Summary

- Completed at the beginning of the client-contractor working arrangement.

- The contractor is responsible for taxes and insurance.

- If paid at least $600 in a year, the contractor must provide a completed W-9 form to the client.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

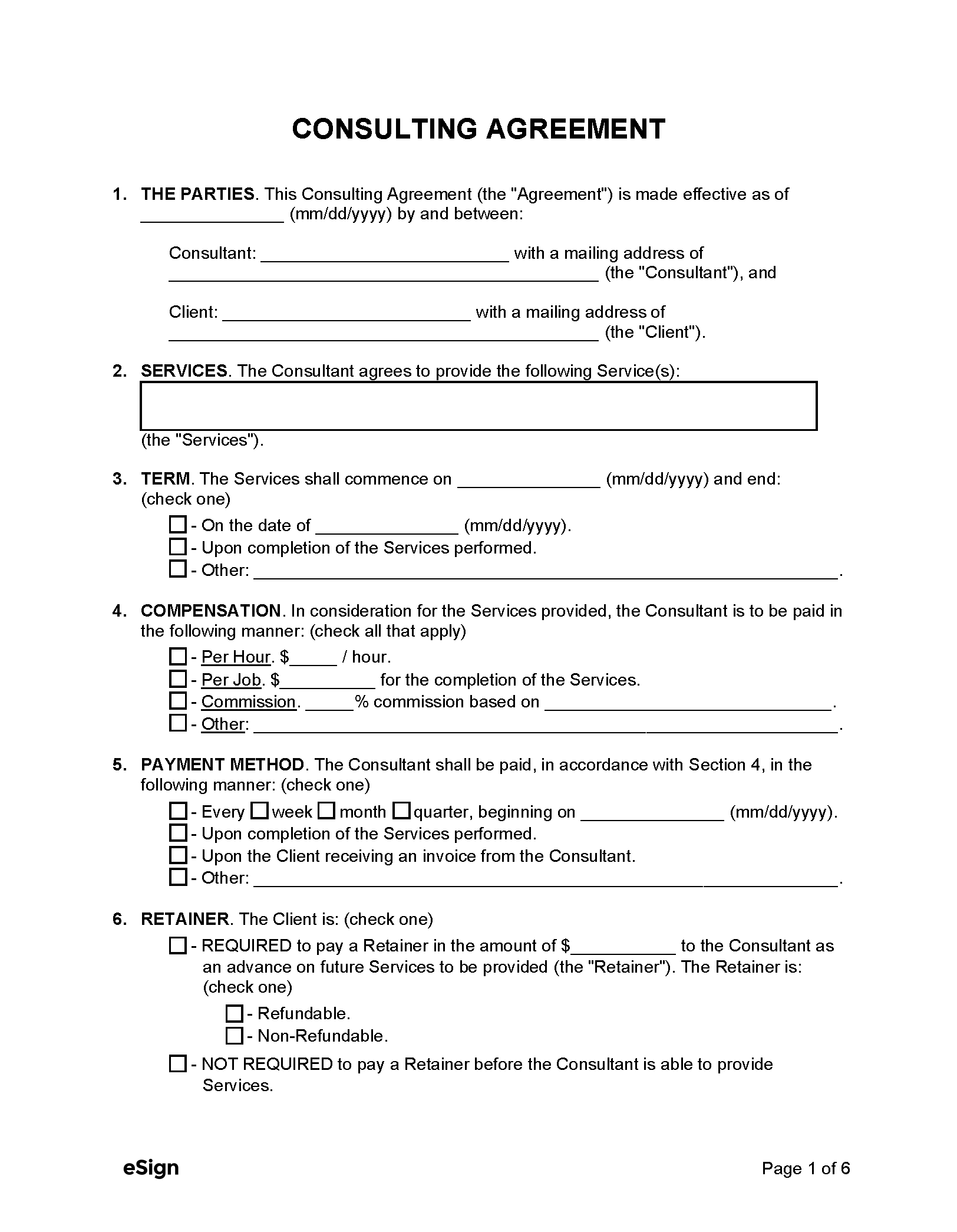

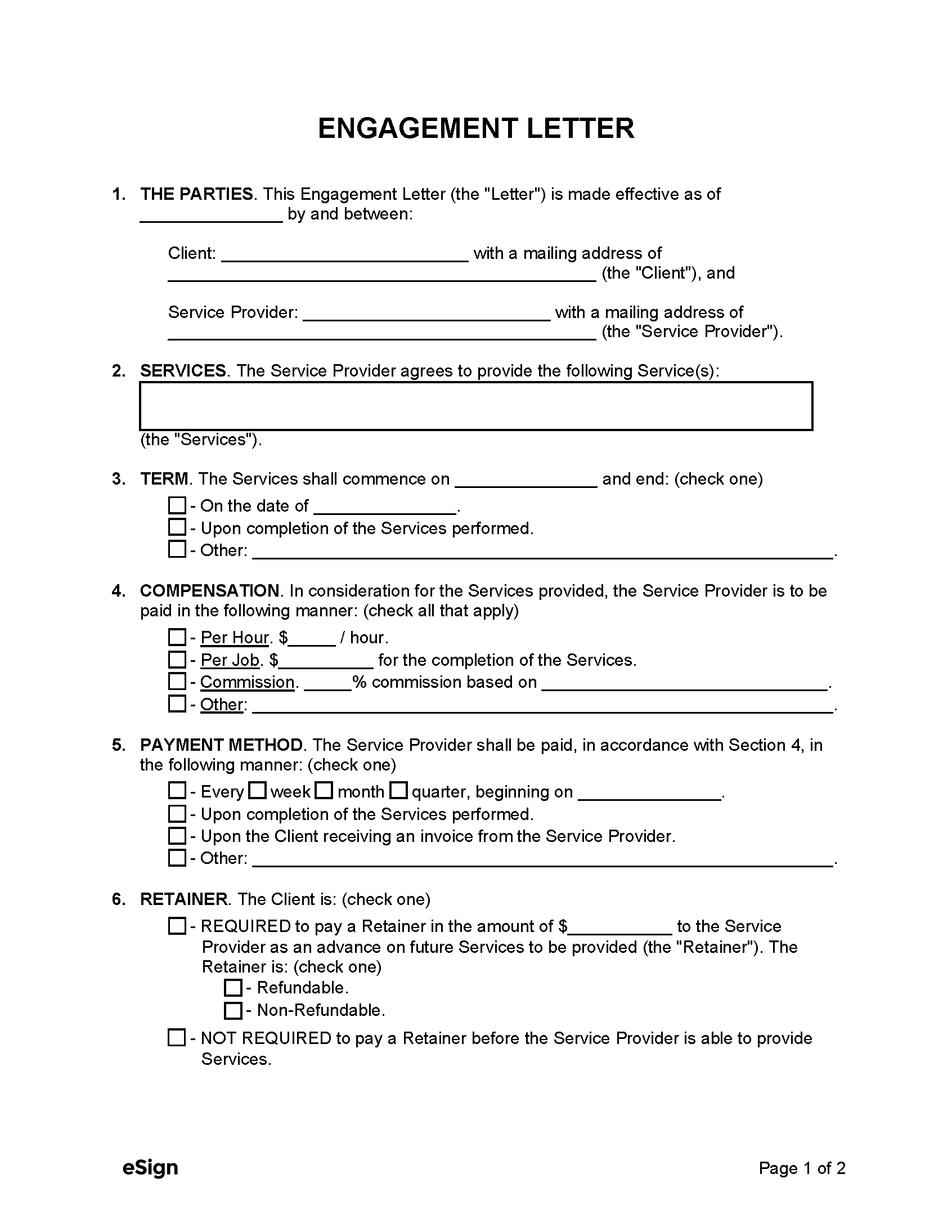

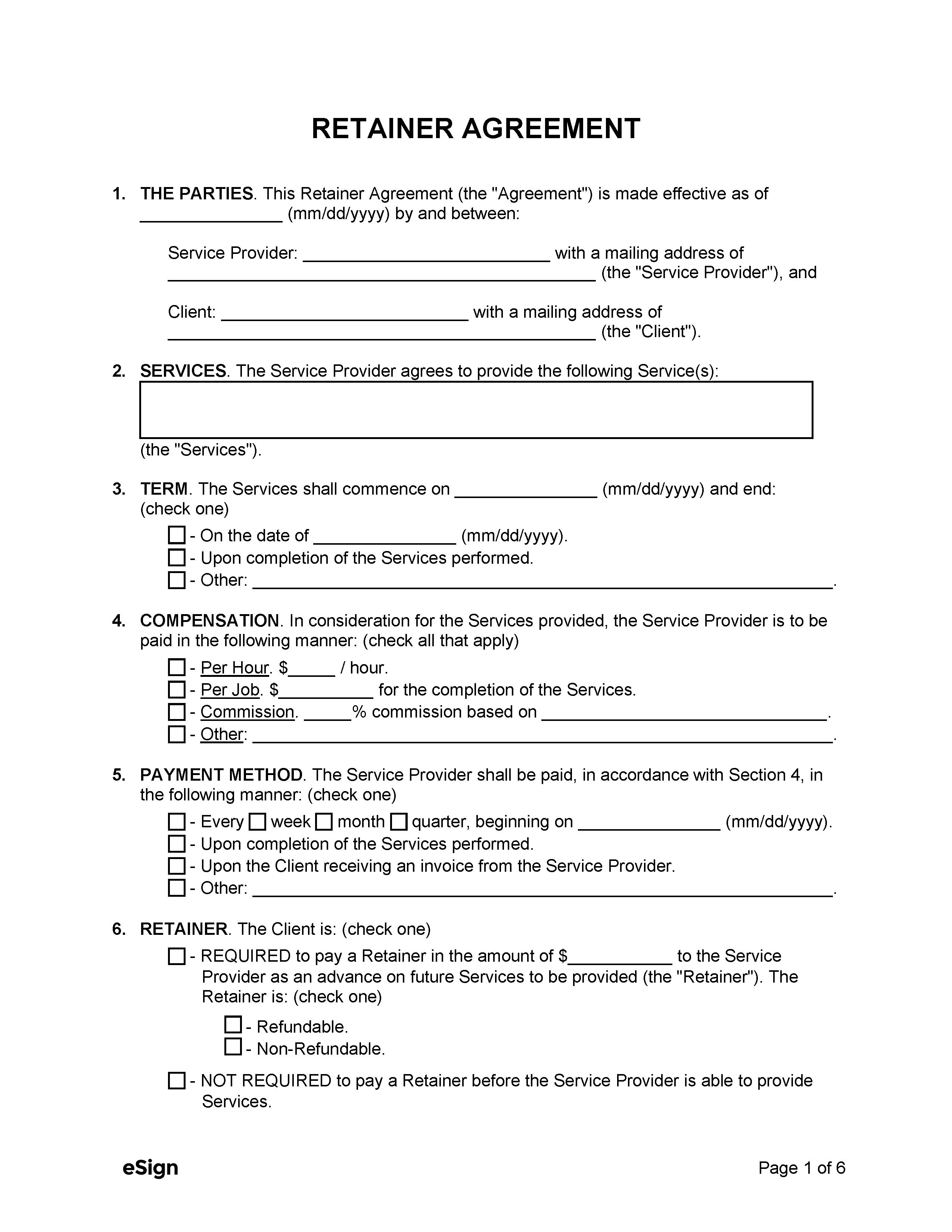

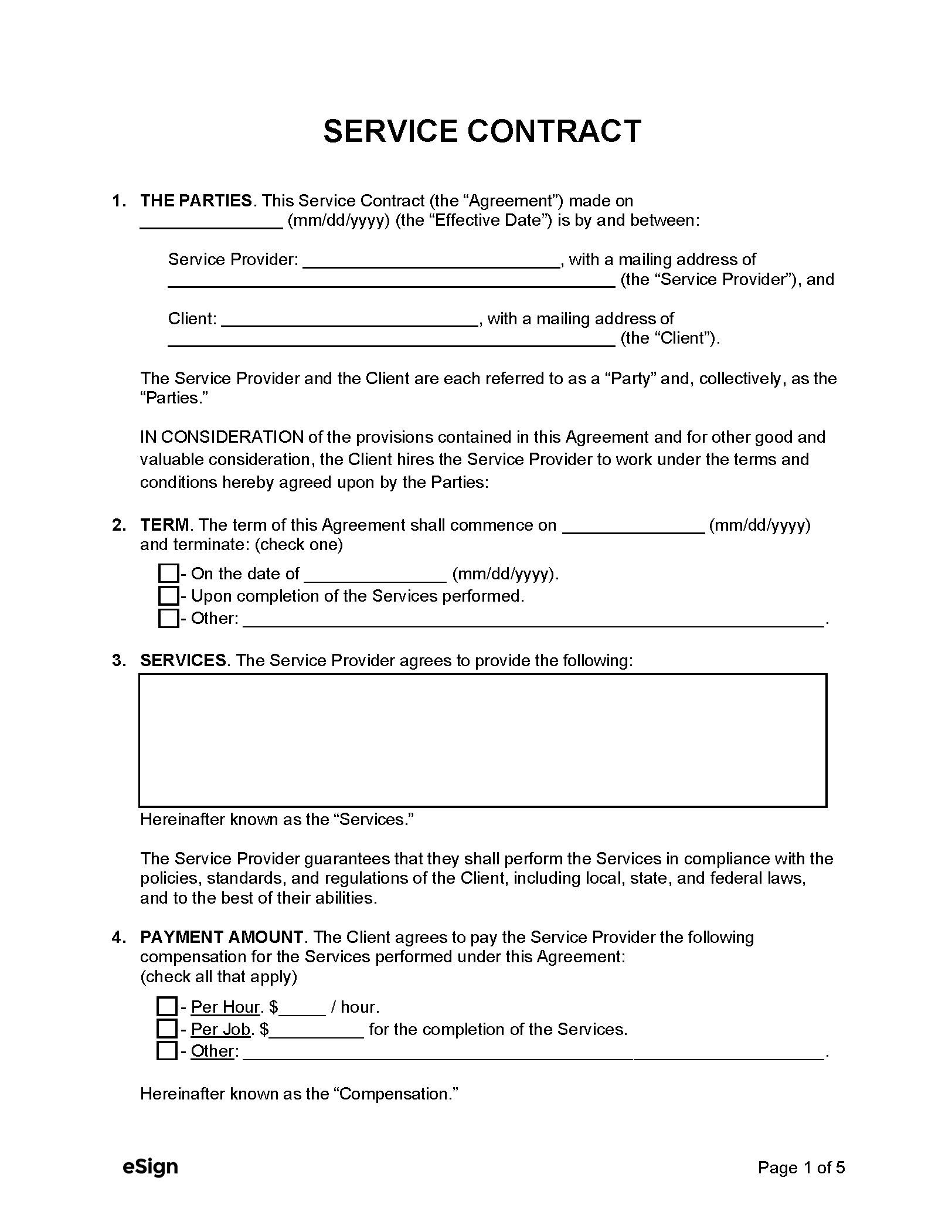

By Type (8)

What is an Independent Contractor?

An independent contractor, or “freelancer,” is a self-employed professional who offers services for payment. Unlike employees, independent