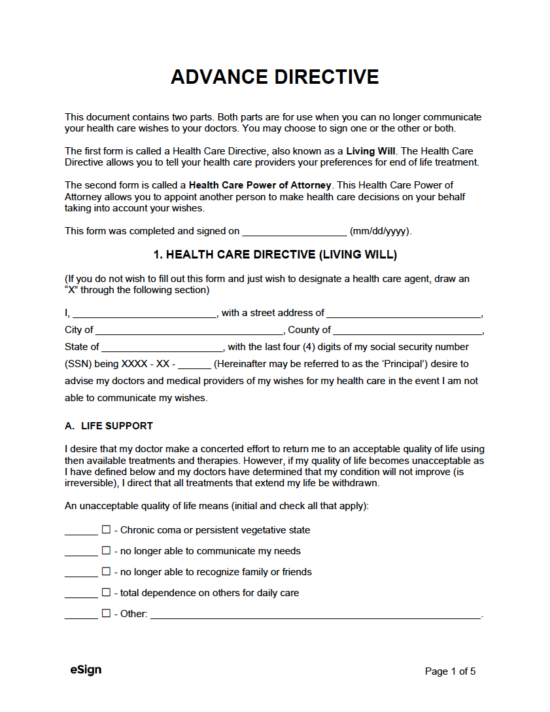

Advance Directive – Combines a living will and medical power of attorney into one document. Advance Directive – Combines a living will and medical power of attorney into one document.

|

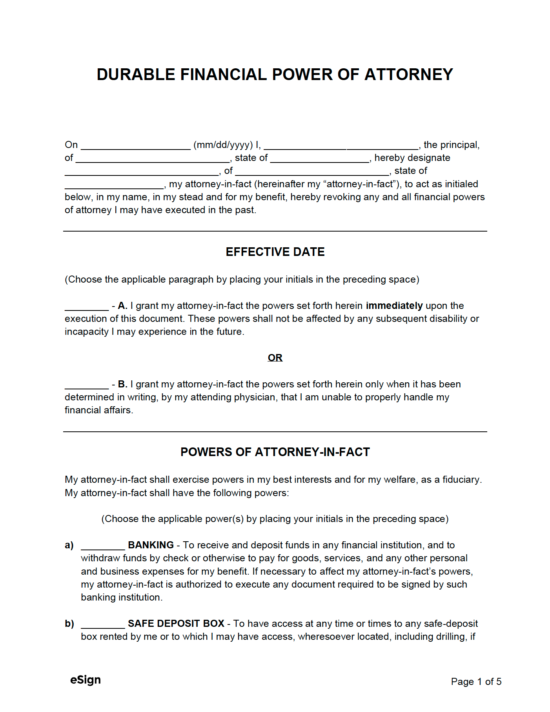

Durable Power of Attorney – Designates an agent to make financial decisions and stays in effect if the principal becomes incapacitated. Durable Power of Attorney – Designates an agent to make financial decisions and stays in effect if the principal becomes incapacitated.

|

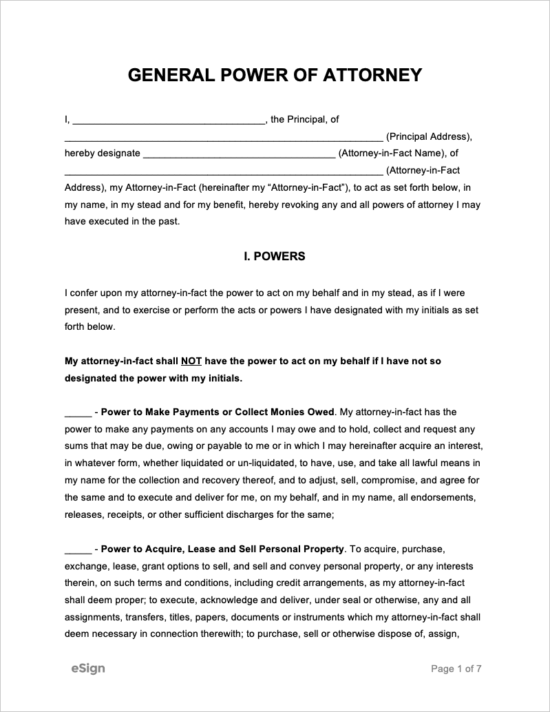

General Power of Attorney – Appoints an agent for financial matters, but becomes void if the principal loses capacity. General Power of Attorney – Appoints an agent for financial matters, but becomes void if the principal loses capacity.

