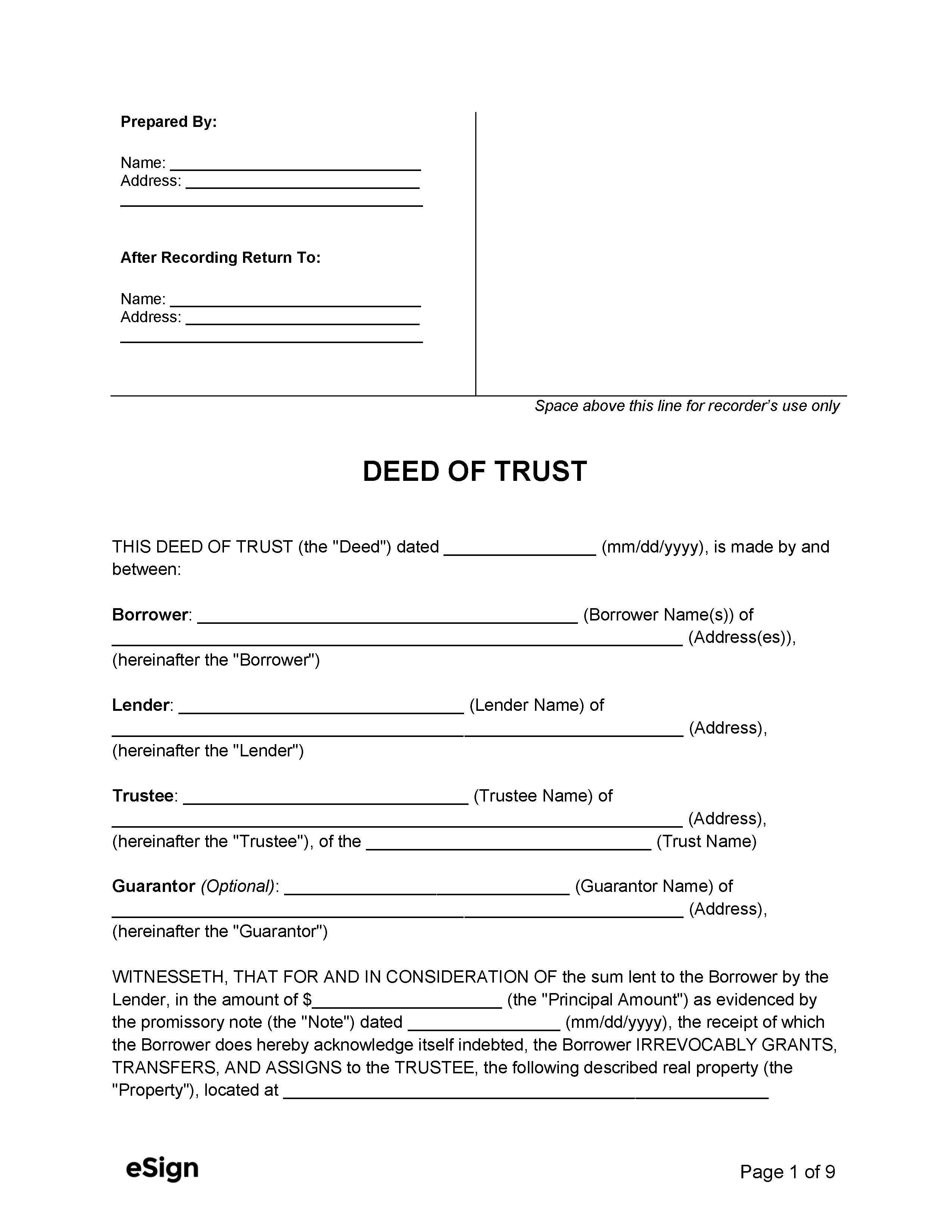

Parties Involved:

- Borrower (Grantor): A property owner who transfers their title to secure a loan.

- Lender: The individual or bank that provides the loan to the borrower.

- Trustee: A neutral third party who holds the property title until the loan is repaid.

