By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

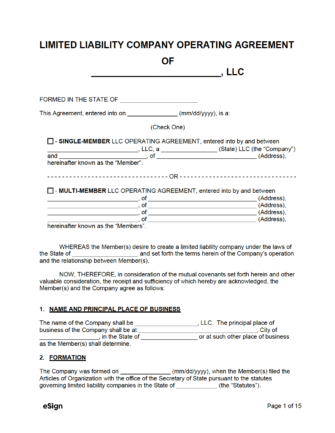

By Type (3)

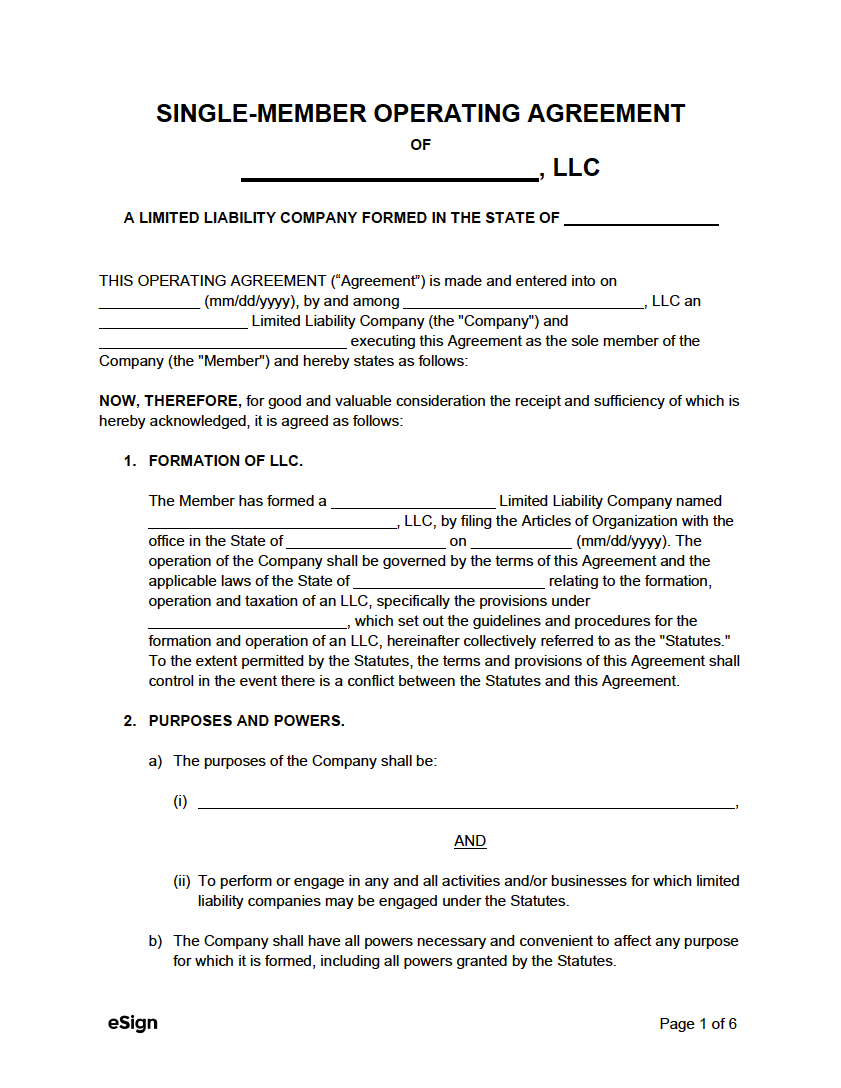

States Requiring an Operating Agreement

The following states have laws requiring LLC’s have an operating agreement:

- California – Agreement can be written, oral, or implied.[1]

- Delaware – Agreement can be written, oral, or implied.[2]

- Maine – Agreement can be written, oral, or implied.[3]

- Missouri – Agreement can be written or oral.[4]

- New York – Agreement must be in writing.[5]

Even if not required by state law, executing an LLC is beneficial as it helps shield its members from personal liability and allows the company to set its own rules rather than rules set by the state.