|

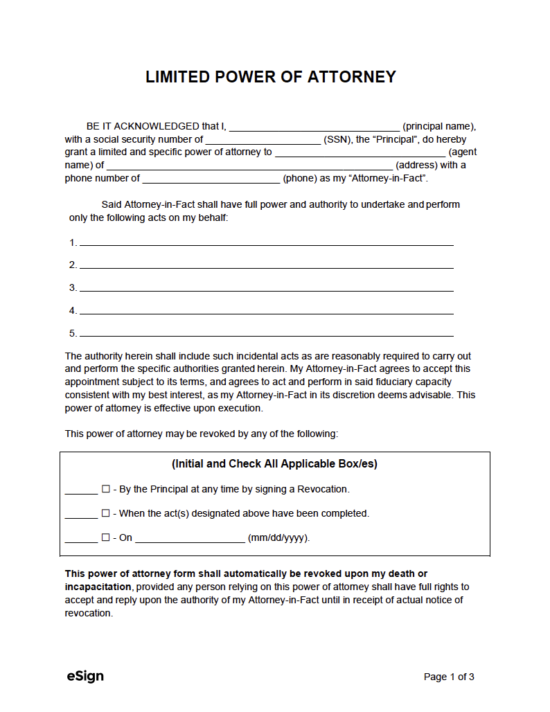

Limited Power of Attorney – Used for specific tasks and usually terminates once they’ve been completed. Limited Power of Attorney – Used for specific tasks and usually terminates once they’ve been completed.