contractors are free from company rules. In other words, contractors must deliver the services they agree to perform, but what they do (and how they do it) is solely up to them.

The freedom contractors enjoy comes with certain trade-offs, including the loss of unemployment insurance, workers’ comp, sick leave, and a stable salary. Contractors are also responsible for deducting and paying their own taxes.

IRS Classification

The IRS designates workers as either employees or contractors. In general, a person is considered a contractor if they meet most of the criteria across three categories:[1]

- Behavioral – Contractors must control how and when they perform their services.

- Financial – Contractors determine their rate and are responsible for their own tools, transportation, and equipment.

- Relationship to Client – Contractors cannot be provided insurance or other benefits from their clients.

It’s important to note that a person doesn’t need to check every box to be classified as a contractor. The line between employee and contractor can be blurry, so the hiring party will need to choose the work classification that fits best.

Employee or contractor.. still can’t decide?

If an employer can’t decide whether a hired person is an employee or a contractor, they can complete and file IRS Form SS-8. For more information, individuals can refer to § 31.3121(d)-1 or visit the IRS website.

Tax Forms

The following tax forms are required if a client pays a contractor $600 or more in a single year:[2]

- Form W-9 – Clients give contractors Form W-9 to complete and return before work begins. While not filed with the IRS, it relays information needed to verify the contractor and prepare Form 1099-NEC.

- Form 1099-NEC – Form 1099-NEC reports contractor payments. The client files it with the IRS and provides a copy to the contractor. A separate form is required for each contractor paid $600 or more annually.