Single vs. Multi-Member LLCs

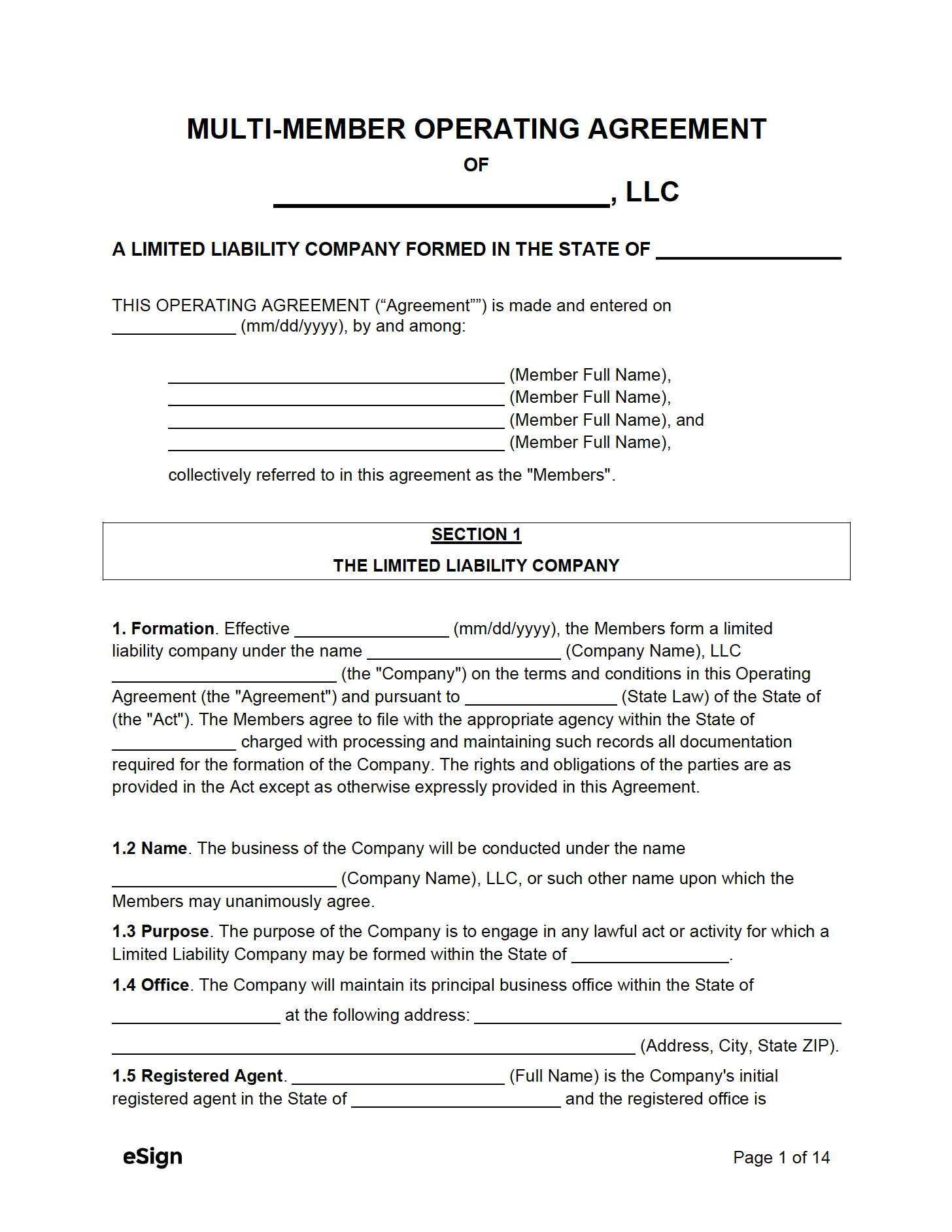

Single-Member LLC

- Single manager/owner with full control over the company

- Profits/losses flow through to owner

- Taxed as a disregarded entity/sole proprietorship

Multi-Member LLC

- At least two owners (members)