|

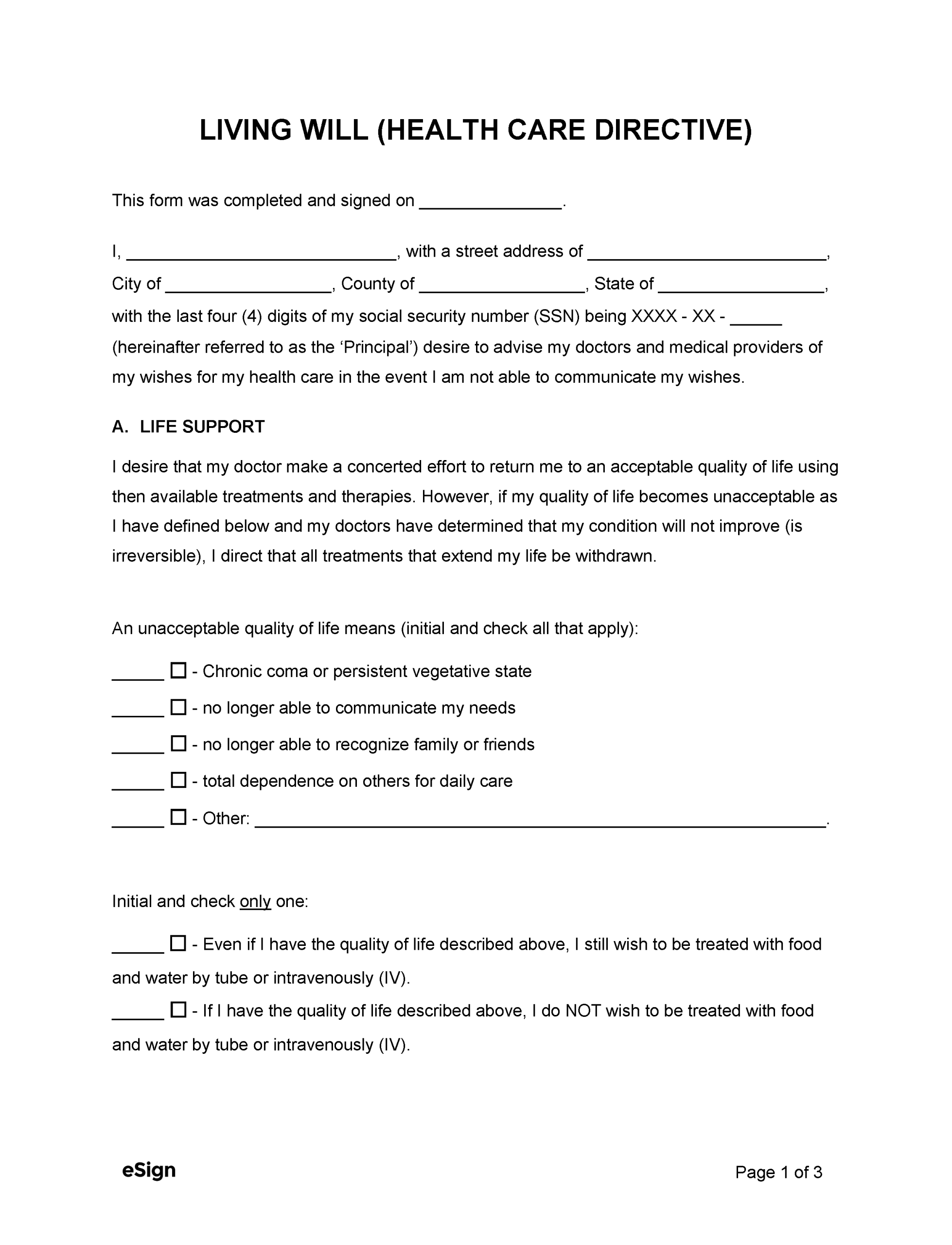

Living Will – States a person’s preferences for end-of-life medical care, including whether to receive life support or artificial nutrition. Living Will – States a person’s preferences for end-of-life medical care, including whether to receive life support or artificial nutrition.

|

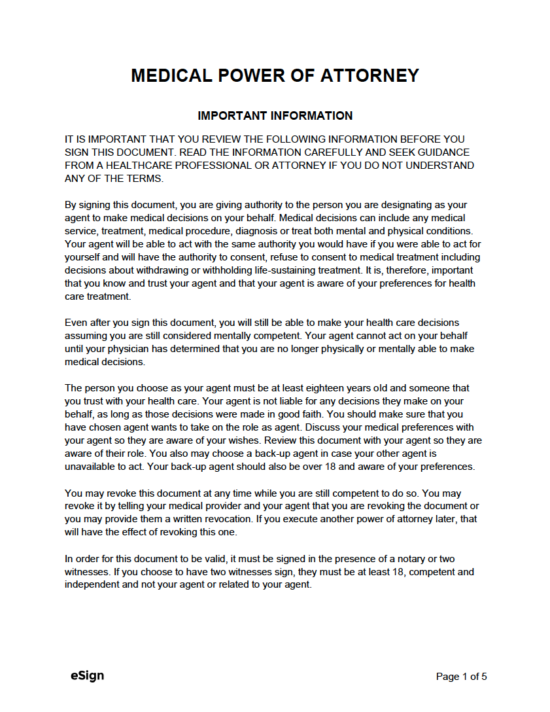

Medical Power of Attorney – Gives an agent the authority to make medical decisions if the principal becomes incapacitated. Medical Power of Attorney – Gives an agent the authority to make medical decisions if the principal becomes incapacitated.

|

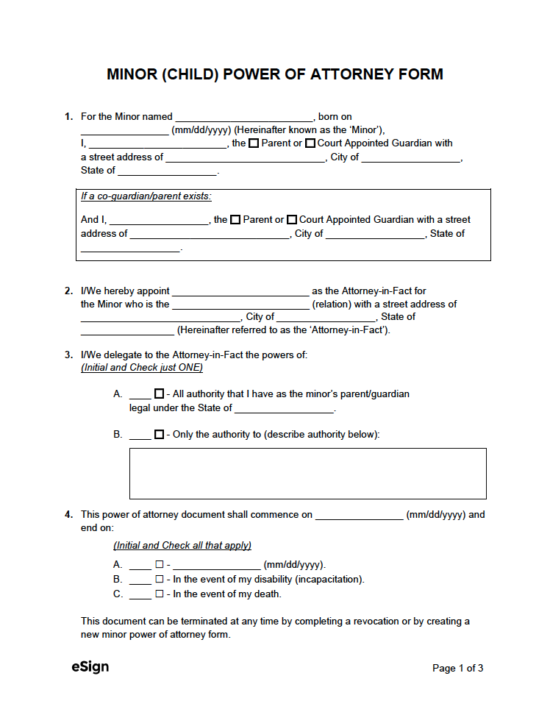

Minor (Child) Power of Attorney – Enables a parent or guardian to authorize someone else to make decisions for their child. Minor (Child) Power of Attorney – Enables a parent or guardian to authorize someone else to make decisions for their child.