By State (35)

Deeds of trust are currently permitted in 35 states:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Georgia

- Idaho

- Iowa

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- New York

- North Carolina

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How it Works

A deed of trust, or “trust deed,” secures a loan by temporarily transferring the legal title of the borrower’s real estate to a neutral trustee. If the borrower defaults, meaning they haven’t fulfilled their loan obligations, the trustee can sell the property to recover the lender’s balance.

During the loan term, the borrower retains equitable title and may continue using their property. Upon repayment, the trustee releases the legal title to the borrower.

Deed of Trust vs. Mortgage

While both deeds of trust and mortgages are used for securing loans, they have a few key differences:

- Foreclosure – Mortgages usually require lenders to file a lawsuit to foreclose. In contrast, a deed of trust allows for a quicker resolution, as many states permit non-judicial foreclosures (see “Power of Sale Clause” below for details).

- Number of parties – A mortgage involves only two parties: the borrower and the lender. A deed of trust adds a third party: the trustee.

Power of Sale Clause

Most deeds of trust include a “power of sale” clause that enables a non-judicial foreclosure if the borrower defaults. States that allow power of sale clauses generally permit deeds of trust, though some exceptions apply.

State-Specific Power of Sale Laws |

|||

| STATE | PERMITTED? | STATUTES | |

| Alabama | Yes | §§ 35-10-11 to 35-10-16, 35-10-3 | |

| Alaska | Yes | §§ 34.20.070 to 34.20.135 | |

| Arizona | Yes | §§ 33-801 to 33-821 | |

| Arkansas | Yes | §§ 18-50-101 to 18-50-117 | |

| California | Yes | §§ 2920 to 2944.10 | |

| Colorado | Yes | Article 38 and Article 39 | |

| Connecticut | No | N/A | |

| Delaware | No | N/A | |

| Florida | No | N/A | |

| Georgia | Yes | §§ 44-14-120 to 44-14-126 | |

| Hawaii | Yes | §§ 667-21 to 667-42 | |

| Idaho | Yes | §§ 45-1502 to 45-1515 | |

| Illinois | No | N/A | |

| Indiana | No | N/A | |

| Iowa | Yes | Ch. 654 | |

| Kansas | No | N/A | |

| Kentucky | No | N/A | |

| Louisiana | No | N/A | |

| Maine | Yes | § 6203-A | |

| Maryland | Yes | §§ 7-101 to 7-113 | |

| Massachusetts | Yes | §§ 244:1 to 244:41 | |

| Michigan | Yes | §§ 600.3201 to 600.3285 | |

| Minnesota | Yes | §§ 580.001 to 580.30 | |

| Mississippi | Yes | §§ 89-1-53 to § 89-1-59, 89-1-63 | |

| Missouri | Yes | §§ 443.005 to 443.454 | |

| Montana | Yes | §§ 71-1-201 to 71-1-235 | |

| Nebraska | Yes | §§ 76-1001 to 76-1018 | |

| Nevada | Yes | §§ 107.015 to 107.560 | |

| New Jersey | No | N/A | |

| New Mexico | Yes | §§ 48-10-1 to 48-10-21 | |

| New York | No | N/A | |

| North Carolina | Yes | §§ 45-4 to 45-107 | |

| North Dakota | No | N/A | |

| Ohio | No | N/A | |

| Oklahoma | Yes | §§ 46.40 to 46.49 | |

| Oregon | Yes | §§ 86.705 to 86.815 | |

| Pennsylvania | No | N/A | |

| Rhode Island | Yes | §§ 34-27-1 to 34-27-5 | |

| South Carolina | No | N/A | |

| South Dakota | Yes | §§ 21-48-1 to 21-4-26 | |

| Tennessee | Yes | §§ 35-5-101 to 35-5-116 | |

| Texas | Yes | §§ 51.0001 to 51.016 | |

| Utah | Yes | §§ 57-1-1 to 57-1-46 | |

| Vermont | Yes | §§ 4991 to 4970 | |

| Virginia | Yes | § 55.1-316 to § 55.1-345 | |

| Washington | Yes | §§ 61.24.005 to 61.24.190 | |

| West Virginia | Yes | §§ 38-1-1 to 38-1-17 | |

| Wisconsin | No | N/A | |

| Wyoming | Yes | Title 34, Ch. 3 & Ch. 4 | |