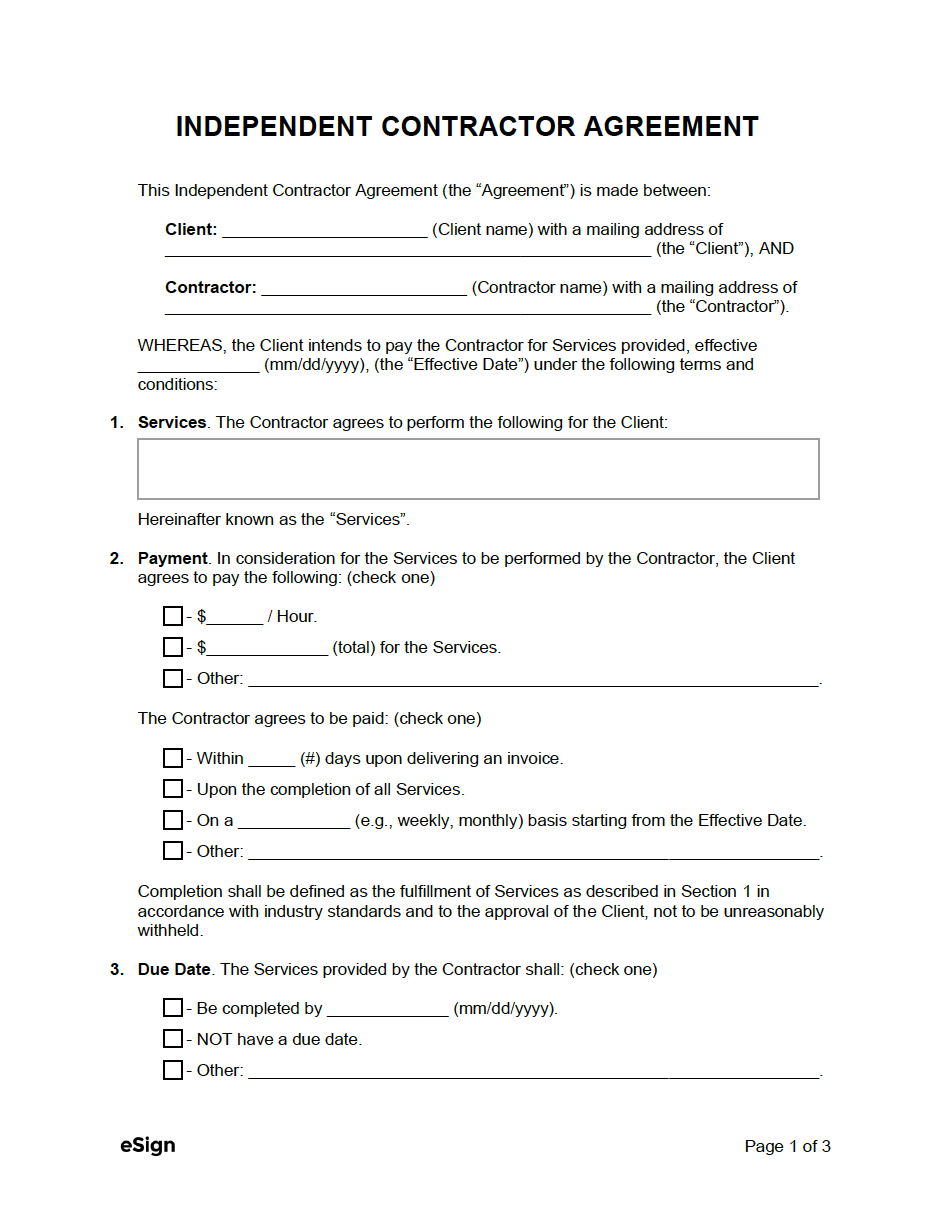

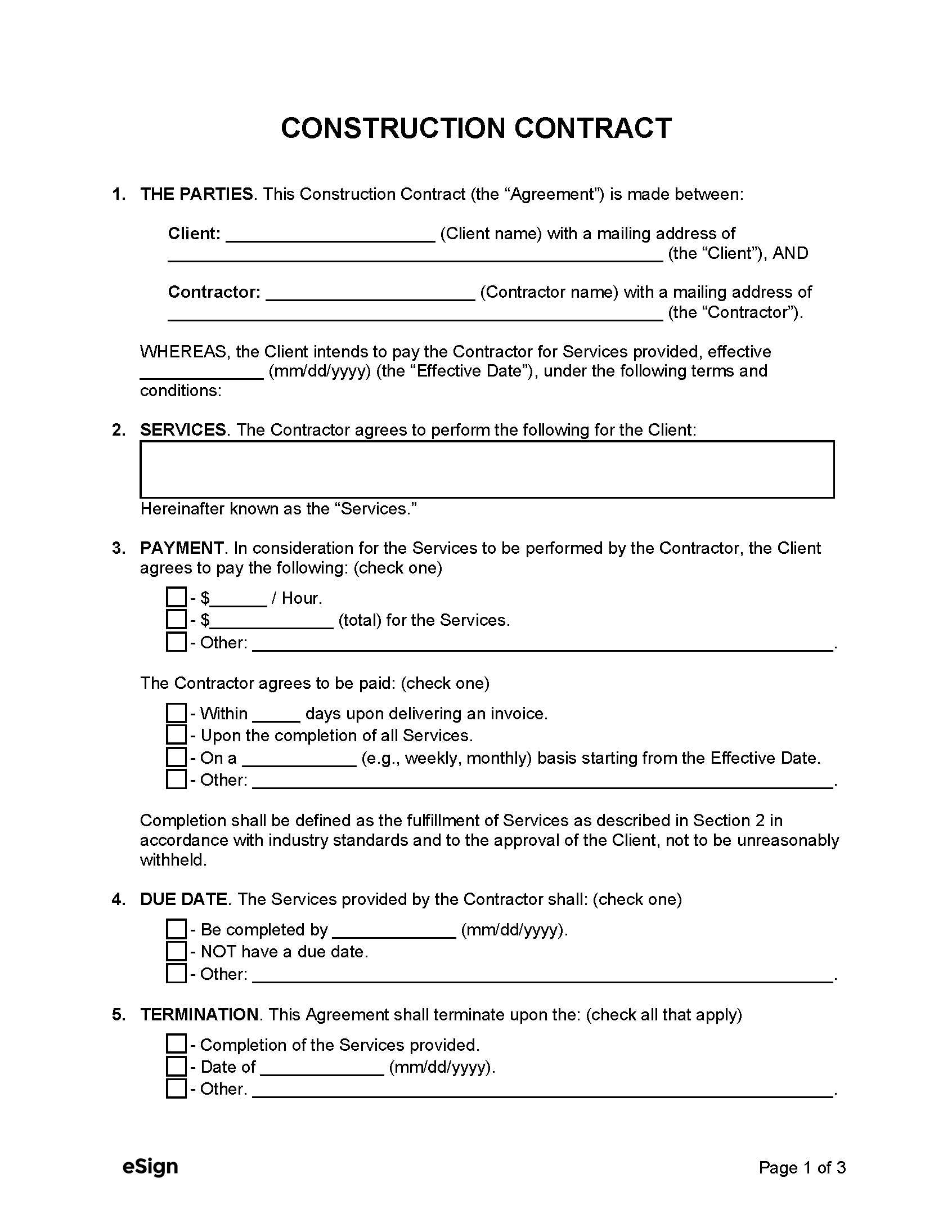

What Should Be Included

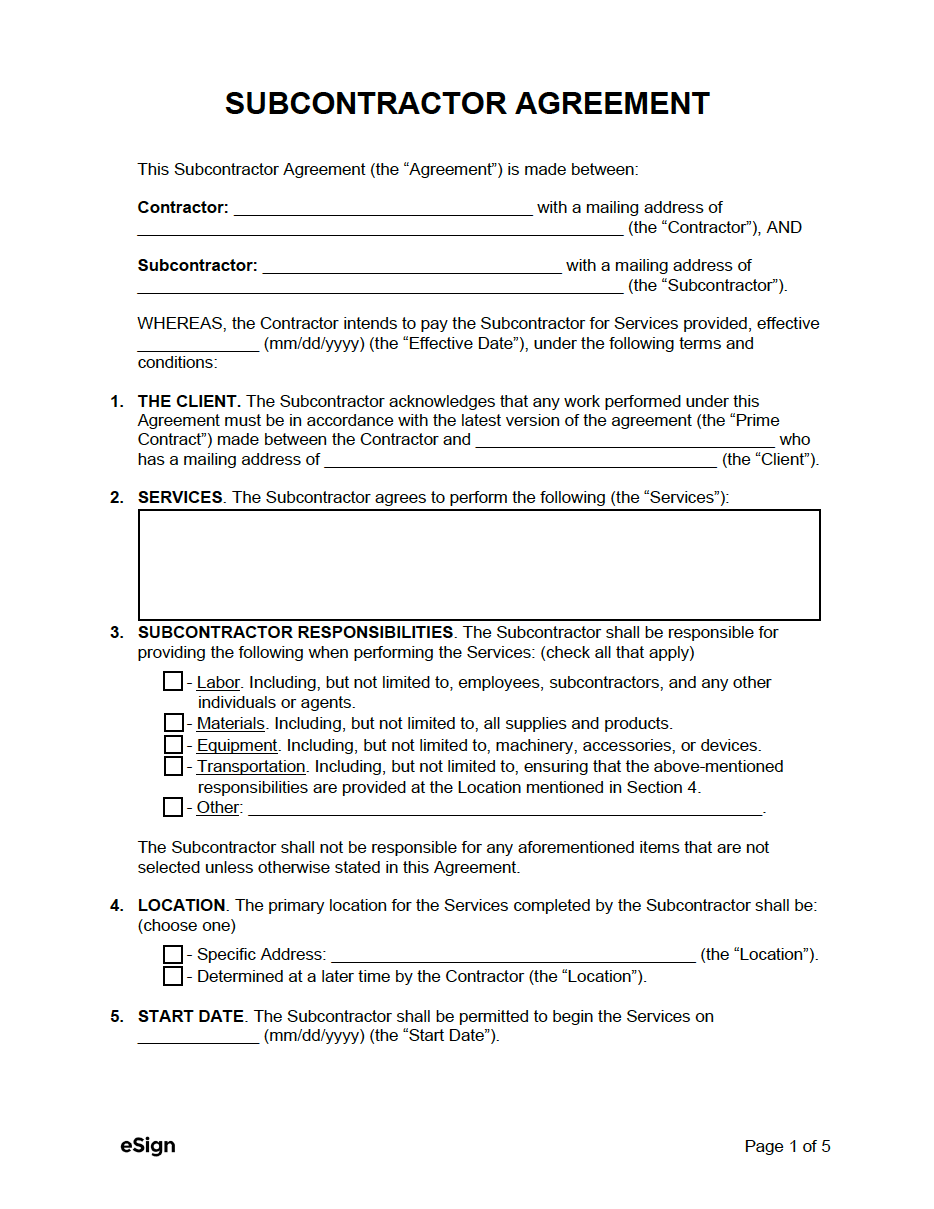

Client + Contractor Info – The names and addresses of the contractor and the hiring client should be provided. If the client is a registered entity, the address should be the company’s principal office, not the worksite (unless both are the same).

List of Services – The services should be described in one to two sentences, providing enough information to convey what services are included and excluded.

Payment – Payment terms are essential to forming a complete agreement. The contract should specify the contractor’s rates, the payment schedule, and any contingencies (e.g., payment upon completion).

Termination – The agreement should provide conditions for termination. Most contracts end upon the completion of services or on a designated expiration date.

Insurance – Clarifying the contractor’s insurance obligations is essential. Agreements may require a minimum coverage amount (e.g., $1,000,000 single limit) or allow any amount that complies with state insurance laws.

Contractor Status – The agreement should include a statement confirming that the worker is deemed an independent contractor in the eyes of the IRS.

Indemnification – An indemnification clause frees the client from any liability resulting from damage or loss caused by the contractor’s services.