|

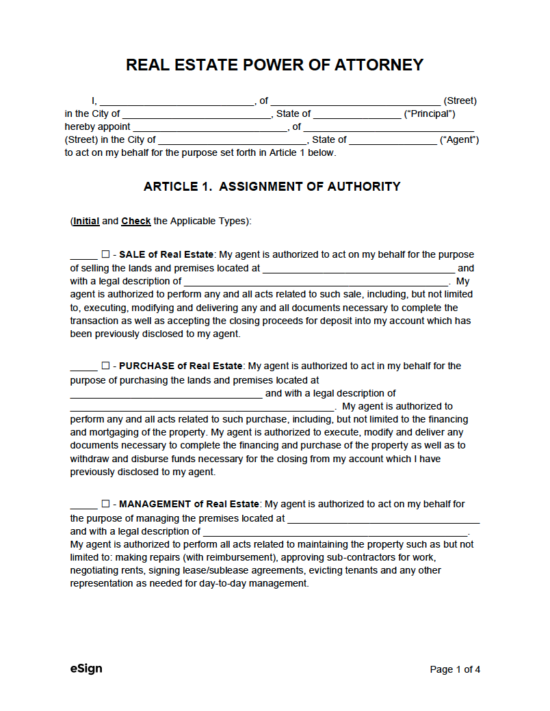

Real Estate Power of Attorney – Names an attorney-in-fact to represent the principal in real estate transactions. Real Estate Power of Attorney – Names an attorney-in-fact to represent the principal in real estate transactions.

|

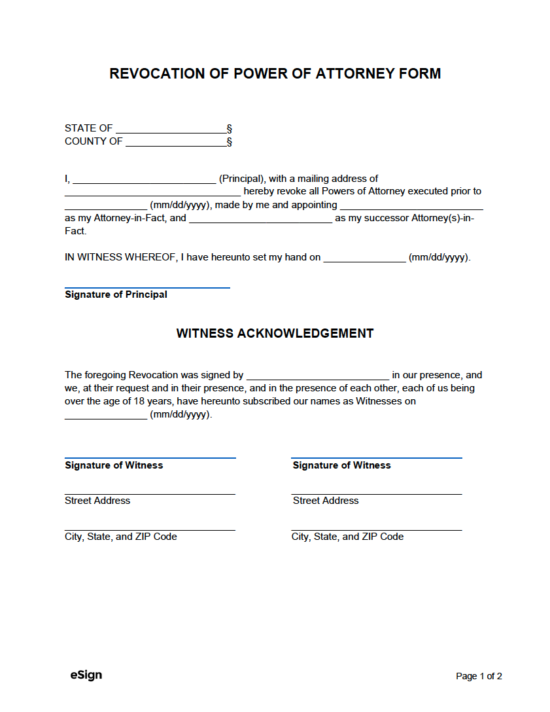

Revocation of Power of Attorney – Terminates an existing power of attorney form. Revocation of Power of Attorney – Terminates an existing power of attorney form.