- May be member-managed (run directly by owners) or manager-managed (run by appointed managers)

- Split profits/losses between members as defined in the operating agreement

- Taxed as a partnership (by default) or corporation

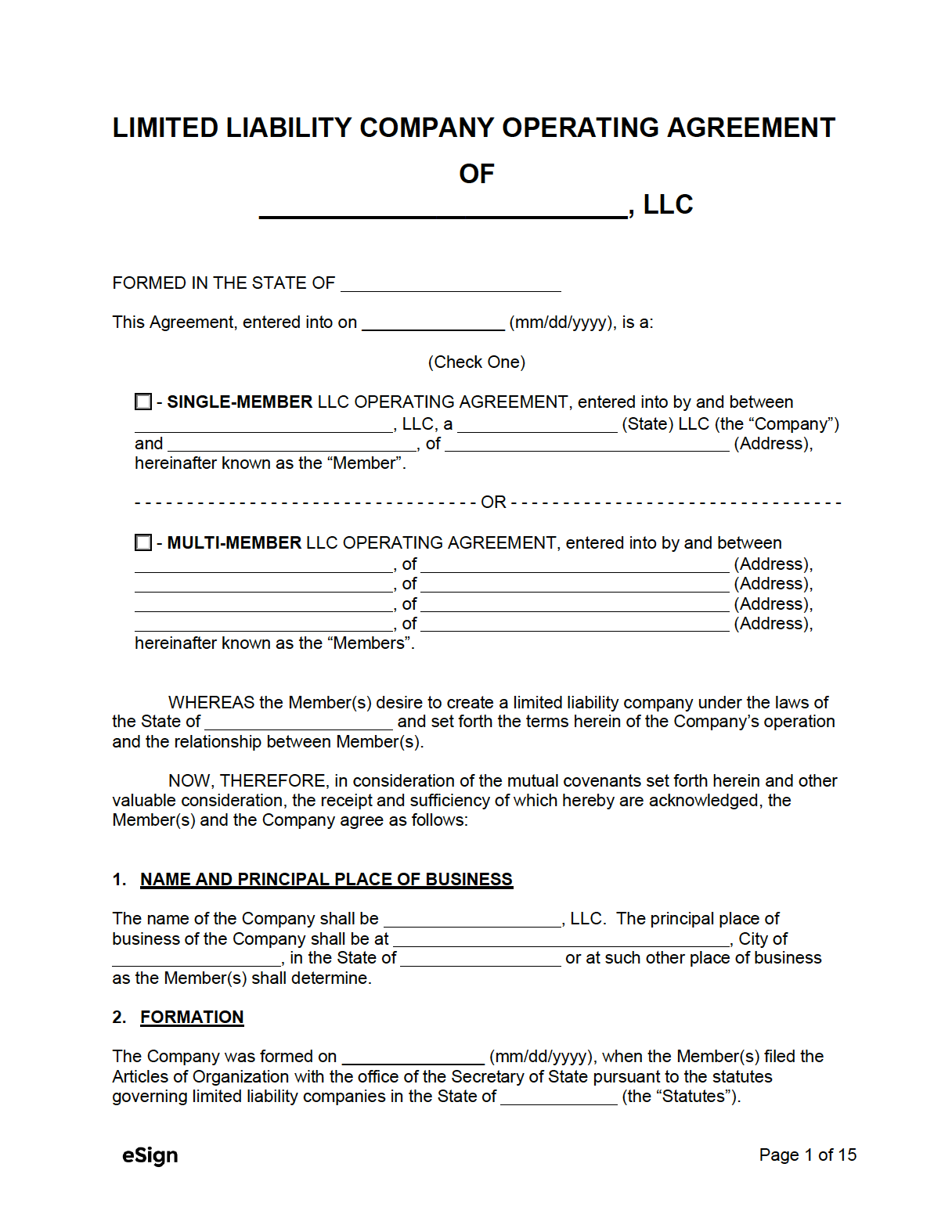

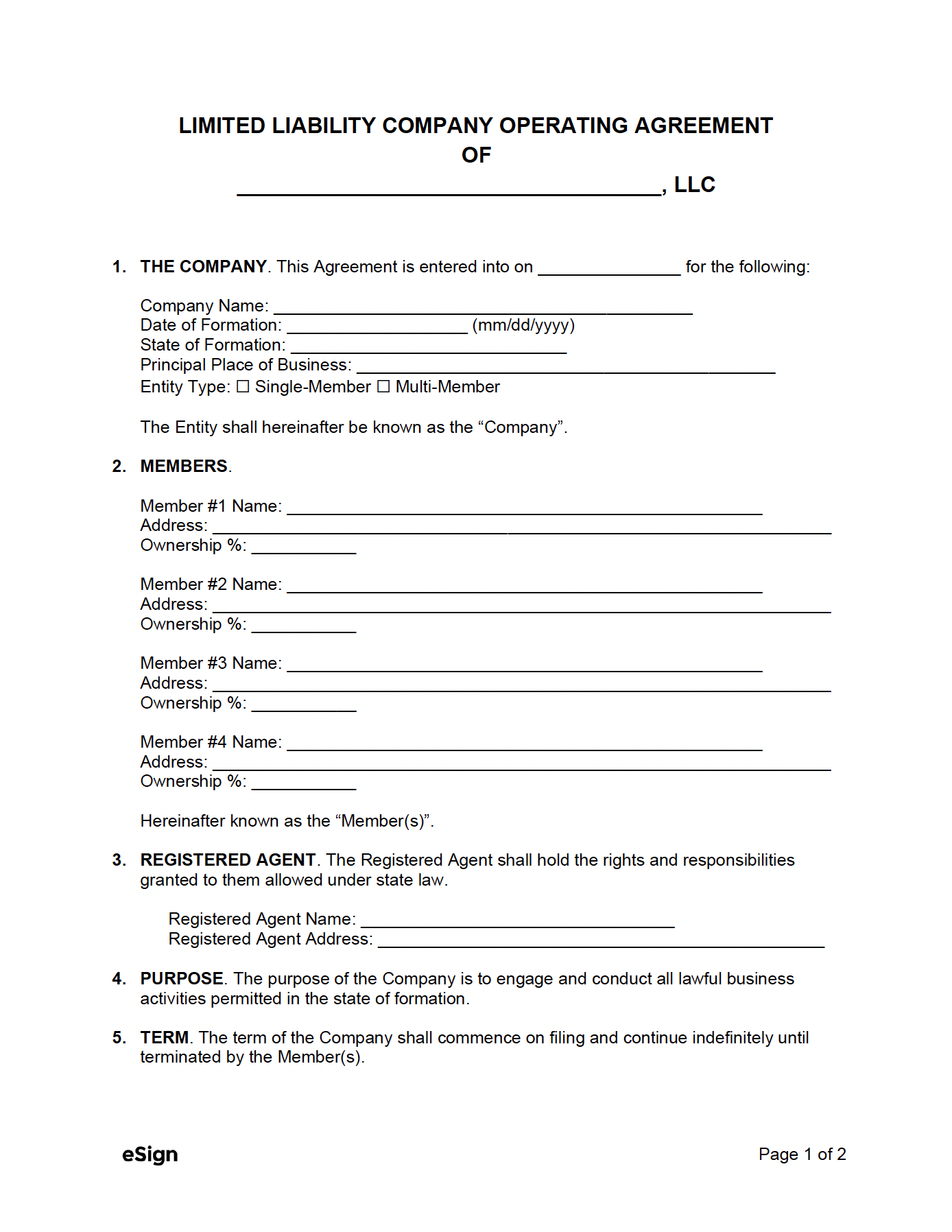

Structure of an Operating Agreement

While an operating agreement does not need to follow a specific layout, there is a generally accepted framework for structuring the contract.

