Required in: California, Delaware, Maine, Missouri, and New York.

Regardless of a state’s requirements, creating an operating agreement at the onset of an LLC is highly recommended due to the organizational and structural benefits they provide.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

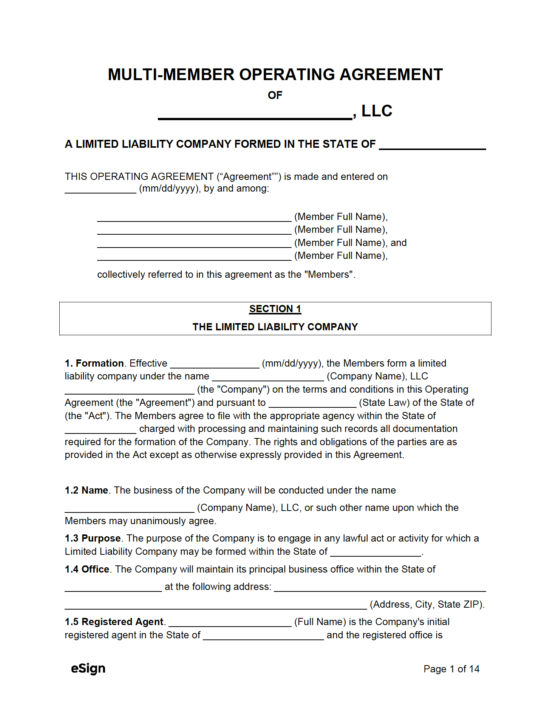

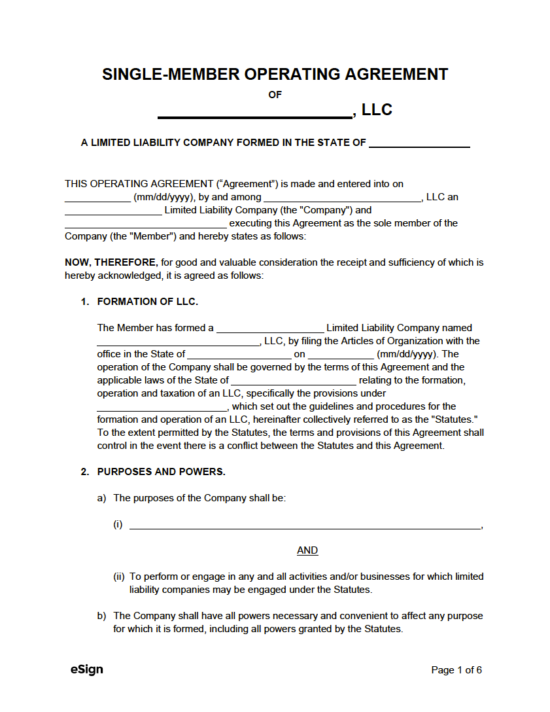

By Type (3)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

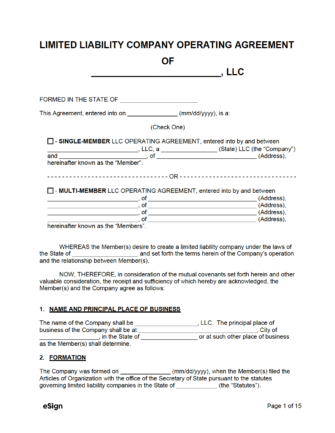

What is an LLC Operating Agreement?

An LLC operating agreement establishes the fundamental guidelines and operational procedures of a newly formed company. It allows the business’ founder(s) to outline the entity’s short- and long-term plans. A straightforward game plan makes navigating the inevitable hurdles that startups face significantly easier. It’s important to know that the agreement is not set in stone but can (and should) be altered to match the company’s visions and goals as it grows.