|

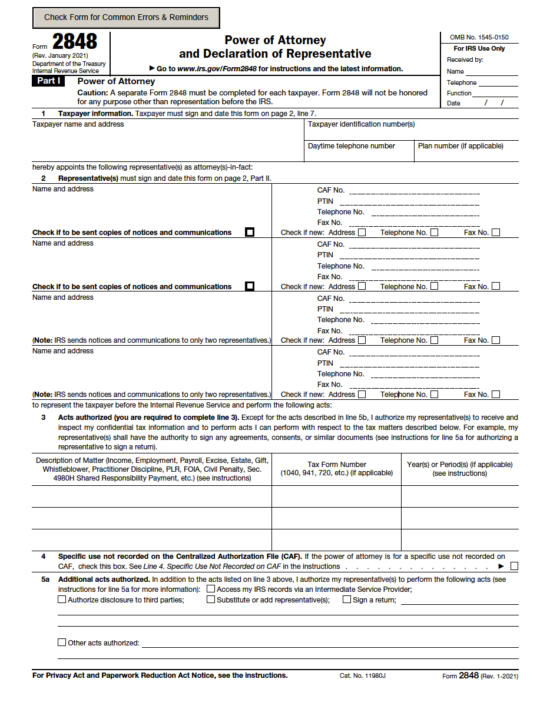

Tax Power of Attorney (2848) – Required by most tax accountants and lawyers when filing taxes on their client’s behalf. Tax Power of Attorney (2848) – Required by most tax accountants and lawyers when filing taxes on their client’s behalf.

Download: PDF

|

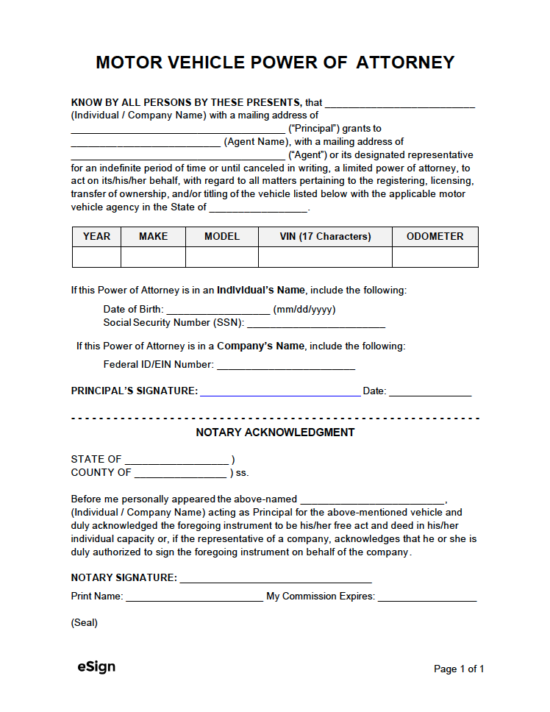

Vehicle (DMV) Power of Attorney – Grants an agent permission to handle motor vehicle transactions (registration, selling, etc.). Vehicle (DMV) Power of Attorney – Grants an agent permission to handle motor vehicle transactions (registration, selling, etc.).

|

How Power of Attorney Works

Power of attorney is granted when the principal drafts a form naming another person (agent or attorney-in-fact) to represent them, usually in medical or financial matters.