Name and Formation

This establishes the basic details of the company and includes the date of formation, as well as the state in which it was founded. Furthermore, the registered agent’s name and place of business should also be included.

Members and Duties

If the entity is a multi-member LLC, the members and duties section will include the full names of each member and their personal addresses. Each member’s duties can also be established to ensure everyone clearly understands their roles within the company.

Capital Contributions and Ownership

The amount given by a member to fund the company should be detailed in the agreement. Each member’s ownership percentage should be stated near the beginning of the document. The sum of all percentages must equal 100%.

Voting Rights

For multi-member LLCs, the operating agreement should include the process for voting on major decisions, who has the right to cast votes, and what majority is required to pass a vote.

Distributions

This section explains when, how, and in what form profits are allocated to members. It states that each member will have profits credited to their individual capital accounts based on their ownership percentage.

Membership Changes

Establishes the process for adding or removing a member from the LLC, when members can sell or transfer their shares, what happens if a member dies, and other member-related procedures.

Dissolution

Provides guidance as to what circumstances will dissolve the LLC and how that will be conducted and supervised.

LLC Laws: By State |

||||

| STATE | LAWS | |||

| Alabama | § 10A-5A-1.08 | |||

| Alaska | § 10.50.095 | |||

| Arizona | § 29-3105 | |||

| Arkansas | § 4-38-105 | |||

| California | § 17701.10 | |||

| Colorado | § 7-80-108 | |||

| Connecticut | § 34-243d | |||

| Delaware | Title 6, Ch. 18 | |||

| Florida | § 605.0105 | |||

| Georgia | Title 14, Ch. 11 | |||

| Hawaii | § 428-103 | |||

| Idaho | § 30-25-105 | |||

| Illinois | 805 ILCS 180 | |||

| Indiana | § 23-18-4-4 | |||

| Iowa | § 489.410 | |||

| Kansas | § 17-7672 | |||

| Kentucky | § 275.180 | |||

| Louisiana | § 1319 | |||

| Maine | § 1521 | |||

| Maryland | § 4A-402 | |||

| Massachusetts | Title XXII, Ch. 156C | |||

| Michigan | § 450.4102(r) | |||

| Minnesota | § 322C.0110 | |||

| Mississippi | § 79-29-123 | |||

| Missouri | § 347.081 | |||

| Montana | § 35-8-109 | |||

| Nebraska | § 21-110 | |||

| Nevada | § 86.286 | |||

| New Hampshire | § 304-C:40 & § 304-C:41 | |||

| New Jersey | § 42:2C-11 | |||

| New Mexico | Chapter 15, Article 19 | |||

| New York | § 417 | |||

| North Carolina | § 57D-2-30 | |||

| North Dakota | § 10-32.1-13 | |||

| Ohio | § 1706.08 & § 1706.081 | |||

| Oklahoma | § 18-2012.2 | |||

| Oregon | § 63.057 | |||

| Pennsylvania | § 8815 | |||

| Rhode Island | § 7-16-22 | |||

| South Carolina | § 33-44-103 | |||

| South Dakota | § 47-34A-103 | |||

| Tennessee | § 48-206-101 | |||

| Texas | § 101.052 | |||

| Utah | § 48-3a-112 | |||

| Vermont | § 4003 | |||

| Virginia | § 13.1-1023 | |||

| Washington | § 25.15.018 | |||

| West Virginia | § 31B-1-103 | |||

| Wisconsin | Ch. 183 | |||

| Wyoming | § 17-29-110 | |||