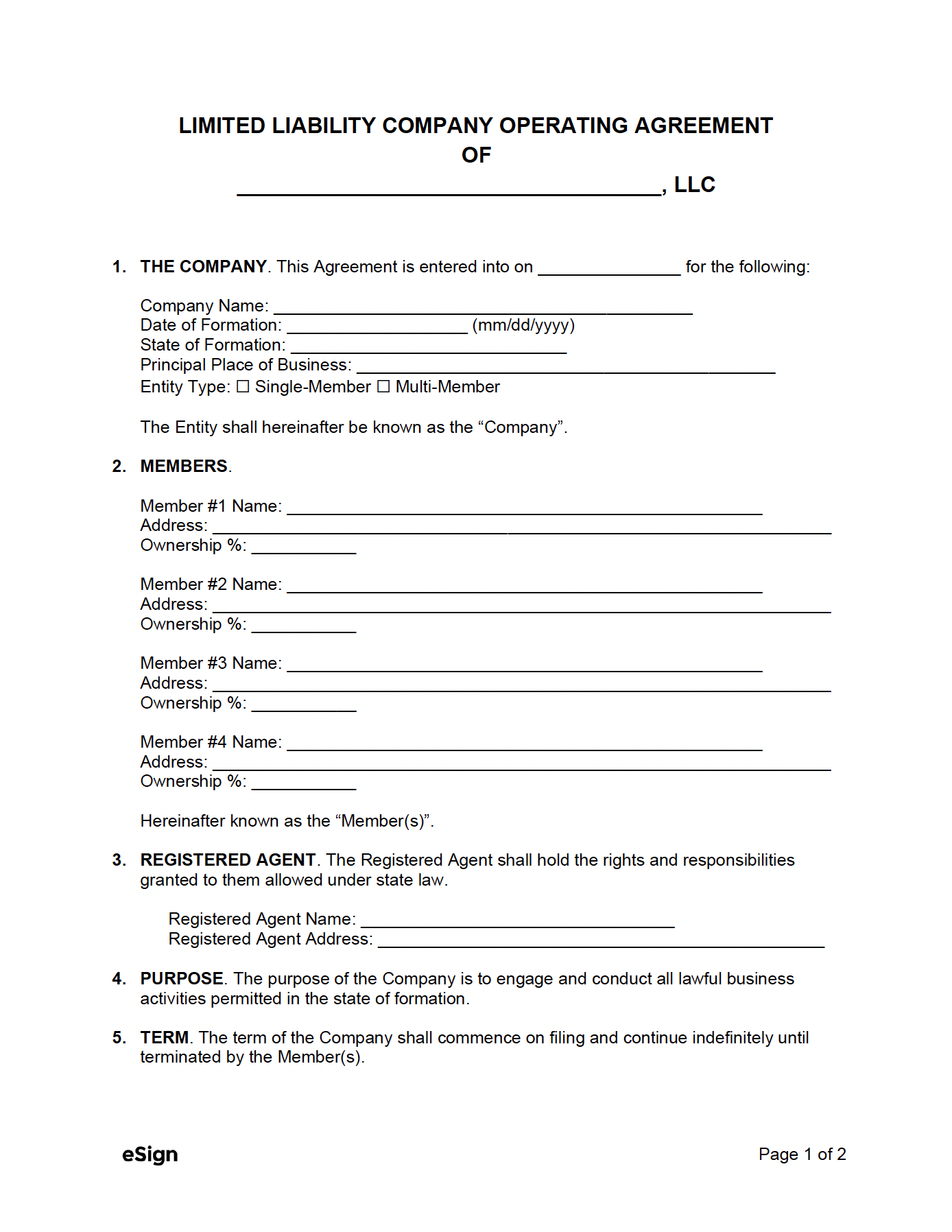

Sample

Download: PDF, Word (.docx), OpenDocument

LIMITED LIABILITY COMPANY OPERATING AGREEMENT

OF

[COMPANY NAME], LLC

1. THE COMPANY. This Agreement is entered into on [MM/DD/YYYY] for the following:

Company Name: [COMPANY NAME]

Date of Formation: [MM/DD/YYYY]

State of Formation: [STATE]

Principal Place of Business: [ADDRESS]

Entity Type: ☐ Single-Member ☐ Multi-Member

The Entity shall hereinafter be known as the “Company”.

2. MEMBERS.

Member #1 Name: [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #2 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #3 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #4 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Hereinafter known as the “Member(s)”.

3. REGISTERED AGENT. The Registered Agent shall hold the rights and responsibilities granted to them allowed under state law.

Registered Agent Name: [REGISTERED AGENT NAME]

Registered Agent Address: [REGISTERED AGENT ADDRESS]

4. PURPOSE. The purpose of the Company is to engage and conduct all lawful business activities permitted in the state of formation.

5. TERM. The term of the Company shall commence on filing and continue indefinitely until terminated by the Member(s).

6. MEMBER CAPITAL CONTRIBUTIONS. The Member(s) may contribute their own assets at any time to benefit the Company. All capital contributions shall be listed in an attached addendum and signed by all Member(s).

7. DISTRIBUTIONS. After meeting the financial obligations of the Company, the Company shall distribute cash and other assets to the Member(s) in a manner determined by the Member(s).