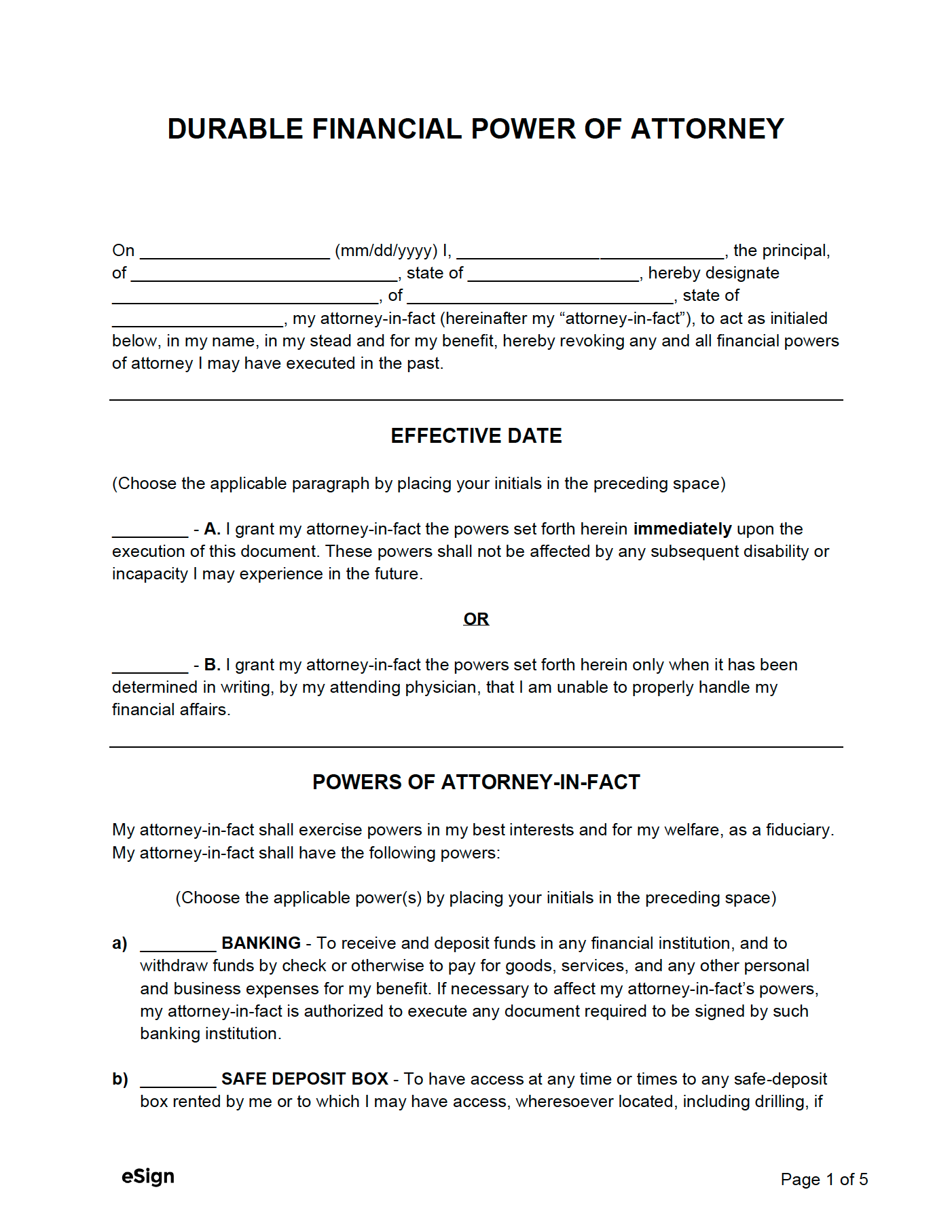

The specific type of POA used typically depends on two factors:

- The kinds of transactions and decisions the principal wants the agent to handle.

- Whether the appointment should continue if the principal loses the physical or mental ability to make decisions, a condition known as “incapacitation.”

The principal can, at any time, draft a revocation form to end the power of attorney and terminate the agent’s authority.

Durable vs Non-Durable Power of Attorney

Although both durable and non-durable powers of attorney authorize a financial agent to act on the principal’s behalf, there are key differences between the two:

Durable

- Authority remains effective if principal is incapacitated

- No need for court-appointed guardian

- Terminates upon death

Non-Durable

- Authority terminates upon incapacity or death

- Court-appointed conservator required

- Typically used for specific transactions or periods of time

Choosing the Right Power of Attorney

The type of power of attorney document chosen will depend on the needs of the principal:

How to Get a Power of Attorney

Step 1 – Select an Agent

An agent, also known as an “attorney-in-fact” or “proxy,” is the person the principal chooses to make financial or medical decisions on their behalf. A spouse, family member, close friend, or legal professional is a common choice.

Step 2 – Choose a Power of Attorney Form

Each power of attorney form grants the agent varying decision-making authority, so the principal must select one that aligns with their needs. They must also indicate in the form whether it is durable or non-durable and clearly define the agent’s scope of authority.

Step 3 – Complete the Power of Attorney Form

Once the powers are determined, the principal should meet with the agent to review expectations and complete the documents. The agent must understand the principal’s intentions and their responsibilities before accepting the role.

Note: It is generally recommended to use a power of attorney form that follows the statutory language of the principal’s state of residence.

Step 4 – Sign the Document

Signing requirements vary by state and type of power of attorney. Standard procedures include notarization and two witness signatures. In some states, the principal’s family members, beneficiaries, or healthcare providers are prohibited from serving as witnesses.

Step 5 – Register and Use

Depending on the state, the principal may need to register the power of attorney with a government agency, especially in real estate matters.