Sample

- Download (blank): PDF, Word (.docx), OpenDocument

- Download (with sample data): PDF

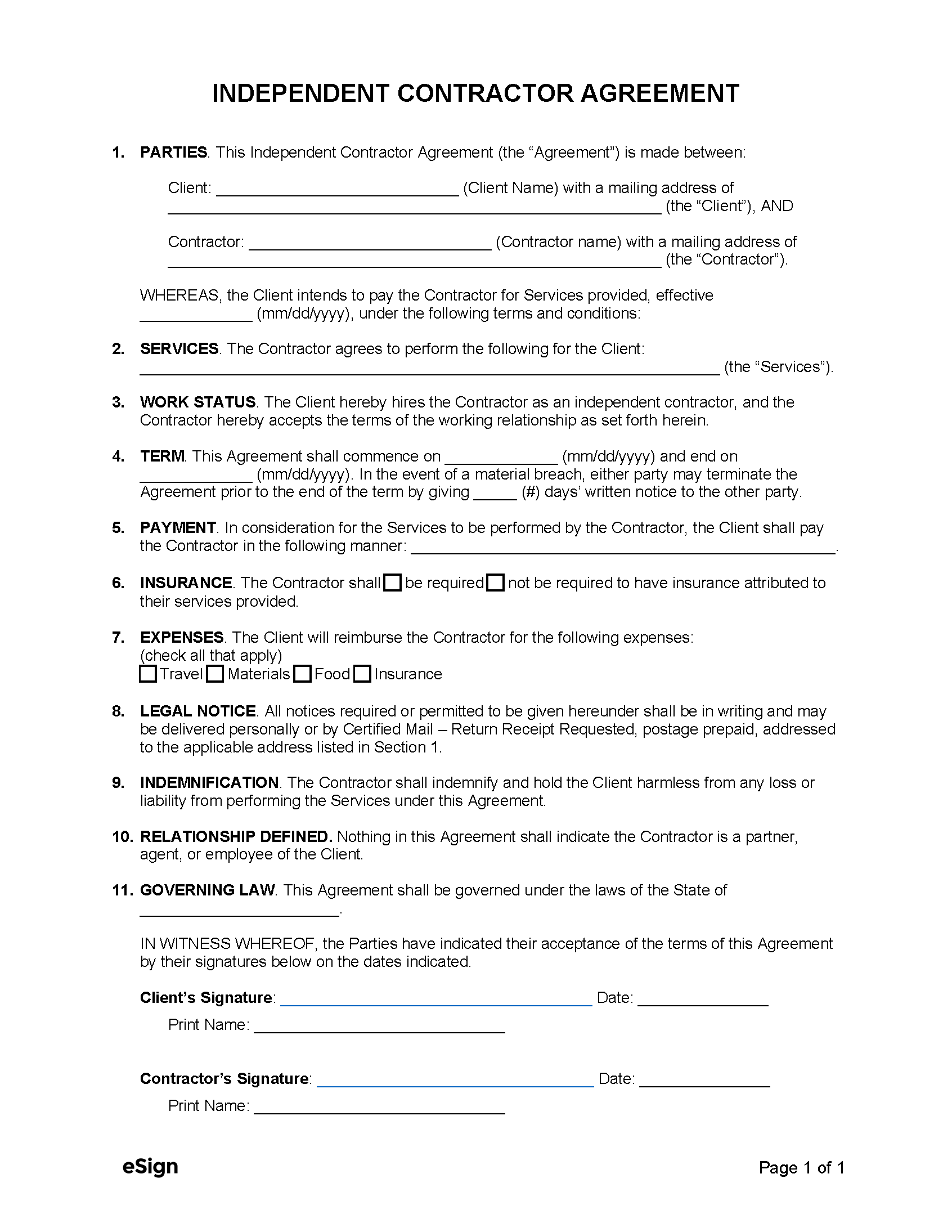

INDEPENDENT CONTRACTOR AGREEMENT

1. PARTIES. This Independent Contractor Agreement (the “Agreement”) is made between:

Client: [CLIENT NAME] with a mailing address of [CLIENT ADDRESS] (the “Client”), AND

Contractor: [CONTRACTOR NAME] with a mailing address of [CONTRACTOR ADDRESS] (the “Contractor”).

WHEREAS, the Client intends to pay the Contractor for Services provided, effective [MM/DD/YYYY], under the following terms and conditions:

2. SERVICES. The Contractor agrees to perform the following for the Client: [LIST ALL SERVICES HERE] (the “Services”).

3. PAYMENT. In consideration for the Services to be performed, the Client agrees to pay the Contractor $[AMOUNT] per [PAYMENT BASIS (E.G., HOUR)]. Payment shall be made by [PAYMENT METHOD] every [PAYMENT FREQUENCY].

4. DUE DATE. The Services provided by the Contractor shall be completed by [COMPLETION DATE (IF ANY)].

5. TERMINATION. This Agreement shall terminate upon [END DATE OR OTHER TERMINATION EVENT].

6. OPTION TO TERMINATE. The parties shall not have the option to terminate this Agreement earlier than the agreed-upon terms mentioned in Section 5 unless there is a reasonable cause.

7. EXPENSES. The Contractor shall be responsible for all expenses that are attributable directly to the Services performed under this Agreement.

8. INSURANCE. The Contractor agrees to bear all responsibility for the actions related to themselves and their employees or personnel under this Agreement. In addition, the Contractor agrees to obtain comprehensive liability insurance coverage in case of bodily or personal injury, property damage, contractual liability, and cross-liability.

9. CONTRACTOR STATUS. The Contractor, under the code of the Internal Revenue Service (IRS), is an independent contractor, and neither the Contractor’s employees nor contract personnel are or shall be deemed the Client’s employees.

10. BUSINESS LICENSES, PERMITS, AND CERTIFICATES. The Contractor represents and warrants that all employees and personnel associated shall comply with federal, state, and local laws requiring any required licenses, permits, and certificates necessary to perform the Services under this Agreement.

11. INDEMNIFICATION. The Contractor shall indemnify and hold the Client harmless from any loss or liability from performing the Services under this Agreement.

IN WITNESS WHEREOF, the parties have indicated their acceptance of the terms of this Agreement by their signatures below on the dates indicated.

Client’s Signature: _______________________ Date: [MM/DD/YYYY]

Print Name: [CLIENT NAME]

Contractor’s Signature: _______________________ Date: [MM/DD/YYYY]

Print Name: [CONTRACTOR NAME]