8. BOOKS AND RECORDS. The Company shall maintain complete and accurate books and records of the Company’s business and affairs as required by the State of Formation.

9. MANAGEMENT. The day-to-day management of the Company shall be determined by the Member(s). The Member(s) may elect a Manager to oversee day-to-day operations.

10. ANNUAL MEETINGS. The Member(s) agree to meet on an annual basis. The Member(s) shall be notified of the date, time, and the location of the meeting within thirty (30) days it is to take place.

11. NOTICES. All notices, demands, requests, or other communications relating to this Agreement must be in writing and delivered via certified mail.

12. ARBITRATION. All claims and disputes arising under this Agreement are to be settled by binding arbitration in the State of Formation, or another location agreed upon by all Member(s).

13. AMENDMENTS. This Agreement may not be altered, amended, or changed in any respect unless agreed-upon by a majority of the Member(s). Any changes must be made in writing and signed by all Members.

14. INDEMNIFICATION. The Member(s) shall not be liable, responsible, or accountable, in damages or otherwise, to the Company or any other person acting for on behalf of the Company.

The Member(s) hereto have executed and delivered this Agreement as of the date first above written.

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Single-Member vs. Multi-Member LLC

Differences

- Management – A multi-member LLC can be managed in one of two (2) ways: member-managed or manager-managed. A member can be an individual person, another LLC, or a corporation. If the LLC will be solely run by the business’s owners (and they’ll all be participating in running the company), the LLC will be member-managed. If the owners intend to recruit person(s) outside of the company, nominate one (1) or more of the owners as managers, or some combination of the two, they’ll create a manager-managed LLC. Single-member LLCs, on the other hand, have one single manager/owner.

- Taxes – Single-member LLCs are taxed as disregarded entities/sole-proprietorships; the owner must report all profits and losses to the IRS via Schedule C (Form 1040). Multi-member LLCs are considered partnerships in the eyes of the IRS. Each member pays the equivalent taxes to their company ownership percentage.

Similarities

- Separation – Both single and multi-member LLCs are structured in such a way that they are separate entities from the owners/members. This way, the owners are protected from being chased down to pay any debts and liabilities the company may accrue through the course of doing business.

- Filing – All LLCs must create articles of organization, which then must be filed with the secretary of state in their state of formation. Filing and creating an LLC is generally simpler than other business entities, such as a C or S Corp, and provides more flexibility and protection for investors and owners.

- State Law – Both types of entities are bound to and governed by the laws of the state in which they were formed. While regulations vary from state to state, there are a number of statutes pertaining to LLCs that can be found in each state’s code of law.

- Flow-Through Taxation – LLCs are taxed as “flow-through” entities, so they benefit from pass-through taxation. Unlike corporations, the profits pass through directly to the members of the LLC, which are then reported on their personal income tax returns. This avoids double taxation, which is something that corporations have to deal with.

How to Create an LLC

- Check Name Availability

- Identify the Registered Agent

- File the Articles of Incorporation

- Create the Operating Agreement

- Obtain an EIN (Optional)

- File the Annual Report (Ongoing)

1. Check Name Availability

Each state has its own requirements for naming an LLC. However, the majority have the following two (2) requirements:

- It must be completely unique from other names registered with the state; and

- It needs to end in: “Limited Liability Company,” “Limited Company,” “LLC,” or “L.L.C.”

Certain names, such as those that end with “bank,” “trust,” “credit union,” “insurance,” etc., commonly require additional fees, paperwork, or special approval. Members should use their state’s Secretary of State entity database to cross-reference possible LLC name options.

2. Identify the Registered Agent

A registered agent is a person that is responsible for receiving important documents regarding the entity. If someone were to sue the LLC, the registered agent would be the person served. They are also the designated receiver for official government documents and other important communications. The registered agent must be a resident of the state where the business operates.

3. File the Articles of Incorporation

To make the LLC official, it must be filed with the Secretary of State. Beware that your state may call the Articles of Incorporation by a different name. This can often be done online (click on one of the states above to learn how to file). The information required by most states includes the following:

- Company name

- Principal place of business

- Mailing address

- Registered agent information

- Member name(s), title(s), and address(es)

