By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

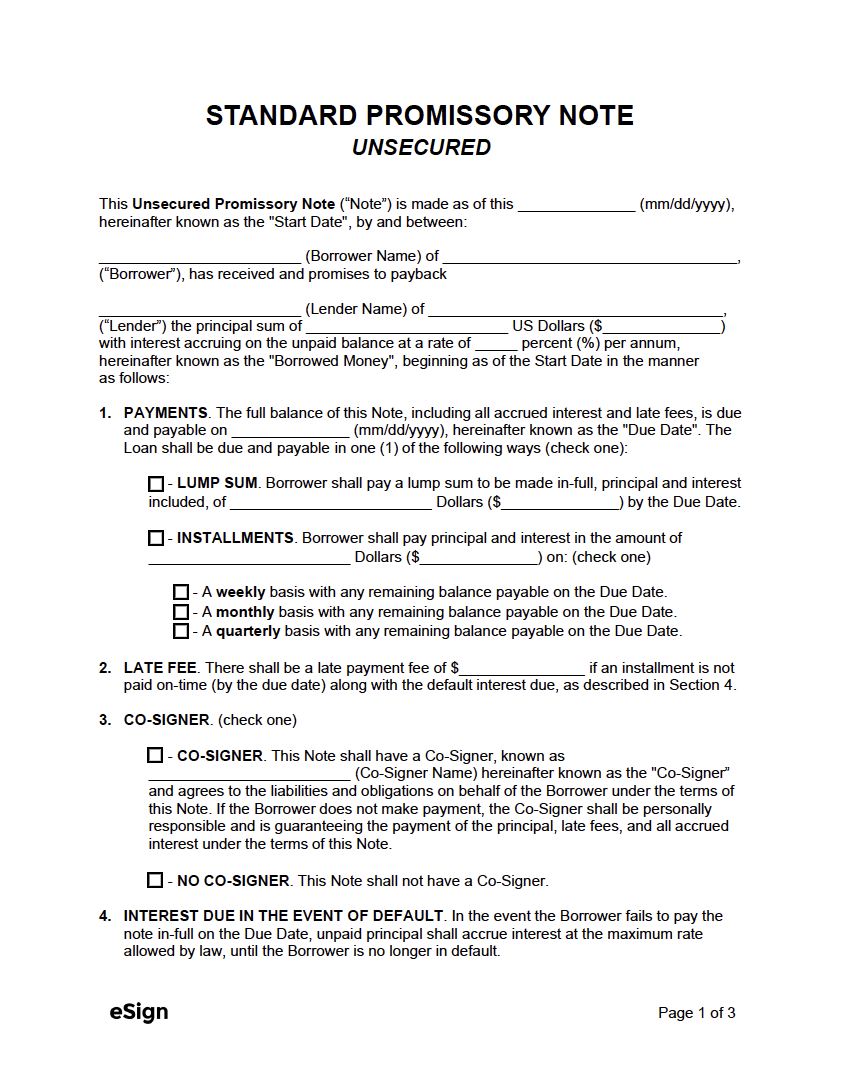

How to Use an Unsecured Promissory Note

Without an agreement in place, the line between donors and lenders can become blurred. Follow the steps below to enter into a binding contract with a borrower, improving the likelihood of getting paid back on time and in full.

Step 1 – Screen the Borrower

Due to the added risks of an unsecured note, the lender should use caution when determining if they should agree to lend to the borrower. If the borrower is not someone the lender personally trusts, it’s worth looking into the borrower’s ability to repay a loan, i.e., if they have a stable source of income, aren’t burdened by other debts, and have a strong credit score. The major providers of credit reports are Equifax, Experian, and TransUnion.

If the lender uncovers anything that leads them to believe the borrower might have difficulty in making payments on the loan, they can compromise with the borrower by requiring a co-signer on the loan, raising the interest rate, or entering into a secured note.

Step 2 – Loan Amount & Interest Rate

There are no limits on the amount a person can borrow as long as the lender agrees to this sum. However, states have varying usury limits that restrict the interest rates lenders can charge borrowers. On top of that, the lender is legally required to charge the borrower a rate that is at (or above) the minimum Applicable Federal Rate (AFR). These rates change on a monthly basis. The current rates can be found at the IRS’ Index of Applicable Federal Rates Rulings. There are exceptions to the AFR for loans under $10,000.

Step 3 – Due Date & Payment Schedule

The due date of the note can be negotiated by the lender and borrower. Longer terms often equate to lower payments and higher interest payments (and vice versa). The payment schedule establishes how often the borrower will need to make payments of the principal amount and interest to the lender. The form provides the following four (4) common payment timeframes:

- Weekly – 52 payments a year.

- Monthly – 12 payments a year.

- Quarterly – 4 payments a year.

- Lump-sum – A single payment that covers all outstanding principal and interest.

Should the parties wish to follow a different payment plan, the templates can be edited to reflect any desired changes.

Step 4 – Sign Agreement + Provide Funds

Once the note has been completed, the borrower, lender, and co-signer (if any) will need to sign their names onto the document. Signing can take place digitally through eSign (for free) or by printing the document and having everyone sign in person. Once signed, all parties should be given a copy of the note. At this time, the lender will supply the loan to the borrower. This can be done via cash, a check, a wire transfer, or a digital payment medium (such as Paypal). The borrower is legally required to make timely payments to the lender until the balance has been paid off in full.

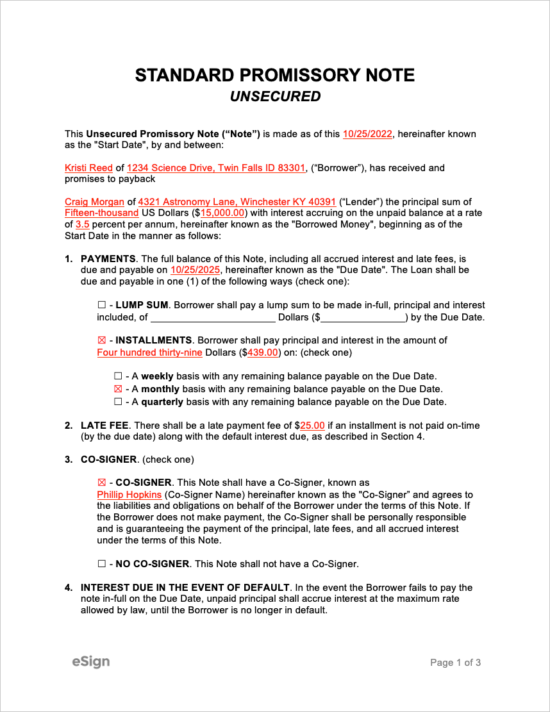

Sample

Download: PDF, Word (.docx), OpenDocument