When the agent completes an act as the principal’s attorney-in-fact, they must have a copy of the power of attorney available to prove their authority.

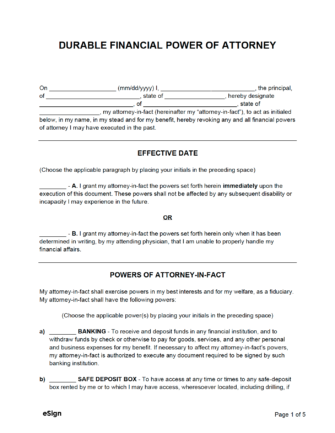

Sample

DURABLE FINANCIAL POWER OF ATTORNEY

I, [PRINCIPAL NAME], the Principal (“Principal”), of [PRINCIPAL ADDRESS], hereby designate [AGENT NAME], of [AGENT ADDRESS] as my Attorney-in-Fact, to act as set forth below, in my name, in my stead and for my benefit, hereby revoking any and all powers of attorney I may have executed in the past.

1. EFFECTIVE DATE. I grant my Attorney-in-Fact the powers set forth herein: (initial one)

[INITIALS] – Immediately upon the execution of this document. These powers shall not be affected by any subsequent disability or incapacity I may experience.

[INITIALS] – Only when it has been determined in writing, by my attending physician, that I cannot handle my financial affairs properly.

2. POWERS. I confer upon my Attorney-in-Fact the power to act on my behalf and in my stead, as if I were present, and to exercise or perform only the acts or powers I have designated with my initials as set forth below.

[INITIALS] – Power to Make Payments or Collect Monies Owed

[INITIALS] – Power to Acquire, Lease, and Sell Personal Property

[INITIALS] – Power to Acquire, Lease, and Sell Real Property

[INITIALS] – Banking Powers

[INITIALS] – Motor Vehicle Transactions

[INITIALS] – Tax Powers

[INITIALS] – Gift Making Powers

[INITIALS] – Lending and Borrowing

[INITIALS] – Other: [DESCRIBE OTHER POWERS].

3. AUTHORITY. Any party dealing with my Attorney-in-Fact may rely fully on the authority granted in this document and is not required to verify how proceeds are used or question the Attorney-in-Fact’s actions. Anyone acting in good faith based on this authority shall not be held liable to me or my estate. I ratify all lawful acts taken under this power, and my Attorney-in-Fact may seek court enforcement to ensure its full effect.

4. LIABILITY. My Attorney-in-Fact shall not incur any liability to me under this power except for a breach of fiduciary duty.

5. AMENDMENT AND REVOCATION. I can amend or revoke this power of attorney by writing to my Attorney-in-Fact. Any amendment or revocation is ineffective as to a third party until such third party has notice of such revocation or amendment.

6. STATE LAW. This power of attorney is governed by the laws of the State of [STATE].

IN WITNESS WHEREOF, I have executed this power of attorney on [DATE].

Principal Signature: _____________________________

ACCEPTANCE OF APPOINTMENT

I, [AGENT NAME], the Attorney-in-Fact named above, hereby accept appointment as attorney-in-fact in accordance with the foregoing instrument.

Attorney-in-Fact Signature: _____________________________

WITNESS

We, the witnesses, each do hereby declare in the presence of the Principal that the Principal signed and executed this instrument in the presence of each of us, that the Principal signed it willingly, that each of us hereby signs this power of attorney as witness at the request of the Principal and in the Principal’s presence, and that, to the best of our knowledge, the Principal is eighteen years of age or over, of sound mind, and under no constraint or undue influence.

Witness Signature: _____________________________

Print Name: [WITNESS NAME] Address: [WITNESS ADDRESS]

Witness Signature: _____________________________

Print Name: [WITNESS NAME] Address: [WITNESS ADDRESS]

STATE OF [NOTARY: STATE]

COUNTY OF [NOTARY: COUNTY]

On [DATE], before me appeared [PRINCIPAL NAME], as Principal of this power of attorney who proved to me through government-issued photo identification to be the above-named person, in my presence executed the foregoing instrument and acknowledged that he/she executed the same as his/her free act and deed.

Notary Signature: _____________________________

Print Name: [NOTARY NAME]

My Commission Expires: [DATE] (seal)