- The payment of a fee

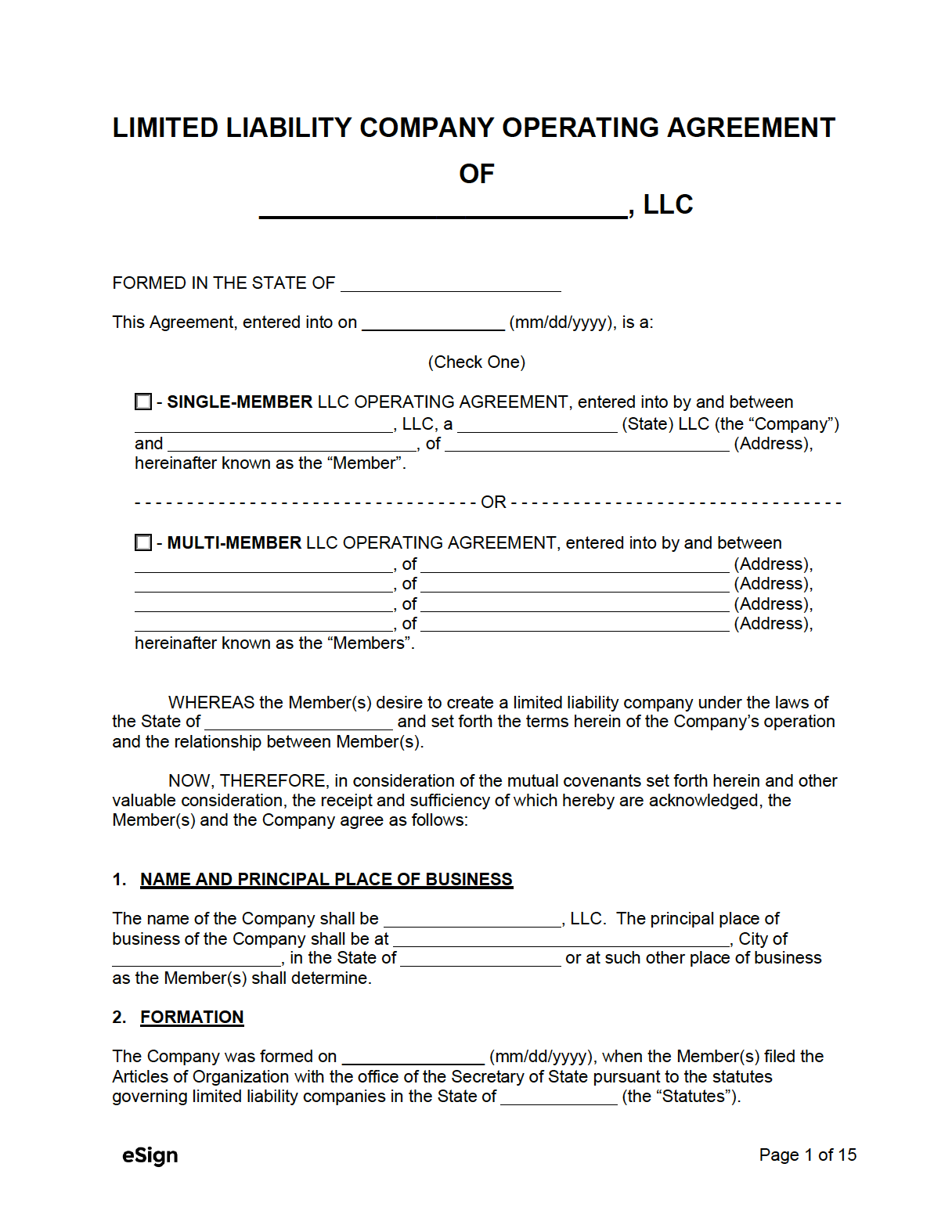

4. Create the Operating Agreement

There is a vast number of ways to create an LLC Operating Agreement, including the following options:

- Completing an attorney-drafted form only through eSign (most recommended).

- Downloading and completing the free template either on the computer or by hand (download in PDF, Word, or ODT).

- Hiring an attorney to draft the form (the most expensive option).

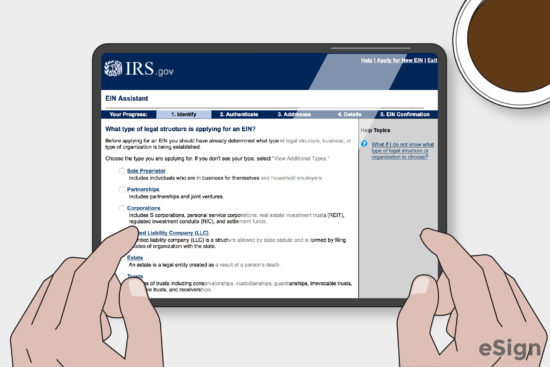

5. Obtain an EIN (Optional)

An EIN (Employer Identification Number) is assigned by the IRS to business entities for tax administration purposes. A company can only have one (1) EIN. It is not a requirement for all businesses, but it is a requirement if the LLC will be opening a business bank account, hiring employees, and filing certain tax returns. A complete list can be found by going to the IRS article Do You Need an EIN?

- Apply online: IRS Online Application

- Eligibility: 1) The business must be in the United States, and 2) the person that is applying for the EIN needs to have their own SSN, EIN, or ITIN.

- Cost: Free

6. File the Annual Report (Ongoing)

The annual report is also known as the “Periodic Report,” “Annual Statement,” and “Statement of Information,” among other titles.

The state in which the LLC was filed will require that the LLC file an annual report on an annual basis (most common), although sometimes it could be bi-annually, or per decade, among other timeframes. The report ensures the LLC remains in compliance with state statutes and provides the state with up-to-date information on the company, including its members, registered agent, addresses, and more. If the annual report isn’t filed in a timely manner, the state may charge a fee. If too much time passes, the company will be dissolved by the state. Many states allow the annual report to be filed online. A fee may be required alongside the report, with some states charging a fee as high as $500.

Structure of an Operating Agreement

While an operating agreement does not require a specific layout in order to be legally binding, there is a generally accepted format for structuring the contract, as outlined below. Additional sections can be added at the end or in between sections if deemed necessary by the company’s members.

- Name & Formation

- Members & Duties

- Purpose

- Capital Contributions & Ownership

- Voting Rights

- Distributions

- Arbitration & Mediation

- Membership Changes

- Dissolution

Name & Formation

This establishes the basic details of the company, as well as how it came into existence. The date of creation, as well as the state in which it was founded, are required. Furthermore, the registered agent’s name and place of business should also be included.

Members & Duties

If the entity is a multi-member LLC, the members and duties section will include the full names of each member as well as their personal addresses. While optional, each member’s duties can be established to ensure everyone clearly understands their roles within the company. This is commonly done if the LLC is member-managed instead of manager-managed. A manager-managed company can involve members being passive investors instead of having actual day-to-day responsibilities.

Purpose

Depending on the state’s requirements, the purpose statement can be specific or general. A general purpose statement is a standard paragraph that states the company will be organized for a lawful purpose and will comply with all laws of the state in which it operates. A specific purpose statement is commonly a one (1) to two (2) paragraph description of the primary purpose of the company. This should be a general outline of what services or products the company intends to provide for its clients and customers.

Capital Contributions & Ownership

A capital contribution is an amount ($) given by a member to fund the company during the start-up stage. In return for providing money to the company, members can be given additional ownership in the LLC, often called “units” or “credits.” The term “share” is typically reserved for formal corporations. Each member’s ownership percentage should be stated near the beginning of the document. The percentage of all members needs to add up to 100%.

Voting Rights

For multi-member LLCs, the operating agreement should include the process for voting on major decisions, who has the right to cast votes (and why), what majority is required for passing a vote, and what issues/decisions qualify for voting to take place.

Distributions

A distribution is a share of profit that is delivered to a member at the end of the tax year. It is typically equivalent to their ownership percentage of the business. The agreement should state when and how distributions are made. The way an LLC distributes its profits is dependent on the way it opted to be taxed. For single-member LLCs, the owner can choose to be taxed as a sole proprietor or as a corporation. Multi-member LLCs have the option of being taxed as a partnership or a corporation.

Arbitration & Mediation

Adding a clause dedicated to dispute resolution provides the members with an agreed-upon process for resolving arguments pertaining to the company. With arbitration, the members agree to have a pre-determined third party listen to both sides of the argument, and make a binding decision on the matter. The members are legally required to accept the decision made by the arbitrator. Mediation, on the other hand, involves a third party that listens to both sides of the argument, but instead of making a decision, they help the parties reach their own fair conclusion. While friendlier in nature, mediation can take considerably longer than arbitration.

Membership Changes

Establishes the process for adding or removing a member from the LLC, when members can sell or transfer their shares, what happens if a member dies, and other member-related procedures.

Dissolution

Provides guidance in the event the company is shut down. When a company is dissolved, the remaining assets are distributed, the IRS is notified, a dissolution agreement is completed and signed by all members, and the final taxes are paid.

Laws: By State

The following table contains links to each state’s operating agreement statutes or general LLC laws.

Entity Lookup: By State

Use the links below to look through a state’s database of corporations. It’s useful for finding out if a business name has already been taken by another entity.